Are you a senior/retiree living in Maryland searching for the best Medicare Supplement plan? Medicare Supplement Plans are great for extra coverage of costs not covered by original Medicare. You can customize the plan that best suites you, but it’s important to have a good understanding of the plans. Here we’ll provide all the information necessary on how to get started with supplement plans in Maryland.

A Medicare Supplement Plan, also known as Medigap insurance provides coverage for expenses not covered by Original Medicare. Some of the gaps in Medicare are deductibles, co-payments, and coinsurance. Marylanders can select from Medigap plans offered by private insurers, that vary in coverage and costs. Seniors in the state of Maryland can gain financial security with a Medicare Supplement plan. A Medigap policy offers peace of mind with no network worries. Use your own doctors and hospitals!

Already enrolled in Medicare? Residents of Maryland enrolled in Medicare may know Medigap plans help cover gaps in coverage. There are multiple types of plans available depending on your personal needs. Each plan offers different benefits and varying coverage levels, so it’s important to explore all your options before choosing one. With up to 12 different plans to choose from, it may seem overwhelming, but don’t worry, our advisors make it easy.

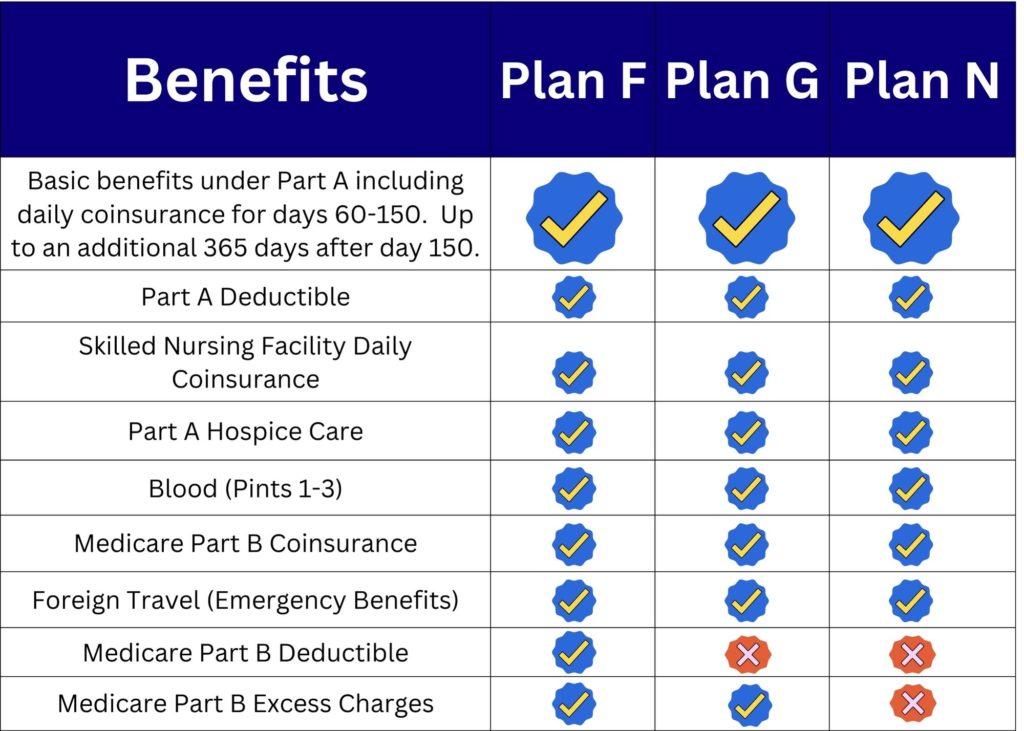

First things first! Just like other states, the Medigap plans in Maryland are all standardized, so the benefits for a Plan N are the same for every insurance company. Currently the most popular Medicare Supplement plans in Maryland are Plan F, Plan G, and Plan N.

While Plan F is the most comprehensive when it comes to benefits, not all Marylanders are eligible to enroll. Only those individuals who went onto Medicare prior to January 1, 2020 are eligible. If you went onto Medicare after this date, then don’t despair. Medicare Supplement Plan G is almost identical to Plan F when it comes to benefits. The only difference is that Plan G does not cover the annual Part B deductible.

So how does Plan N fit in? Medicare Supplement Plan N offers solid benefits with typically a lower premium. Plan N may be ideal for Marylanders with tight budgets. With Medigap Plan N you get all the same benefits as Plan G, except for excess charge coverage. For many this is not a big issue since over 96% of the providers in Maryland participate in the Medicare Assignment program and do not balance bill for excess charges.

