Is Cancer Insurance Worth It? In our opinion it is! Now keep in mind as my grandfather used to say “Opinions are like rear-ends…everyone has one and they usually all stink.” Now with that being the case, what makes our opinion different. Well, we are going to back that opinion up with data.

Now before you say…”There is no family history of cancer that I need to worry about.” Remember that for there to be a family history it has to start with someone. We’ve all known people who have been diagnosed with cancer, and they are the first one in their family to have it.

Cancer is a disease that affects millions of people each year, and the cost of treatment can be significant. While traditional health insurance for those under the age of 65, Medicare, and Medicare Advantage plans can help cover the cost of cancer treatment, it may not cover everything. That’s where cancer insurance comes in. Cancer insurance is a type of supplemental insurance that can provide additional financial support to help cover the cost of cancer treatment.

One of the main reasons to buy cancer insurance is to help cover the cost of treatment. Cancer treatment can be expensive, and the cost of chemotherapy, radiation, and other treatments can add up quickly. According to The Agency for Healthcare Research & Quality (AHRQ) it is estimated that direct medical costs for cancer in the US back in 2015 were a staggering $80.2 BILLION (while 52% of this amount was for outpatient hospital and doctor office visits). The National Cancer Institute estimated that cancer-related medical costs in the US were $208.9 BILLION in 2020.

According to the American Cancer Society it is estimated that there will be over 1,900,000 new cancer cases diagnosed in the US during 2023. The risks of developing cancer are extremely high. In fact the older that you get the chances increase. Research shows that 88% of those diagnosed with cancer are over the age of 50. The chances of cancer increase even more in each individual’s case based on their lifestyle (such as smoking, heavier body weights, drinking alcohol, and their diet). Keep in mind that if an individual has a family history of cancer, their chances of being diagnosed with cancer during their lifetime can increase even more.

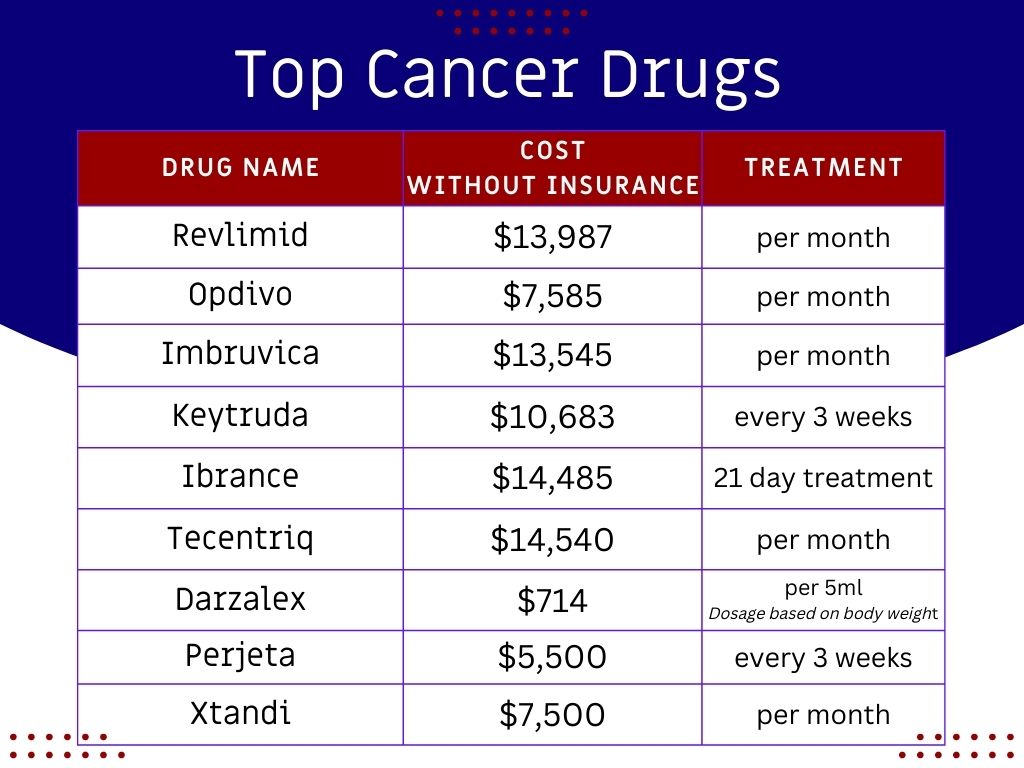

The list price for many of the needed prescription medicines are now more than $100,000 annually. According to an article by GoodRx one of the most expensive drugs in the US is Kimmtrak which retails at $18,760 for a single vial. Annual treatment costs would be $975,520. Now keep in mind that this is not traditional radiation or chemotherapy treatment. According to an article published by the American College of Radiology states that the cost to treat prostate cancer with proton therapy radiation can reach $40,000. Individuals and their families can use cancer insurance to obtain a lump sum of money that helps cover these costs and alleviates the financial burden. While insurance may cover a large portion of the costs of these drugs, there will still be high amounts of out of pocket spending by the consumer. Cancer insurance is worth having because it provides extra money directly to you to help pay for these expenses.

