Are you a senior citizen in Maryland looking to better understand Medicare Advantage plans and what they can do for you? If so, then this blog post is meant just for you! We’ll be covering the basics of Medicare Advantage plans available in Maryland, including their coverage levels, costs, and eligibility requirements.

Stick with us until the end of this post and you’ll leave feeling more knowledgeable about how these plans work – so that you can decide if one is right for your medical needs. Let’s get started!

Medicare Advantage plans are a popular choice for seniors these days, but many folks just don’t understand them. Essentially, Medicare Advantage plans are an alternative option to traditional Medicare. Enjoy the convenience of having all your Medicare benefits in one package with Medicare Advantage – including Original Medicare Parts A and B, plus vision, hearing, and dental. In addition, Medicare Advantage plans can offer integrated coverage for prescription drug costs. These plans are offered by private insurance companies and can have different costs, and restrictions depending on exactly where you live and which plan you want. It’s important to do your research and compare options before making a decision. If you’re looking for an all-in-one healthcare solution, Medicare Advantage plans might be the way to go.

Maryland’s Medicare Advantage plans have become increasingly popular and for good reason. Retirees can take advantage of benefits offered by these plans to get the care they need at an affordable cost. One of the main advantages of these plans is that they provide comprehensive coverage, which includes all of the benefits offered by Original Medicare plus additional services such as prescription drug coverage, vision and dental care, and wellness programs. Additionally, many of these plans offer low premiums and low copays for doctor visits, making them a cost-effective option for seniors on a budget.

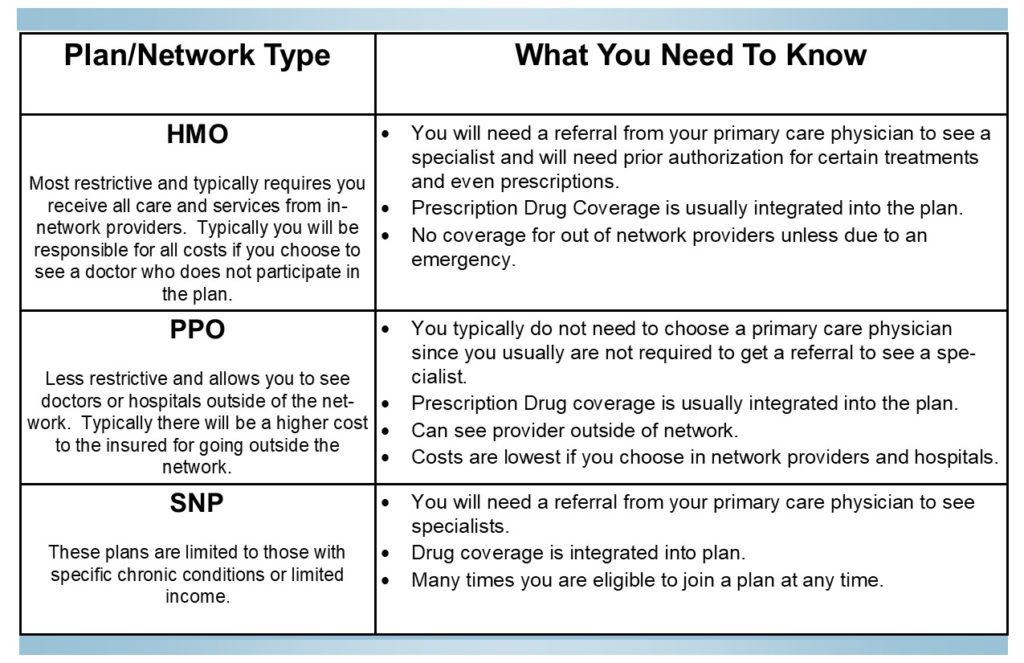

There are mainly three types of Medicare Advantage plans available in Maryland.

In the chart below we break down how these plans differ.

With so many benefits available, it’s no wonder that Maryland’s Medicare Advantage plans have become a favorite option among seniors seeking quality healthcare coverage.

When it comes to choosing a plan the options can seem overwhelming. It’s important to compare the different plan types (type of network they offer) and prices to determine what will work best for your needs and budget. Several carriers offer plans at different price points. Typically the lower monthly premium plans are offset by higher co-payments, whereas the higher monthly premium plans offer lower co-payments.

In the state of Maryland, there are not as many plans available that you might see in another state. This is mainly due to the reimbursement rates that the plans receive from Medicare for the state of Maryland (less than others). Another issue that you might run into is that the networks in Maryland are smaller (especially in the rural areas) which means that your doctors may not participate in the plan. Currently the most popular Medicare Advantage plans in Maryland come from the following insurance carriers (not in any specific order):

Currently Humana offer 3 plans in the state of Maryland. While all the plans use a PPO network, only 2 of them have integrated prescription drug coverage. These plans range in price from $0.00 – $69.00 per month.

