Learn how your medicare premium changes as you age. Finding the best Medicare supplement plans in can feel overwhelming, and determining their rates can seem even more difficult. Especially when every company online wants your personal information before showing you rates! Not at Senior Benefit Services!

In this article, we show you sample Medicare supplement rates by age and help you calculate medicare premiums for different plans. Your medicare costs may vary depending on your situation, age, and plan. Plan for future medicare costs by reaching out to one of our team members today.

How to Find the Best Medicare Premium Costs & Supplement Rates By Age –

In this guide, we’ll examine ways to manage your medicare costs, which includes medicare rates, and how your age can affect your coverage options, helping you compare medicare plans and find the best supplement plan costs.

Most of the time when we think about Medicare or Medicare supplement plans, we don’t think past the age of 65.

We are all assuming that once we reach that golden age, we will figure things out and then move on into retirement easily.

For some of us that will be true, but you will be shocked to find out that most of us might not even enroll in Medicare Part B when we turn 65.

This means we could miss our initial enrollment period which is the only time your approval is guaranteed, or we might just wait too long to finally decide to enroll and have to pay a penalty.

In other cases, you’re over 65 and your premiums increase. Now you are comparing Supplement insurance companies and their rates to see if you can save money.

Either way, we can help! — Click here for a free quote!

Others will enroll and stick with primary Medicare or go with a Medicare Advantage plan.

All of the options are fine, but what do you do when money is going out faster than it is coming in?

Shouldn’t there be a fast way to look at some monthly premiums based on your age and try to get some help lowering them?

We want to help you through the high premiums and the noise on what options can be best by laying them out easily in this post.

Get The Medsup Plan With The Best Rate

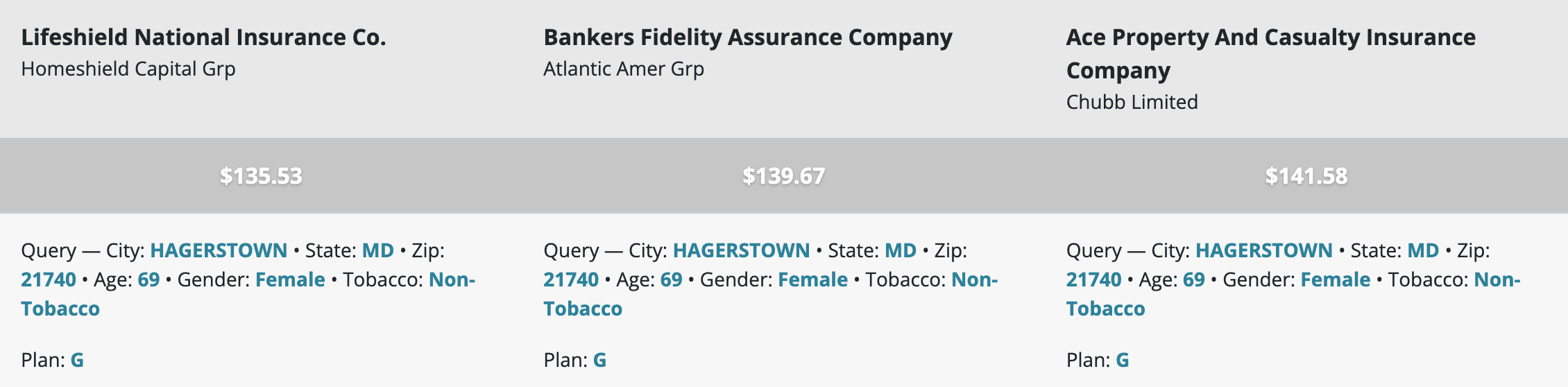

However, the same plan might be more from another company such as Bankers Fidelity $139.67/month or ACE Property & Casualty at $141.58/month.

It is easy to think that maybe a company such as State Farm or Blue Cross/Blue Shield must offer better benefits because they are more widely known or that they are the “Safer Bet,” but the truth is that their Plan G is exactly the same as any Plan G, but far more expensive.