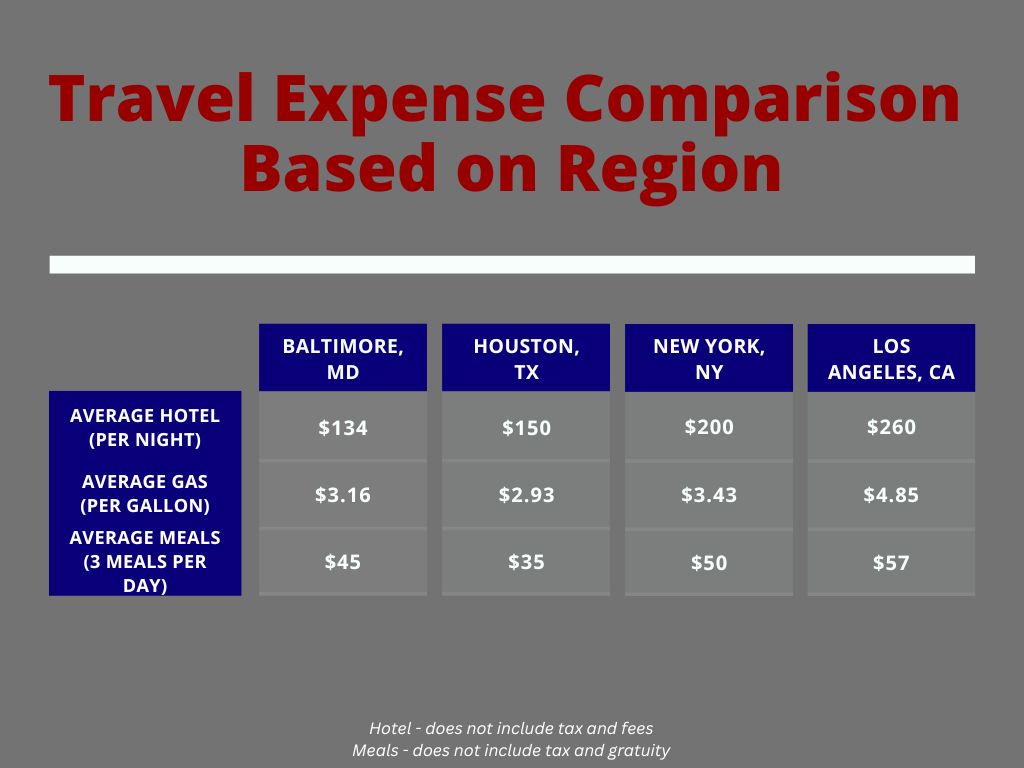

Another reason to buy cancer insurance is to help cover the cost of non-medical expenses. Cancer treatment can also include additional expenses such as transportation to and from treatment, lodging for out-of-town treatment, and even loss of income due to time off work. Cancer insurance can ease the financial burden on the individual and their family by providing a lump sum of money that they can use to cover these expenses. Covering these expenses also helps make cancer insurance worth looking at.

Cancer insurance can also provide a sense of peace of mind. Knowing that you have additional financial support in the event of a cancer diagnosis can provide a sense of security. This helps individuals and their families focus on recovery and treatment, rather than worrying about financial stress.

It’s also important to keep in mind that cancer insurance can complement traditional health insurance. Cancer insurance can help fill in the gaps that traditional health insurance may not cover and provide additional financial support. So, let’s take a look at some of these gaps in different types of insurance:

While these numbers alone are alarming, according to data provided by Bankrate in early 2022, a whopping 56% of Americans would not be able to pay an unexpected bill of $1,000 with their savings.

Even though health plans typically set a limit on the amount a policyholder must pay for medical expenses out of pocket in a calendar year, they do not cover additional expenses that individuals often incur when being treated for cancer, such as:

The good news is that you never got cancer! In fact we highly recommend that when folks purchase cancer insurance that they add the return of premium rider just for this reason. This makes having cancer insurance a win-win for you!!

Those diagnosed with cancer will receive additional financial support from cancer insurance. It can help cover the cost of treatment, non-medical expenses, and provide a sense of peace of mind. It’s important to speak to an insurance agent to understand the coverage and options that are available.

You can then make an informed decision about whether cancer insurance is the right choice for you. Understanding that cancer insurance is a compliment to traditional health insurance is very important. To find out if a cancer insurance is worth it and right for you. Contact Senior Benefit Services, Inc at (800) 924-4727.