Currently UnitedHealthcare offers up to 4 plans in Maryland. For 2 of the plans a PPO network is used and for the other 2 an HMO network is used. Only 1 plan does NOT have integrated prescription drug coverage. The plans range in price from $0.00 – $26.00 per month.

In addition to their standard Medicare Advantage plans, UnitedHealthcare offers 2 Dual Eligible SNP plan for those on both Medicare and Medicaid.

At the moment Johns Hopkins offers up to 5 plans in Maryland. The HMO network is used for 2 of the plans while the other 3 use a PPO network. All but 1 plan has integrated prescription drug coverage. The plans range in price from $0.00 – $130.00 per month.

Currently Carefirst offers 2 plans in Maryland. Both plans use an HMO network and have integrated prescription drug coverage. The plans range in price from $18.00 – $75.00 per month.

In addition to their standard Medicare Advantage plans, Carefirst also offers a Dual Eligible SNP plan for those on both Medicare and Medicaid.

Are you tired of feeling overwhelmed and confused when it comes to choosing the best plan option for your needs? Senior Benefit Services assists you in locating the right plan to suit your lifestyle – no daunting task here! Start by contacting us so we can help identifying your specific needs and then compare plans from several different providers. Remember, the best plan option for you might not be the same as someone else’s, so you will want to take the time to find the one that works best for you.

So when can you actually sign up for a Medicare Advantage plan in Maryland? Let’s look four different enrollment periods that you can take advantage of:

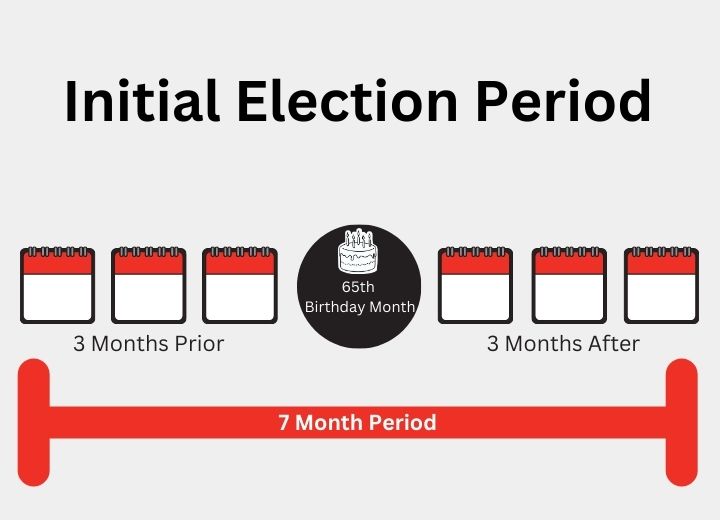

During the Initial Coverage Election Period (IEP), you are eligible to enroll in Medicare when you turn 65 or when you receive benefits due to disability. This enrollment period includes three months before your 65th birthday, the month of your birthday and three months after.

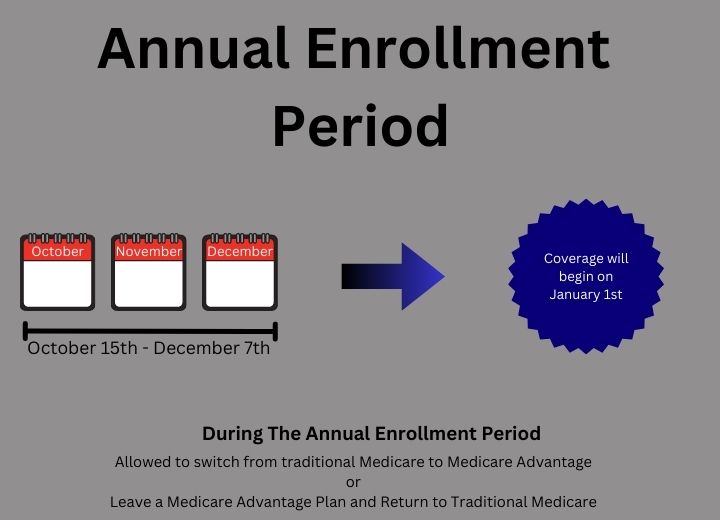

During the Annual Election Period (AEP), you can switch from Original Medicare to a Medicare Advantage Plan from October 15 to December 7. If you are already enrolled in a Medicare Advantage Plan, you have the option to switch between plans during this period.