Every company is mandated by law to offer the exact same benefits per plan.

This means that All N Plans are the same, and all F Plans are the same, it doesn’t matter who you buy the policy through.

For example, if you’re comparing Medigap companies by rate increases, you’ll find all companies have the same percentage of increase.

We think this is very important to note because as you look through more supplement rate plans by age, we want you to remember that you should always go with the lowest price and if you are unsure you can contact us here: 1.800.924.4727 and check today’s medicare rates or fill out our quote form below.

This enrollment period starts on the first day of the month you will turn 65 and are enrolled in Medicare Part B. The best thing about this specific open enrollment period is that you are guaranteed approved no matter your health conditions.

Keep in mind that you can’t delay or replace your Medsupp Open Enrollment Period. A 66 year old male or female who is in great shape is probably going to be looking at a Plan N when starting out just because these plans are going to be the most affordable and you will probably be in excellent health.

But you always want to be mindful that when your initial supplement plan enrollment period passes, you might be required to go through underwriting if you decide to switch plans in the future so think about the now and your future. This could effect your supplement rates, depending upon the supplement plan details.

According to Medicare.com, anyone turning age 65 or going onto Medicare starting in 2020 will not be able to purchase Plan F.

If you already have supplement plan and supplement rates prior to 2020 and have Plan F, then you can keep it.

Otherwise, we will basically be losing supplement plan F after 2020 so keep that in mind. Below are some sample Medigap rates by age for 65-69 for both male and female. Review some typical Medigap charges for your age group.

How Medicare Rates Change Through Different Life stages – Your supplement rate eligibility periods

Medicare Supplement Rates For 65 – 69 Years Old

- Male

- Female

Special senior rates available during enrollment. Understanding how senior rates are calculated are very important. Please check out these sample Supplement rates. See how Medigap charges differ between plans. Compare senior rates across all 3 plans. Find the best supplement rate for your needs.

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 65 Years Old | $114.00 | $152.00 | $180.00 |

| 66 Years Old | $114.00 | $152.00 | $180.00 |

| 67 Years Old | $114.00 | $152.00 | $180.00 |

| 68 Years Old | $120.00 | $153.00 | $181.00 |

| 69 Years Old | $121.00 | $156.00 | $184.00 |

Understanding your medicare premium structure. See how Medigap charges differ between plans.

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 65 Years Old | $99.00 | $133.00 | $157.00 |

| 66 Years Old | $99.00 | $133.00 | $157.00 |

| 67 Years Old | $99.00 | $133.00 | $157.00 |

| 68 Years Old | $104.00 | $133.00 | $157.00 |

| 69 Years Old | $105.00 | $135.00 | $160.00 |

Check your medicare premium qualification status. Get personalized senior rates today!

Medigap Rates For 70 – 75 Years Old

If you waited until you reached your 70’s before enrolling into Medicare, you can still qualify. Your rates may be more expensive than for someone in their 60’s, but we’ll show you the best plans and rates here.

How supplement rates are determined. Here’s how the pricing works:

For every year you go without Part B of Medicare during a time in which you could have had it, your rates go up by 10%.This means if you are starting out at 70, your premiums are already 50% more than they would have been and if you wait until 75 they are going to be 100% more than they would have been.

This is important because it’s going to be hard to pay much higher premiums and still afford to pay the plan rates. On the other hand, if you didn’t wait until your 70’s to get coverage, you could be in a situation where you need to switch plans.

This can happen because you might be considering what would happen if you started to need to visit the doctor more, or because of monthly premiums. Below are some quick sample Medigap rates by age for both men and women:

- Male

- Female

Understanding your medicare premium structure. Current supplement rates may vary by location. See how Medigap charges differ, and compare supplement rates across different plans.