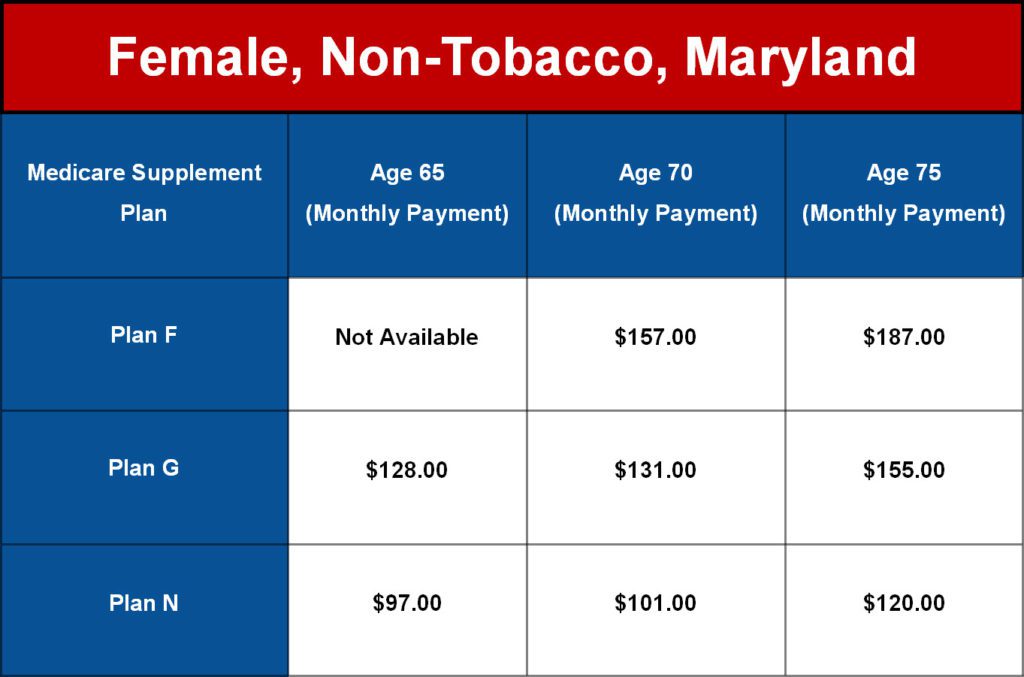

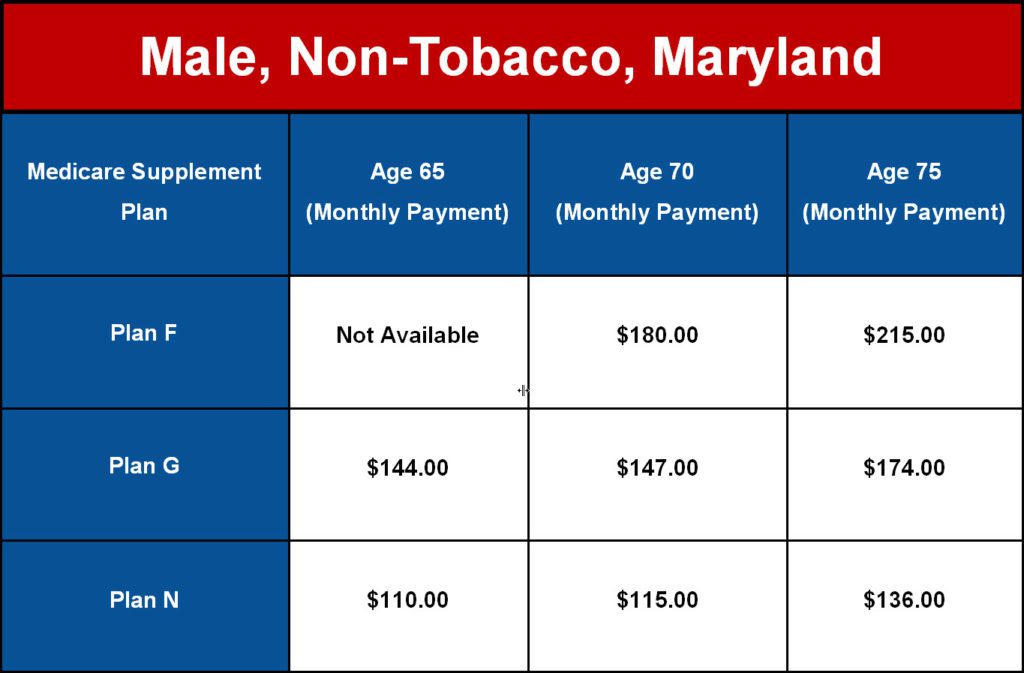

In Maryland? Curious what a Medicare Supplement plan costs? The charts below outline some of the current pricing for both males and females. You may see rates less than these listed on other websites, but many of those rates include discounts such as household or active wear. We prefer not to list those since not all folks qualify for them. Our advisors will of course look for each and every discount to help you get the best pricing for your Medigap plan. Once again it is important to remember that if you went onto Medicare January 1, 2020 or later, you are not eligible to enroll in Plan F.

Are you confused about which MD Medicare supplement plan is suitable for you? Don’t panic! First, evaluate your medical needs and budget. Consider the doctors you visit frequently and ask them if they participate in the Medicare Assignment program. This is making sure that they do not balance bill for an additional 15% over what Medicare approves.

Then, take a look at the prescriptions you are currently taking and make sure that your stand-alone Part D plan covers those at the lowest possible costs. When it comes to getting help with your Part D plan premiums, there is a state program that is based off income and not assets. Many seniors in Maryland qualify for this benefit.

Lastly, while many folks are turning to Medicare Advantage plans due to the low monthly premiums, it is important to remember that plan networks in Maryland are much smaller in the rural areas than in the larger cities.

Are you feeling overwhelmed about choosing a Medicare supplement plan in Maryland? Depending on your budget, you may feel that a Medicare Supplement plan may simply cost too much. The commercials on TV touting little to no premium Medicare Advantage plans may seem like a no-brainer. While a Medicare Advantage plan might seem appealing, it is important to understand that it is not the same as a Medicare Supplement plan.

Many of our clients do opt to get a Medicare Advantage plan from us, but our advisors make sure that you completely understand that these plans use a cost-sharing approach. This means that you will have co-pays and even co-insurance payments that you will need to pay when receiving care. Some examples of these co-pays include small ones when visiting your primary care physician, but large ones when there is a hospital stay.

Signing up or making changes to your existing MD Medicare Supplement Plan may seem like a daunting task, but it doesn’t have to be. At Senior Benefit Services we make it EASY! Fortunately, we make the process simple and straightforward. We will help you understand what Medicare Supplement plans available and which ones you should consider. If you already have a Medicare Supplement plan it is always in your best interest to get a comparison quote. To review your current Medigap policy and pricing, you can either call us at (800)924-4727 or complete our online quote request.