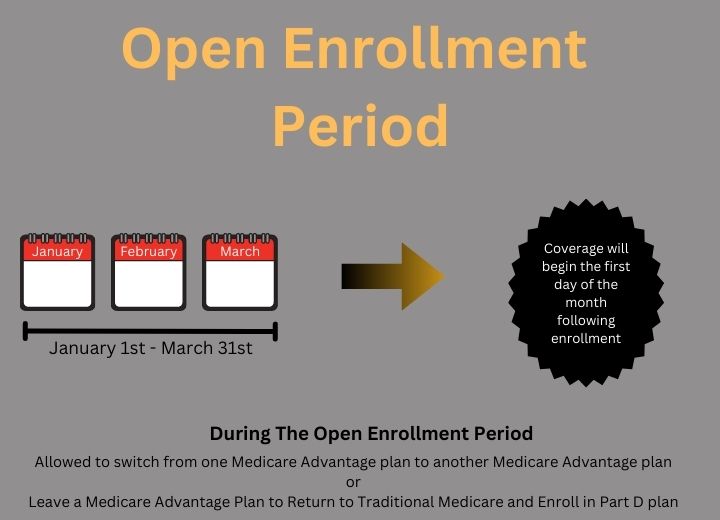

During the Open Enrollment Period (OEP) between January 1 and March 31, you can switch between Medicare Advantage Plans or return to Original Medicare.

People who experience unusual life circumstances, such as losing a job and its accompanying health coverage or moving out of an area serviced by their current Medicare Advantage plan, can take advantage of special enrollment periods (SEP) offered by Medicare.

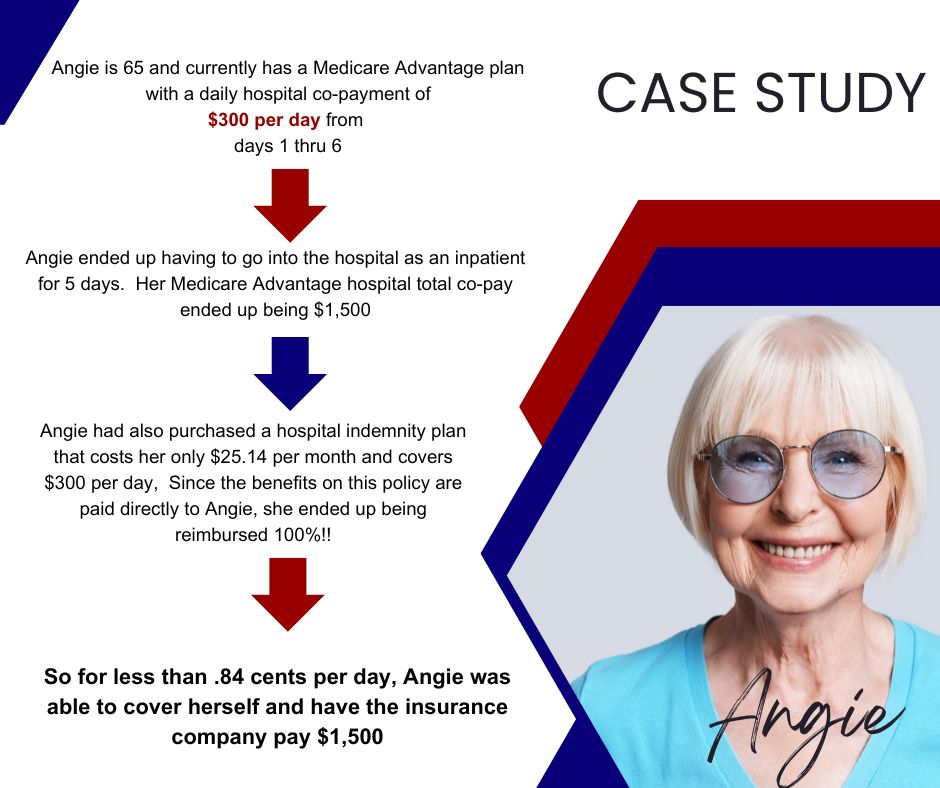

Dealing with expensive copays with a Medicare Advantage plan can be frustrating, but there are steps you can take to eliminate the big ones. Start by reviewing your plan’s benefits and looking for areas where copays may be particularly high. Explore options like a hospital indemnity plan that allows you to shift the higher costing co-pays onto the insurance company for a small monthly premium.

You now have the knowledge to confidently choose a Medicare Advantage Plan in Maryland. First we need to explore your location to find the most suitable benefits, plans and prices for you. Here at Senior Benefit Services, Inc., we understand the importance of these factors, as well as how complicated choosing a plan can be. We offers senior citizens of Maryland unbiased information regarding all their Medicare needs. If you have any questions or concerns about joining a particular advantage plan in Maryland, contact us today. Our experienced advisors will help you select the most suitable insurance plan for your needs and budget.