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 70 Years Old | $126.00 | $158.00 | $188.00 |

| 71 Years Old | $129.00 | $165.00 | $194.00 |

| 72 Years Old | $134.00 | $172.00 | $200.00 |

| 73 Years Old | $138.00 | $178.00 | $212.00 |

| 74 Years Old | $143.00 | $184.00 | $219.00 |

| 75 Years Old | $149.00 | $191.00 | $225.00 |

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 70 Years Old | $109.00 | $138.00 | $164.00 |

| 71 Years Old | $113.00 | $143.00 | $169.00 |

| 72 Years Old | $118.00 | $149.00 | $174.00 |

| 73 Years Old | $123.00 | $156.00 | $185.00 |

| 74 Years Old | $127.00 | $162.00 | $190.00 |

| 75 Years Old | $132.00 | $168.00 | $195.00 |

Medsup Rates For 76 – 80 Years Old

Your rates for a Medsup plan at 77 or 80 are probably going to be at their highest level when you are in this age range.

This doesn’t mean there isn’t any room for savings and if you are pretty good health at this point, you still may be able to find a different company with lower prices.

It might feel odd to make a change to a plan that you have had for a long time, but sometimes even changing the company is all that is needed to get a large amount of savings.

Remember that any insurance company that offers your plan has to provide the same primary supplement plan benefits, regardless of the price. This means that a Plan G benefits with one carrier have to be the exact same benefits with another carrier. The only difference can be what the rates are with each carrier.

In other words, the company you go through for benefits don’t matter because the supplement plan benefits have to be the same and any Doctor or Hospital that accepts Medicare will accept Medigap plans.

Below are a few rates by age for men and women:

- Male

- Female

Understanding your medicare premium supplement rate structure. See how Medigap charges differ between plans.

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 76 Years Old | $155.00 | $199.00 | $236.00 |

| 77 Years Old | $161.00 | $207.00 | $246.00 |

| 78 Years Old | $168.00 | $215.00 | $256.00 |

| 79 Years Old | $175.00 | $222.00 | $263.00 |

| 80 Years Old | $180.00 | $229.00 | $271.00 |

Sample Quotes: Male – Non-Tobacco – Living in Hagerstown, MD

Click here for a custom rate based on your specific state and tobacco use.

Understanding your medicare premium supplement rate structure. See how Medigap charges differ between plans.

| Age | Plan N | Plan G | Plan F |

|---|---|---|---|

| 76 Years Old | $137.00 | $174.00 | $205.00 |

| 77 Years Old | $142.00 | $181.00 | $214.00 |

| 78 Years Old | $148.00 | $188.00 | $222.00 |

| 79 Years Old | $152.00 | $194.00 | $229.00 |

| 80 Years Old | $157.00 | $199.00 | $236.00 |

Sample Quotes: Female – Non-Tobacco – Living in Hagerstown, MD

Grab your free Medicare pricing today!

Medicare Supplement Rates Premium Pricing Method

The reason this is important to pay attention to is that you could purchase a policy when you are 65 that is super affordable, but by the time you reach 81 your rates could have skyrocketed.

You can calculate your Medigap charges based on three different ways that an insurance company can set your premium prices. It is going to depend on the state which option is offered by which company:

Community – Rated

Issue Age – Rated

Attained Age – Rated

Now that we have an understanding of how policy premiums are priced let’s look at what the best Medigap plan could be for your age group.

The Best Medigap Plan By Age

Keep in mind, that there are several factors to take into consideration when it comes to purchasing a supplement plan, not just your age. Rates are also based on whether or not you have or currently use tobacco products. We are just attempting to give you an idea of where you might want to start based on your age.

Male or Female Ages 65 – 69

As a 65 year old female, you are going to probably still be in the best shape of your life with no significant medical issues and very little need to visit a doctor outside of emergencies and well care visits.

Because of this, we would say Plan N is probably going to be the best option for you. As you read above, for the lowest rates Plan N is going to be your best option, or Medicare Plan G if you don’t want co-pays.

This is great because all you will pay is a co-pay when you make any visits to your doctor.

In my opinion the Plan G or Plan N would be best for someone turning 65.

We would recommend the G for someone who does not want to worry with co-pays.

We would recommend the N for someone who is healthy and doesn’t mind paying a co-pay.

Miranda Davis Hapner

Female or Male Ages 70 – 80

Once you get to this age range, such as a 73 year old male looking into the best Medicare Supplement plans, your best option will be to get the plan you can afford most.

However, if you can afford it, Plan G is probably going to be the best option for you based on the fact that there are only two differences between Plan G and Plan F.

- Plan G rates are a much more affordable than Plan F

- Plan G doesn’t cover your Medicare Part B Deductible

When you add those two things together, Plan G becomes one of the best options around.

If we look at the rate tables above for a 70 year old female, the Plan F will cost us $164.00/month, and a Plan G will cost us only $138.00/month.

Now here is where it gets fun, the total out of pocket amount for each plan looks like this:

| Plan | Premium | Part B Deductible | Annual Cost |

|---|---|---|---|

| Plan G | $138.00/month | $240/year | $1,896.00 |

| Plan F | $164.00/month | Included | $1,968.00 |

We are talking about a total annual savings of $86.00 which is right around $7.00/month in savings. While this particular example shows only a small savings, it still does not make sense to pay extra for Part B deductible coverage if you still save money with Plan G.

Depending on the plan (especially the older ones) you currently have, the savings could be far greater.

What About Plan F?

In all honesty, Plan F will be going away soon, and if you currently have Plan F, you will probably find more savings by switching to a Plan G now and forking over that small annual deductible.

We don’t see any reason for someone new to join into a Plan F, and if you are a 76 year old male or a 77 year old female, then we think you should be reaching out to us for some quotes on a Plan G, just to be on the safe side. Rates are changing every year, so it pays to get a quote from us.

Pros & Cons Of Medicare Supplement Plans

We haven’t found anything in life that is perfect yet, so it would be crazy to think that Medicare supplement plans are, below we discuss the pros and cons:

Pros

Your Acceptance Is Guaranteed For 6 Months

The month you turn 65 you qualify for whats known as your IEP or Initial Enrollment Period, which will last for 6 months.

As long as you enroll in Medicare A & B, you can get approved for a Medsup policy no matter what your current medical conditions are, just think of it like a one time get out of jail free card. Once again, you are going to be looking at the different rates for plans available in your area.

Your Policy Is Guaranteed Renewable

As long as you pay your monthly premiums, your policy is guaranteed renewable, which means you don’t have to go through underwriting to renew the policy.

This is an awesome benefit because you can’t loose coverage due to an illness or for being diagnosed with anything.

An Extra Year of Hospitalization Coverage

When you have used up all of the hospitalization coverage that comes with traditional Medicare, your Medsup plan will kick in and give you an additional 365 days of coverage.

This is a great benefit because in the chance that you to stay in the hospital for more than a year, you are covered. This benefit is part of your basic benefits and is built into the rate of the Medicare Supplement plan.

Cons

Rates Change Annually

Like most health insurance products, Medsup plans renew on an annual basis which means that your rates can also go up on a year-by-year basis.

Getting a rate increase is not pleasant! It’s always best to talk to one of our advisors to see if current rates with increases on your supplement plan has made your policy more expensive than others we have available.

Prescription Drugs Aren’t Covered

Part D of Medicare, which is Prescription Drugs, isn’t covered or included with a Medsup plan, you must still purchase this product separately.

Prescriptions can be very important depending on your current health situation and will determine how much additional coverage you may be able to afford.

As part of our service we can assist you with finding the right prescription drug plan once we get you set up for your Medsup plan.

Could Be Hard To Switch Later If You Have Medical issues

Once you are covered and after your 6 month initial enrollment period, if you decide to switch to another Medsup plan it is possible that you can be denied new coverage if you don’t pass the underwriting.

Since you are only protected with guaranteed issue status during your Initial Enrollment Period, if you don’t pass the guidelines for underwriting, you might be stuck in the Medsup plan you started with.

Hopefully this gives you a general overlay of the pros and cons of a Medsup policy.

We can work with you to figure out which option would be best for you and give you the most savings. It only takes a few minutes of your time to see if you can save on your supplement rates.

Medicare Supplement Rate Increases

Will my Medicare Supplement insurance have a rate increase?

This is one of the easiest ways to quickly determine whether you should continue talking with the agent who is trying to sell you the plan. Why?

Any agent who tells you that a supplement plan will not increase current premiums is simply not telling you the truth. If they can’t tell you the truth about something as simple as this, you can only imagine the whoppers you are going to be told after you get your first rate increase.

Are there times when supplement plans don’t have a rate increase? Yes, but that is not the case year after year. Sometimes an insurance company will actually reduce rates on a particular plan if they find that they are not competitive at all or end up with an abnormally low claim ratio for the previous year. Once again, don’t count on this happening.

You will find that supplement plans will have a rate increase each year. The rate increase will typically take effect when your policy renews. In some cases, an insurance company may do a small rate increase when you have an age change and then another one on the policy anniversary. This usually happens when your birthday month is not the same as the policy anniversary month.

What Can Cause My Supplement Rate Increase?

There are several factors that influence a supplement rate increase. Let’s look at just a few of those factors:

- When Medicare increases the annual Part B deductible.

- When Medicare increases the Part A deductible and co-payments.

- Increase costs in healthcare

- Higher than expected claims payout by the insurance company for all policyholders in a particular supplement plan (ex. Plan G has a 9% increase due to high number of claims being paid out, but Plan N only has a 2% rate increase due to a lower amount of claims being paid out).

Why do so many retirees end up paying more for their Medicare Supplement plan than they have to?

Most retirees believe that they cannot qualify for a new plan due to their health. While current health conditions do play a role in underwriting, there are many conditions that carriers do not consider deal breakers. Another reason why many are overpaying is because they don’t want to go thru a high-pressure sales call just to see if they can reduce their monthly premiums.

This is exactly why we make things easy for retirees. Our advisors understand that shopping for health insurance is not fun. In fact, it can cause as much anxiety as walking onto a car lot. When you contact our company, we are going to remove the anxiety and make it a very simple process. First, we are going to simply ask you the following questions:

- Who do you currently have your Medicare Supplement insurance with?

- Which Medicare Supplement plan do you currently have (shows on your insurance card)?

- What zip code do you live in?

- What is your current age?

- Do you use tobacco or not?

From this limited amount of information, we can see which plans are the most competitive in your area. At this point we need to now look at your current health conditions and then narrow down which companies you could potentially qualify for coverage with. The key thing is that we are doing the work and you are simply just answering some questions. Typically, our advisors will show you up to three insurance company options, but will steer away from carriers that have had larger rate increases over the last 5-7 years.

Here is the great thing…no one is going to try and pressure you into switching your current plan. If you like what we have to offer, then great. If what we have to offer does not put you in a better position, then we will tell you that and advise you to keep what you currently have. The worst-case scenario is that you walk away knowing that you are in the plan that you need to be at a great price. The best-case scenario is that you find out we can get you the exact same coverage at a much lower rate and put money back in your pocket each month. You don’t have to wait until you get another rate increase to find out if you can start saving money now.

Plan N vs Plan G vs Plan F Medicare Supplement Rates

We put together a quick summary of the difference in the 3 major plans which are Plan N, Plan G, and Plan F, keep in mind that Plan F will be going away soon, but the option is still available:

| BENEFITS | PLAN N | PLAN G | PLAN F |

|---|---|---|---|

| Part A HospitalCo-Insurance | YES | YES | YES |

| 365 Hospital Reserve Days | YES | YES | YES |

| Part B Co-Insurance /Co-Payment | YES | YES | YES |

| Blood Benefit(First 3 Pints) | YES | YES | YES |

| HospiceCo-Insurance /Co-Payment | YES | YES | YES |

| Skilled Nursing Facility Co-Insurance | YES | YES | YES |

| Part A Deductible | YES | YES | YES |

| Part B Deductible | NO | NO | YES |

| Part BExcess Charge | NO | YES | YES |

| ForeignTravel Benefit | 80% | 80% | 80% |

| Out Of Pocket Limit | N/A | N/A | N/A |

Can I Get A Medigap Plan At Age 80, 85, or 90?

The short answer is Yes, you can get a Medigap plan at the age of 80, 85, or 90 because there is no age limit on a Medigap Plan.

However, the better question is will you be able to afford it and would you qualify medically at that age if you were just starting Medicare or If you were trying to switch to a more affordable plan.

We can’t stress enough the importance of planning out how you will pay for your Medigap plan when you first purchase it. Medicare Supplement plan rates will typically go up each year so planning for the future is important.

Nor can we stress enough the importance of enrolling into Medicare Part A & B as early as possible.

If you are an 80 year old female or male in great health and you think your Medigap rates are entirely too high then we suggest reaching out to us so that we can look into getting you a lower rate.

Medicare Plan G FAQ

Several factors influence Plan G costs:

Age: Rates typically increase as you get older

Location: Premiums vary by state and even zip code

Gender: Women often pay lower rates than men

Tobacco use: Non-tobacco users pay less

Insurance company: Different carriers charge different rates

Pricing method: Community-rated, issue age-rated, or attained age-rated

How do Medicare Plan G costs compare to other plans?

Looking at our sample rates for a 65-year-old:

Plan G: $152/month (male), $133/month (female)

Plan F: $180/month (male), $157/month (female)

Plan N: $114/month (male), $99/month (female)

Is Medicare Plan G worth the cost?

Plan G often provides the best value for comprehensive coverage. While Plan F offers slightly more coverage by paying the Part B deductible, the premium savings with Plan G usually outweigh this additional benefit.

For example, a 70-year-old female would save $312 annually by choosing Plan G over Plan F ($1,656 vs $1,968 annual cost).

Taking Action For Better Medicare Supplement Rates

The best thing about insurance is that it doesn’t cost you anything to find out if you can get approved or covered for a much lower rate. Let Senior Benefit Services provide you a side by side comparison of rates in your state.

The process is going to be different for everyone; however, you shouldn’t let that deter you from seeking out more affordable coverage.

Other ways to reduce your Medicare Supplement premiums

Be open to possibly reducing one of your benefits. For many years the most popular Medigap plan purchased was Plan F. This plan was considered the top-of-the-line plan since it covered all Medicare approved charges, provided first dollar coverage by paying all deductibles and co-payments, and even provided 100% protection for excess charges. Many folks can reduce their annual premiums by $500 or by simply moving to a Plan G. The Plan F and Plan G are the same in coverage except that the Plan F pays the annual Part B deductible for the policyholder and the Plan G does not.

Another way to reduce premiums is to look at a Medicare Supplement that has cost sharing features. The most popular plan that does this is Plan N. With this plan, you are going to have a small co-payment when you visit your doctor or must go to the emergency room. This plan many times can dramatically lower the client’s monthly premiums, but it does require them sharing in the overall costs a bit.

Should you switch to a Medicare Advantage plan to save money?

Keep in mind that if you are considering moving from a Medicare Supplement plan to a Medicare Advantage plan that you are now comparing apples to oranges. To understand more about Medicare Advantage plans click our article here.

If you are seriously considering a Medicare Advantage plan, we do not recommend trying to enroll in one directly with the carrier. You will want an honest agent to walk you thru all the areas that you will be responsible for in the way of co-pays and co-insurance. An example of this would be the daily hospital co-pays. Most plans have you pay a hospital co-pay for the first 5-7 days you are an inpatient. This is not a $20 co-pay that you would make to your primary care physician but rather a $300+ per day co-pay. Many times, just one hospital stay could end up making your total out of pocket expense higher than what your plan premium would cost you for the year.

Let Us Help You

If you are even just the slightest bit curious as to whether you can lower your Medicare Supplement premiums, then give us a call at (800)924-4727 or click the button below.