Finding quotes and information for your specific state’s Medigap plans can be time consuming and if you are in the process of moving, understanding how your plan will work in a new state can be mind boggling.

But it doesn’t have to be:

Each plan is exactly the same in almost every state besides a few and once you learn how they work, the only thing you have to concern yourself with is pricing and extra benefits.

Today I am going to go over the most expensive, most affordable and mid-range states when it comes to Medicare supplement plans by state, as well as how to get the most savings no matter the state you live in.

Get Your FREE Medicare Supplement Quote

We recommend you get started with a free Medicare Supplement quote by state.

What Are Medicare Supplement Plans

In general, Medicare Supplement plans are health insurance products that help supplement original Medicare parts and are offered through private insurance companies.

They help pay some of the hospital and medical costs for things that original Medicare doesn’t cover like:

- Emergency Overseas Travel

- Co-Payments

- Co-Insurance

- Yearly Deductibles

- Part B Excess Charges, Etc…

This is where the nickname Medigap comes from, this policy fills the “gaps” that can be found in original Medicare coverage.

You will also see this policy referred to as a Medsup plan which is just a shortened version of Medicare (Med) Supplements (Sup) = Medsup.

This was just a quick overview of what a Medicare Supplement Plan is; however, you can read this article if you would like a more detailed breakdown of Medsup Plans.

Medicare Supplement Plans Are Standardized

This post won’t go over what Medicare Supplement plans are; however, you can read this article if you need to learn about Medicare Supplement Plans first.

The best thing about Medicare Supplement, Medigap, or Medsup plans, is that they are standardized in pretty much every state.

The only states that they drastically differ in are Massachusetts, Minnesota, and Wisconsin, these states have their own standardized plans.

We will go over the differences a bit below but for now let’s check out all of the standardized plans.

In almost all states there are around 10 Medsup plans that are standardized and they are named with letters.

These letters go from A to N and most of the time you will hear about Medicare Supplement Plan N, Medicare Supplement Plan G or Medicare Supplement Plan F.

While all of these plans are different and cover different benefits, they will all function the same and have the same name no matter the state you are in.

For example:

A Medsup Plan N in California will have the same plan benefits as a Medsup Plan N in Georgia.

The biggest difference is that the rates can be different and the products can offer additional benefits on-top of the standardized benefits but can never offer less benefits.

This means that if you only are interested in a Medsup Plan G, once you learn all of the benefits and what it covers you never have to figure out if this will change if you move.

Available Plans In 47 States:

Medicare Supplement Plans A – F | |||||

|---|---|---|---|---|---|

Benefits |

Plan A |

Plan B |

Plan C |

Plan D |

Plan F |

|

Part A Hospital Co-insurance |

Yes |

Yes |

Yes |

Yes |

Yes |

|

365 Hospital Reserve Days |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Part B co-insurance / co-payment |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Blood Benefit (first 3 pints) |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Hospice coinsurance / co-pay |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Skilled Nursing Facility co-insurance |

No |

No |

Yes |

Yes |

Yes |

|

Part A deductible |

No |

Yes |

Yes |

Yes |

Yes |

|

Part B deductible |

No |

No |

Yes |

No |

Yes |

|

Part B excess charge |

No |

No |

No |

No |

Yes |

|

Foreign Travel Benefit |

No |

No |

80% |

80% |

80% |

|

Out-of-pocket limit |

N/A |

N/A |

N/A |

N/A |

N/A |

Medicare Supplement Plans G – N | |||||

|---|---|---|---|---|---|

Benefits |

Plan G |

Plan K |

Plan L |

Plan M |

Plan N |

|

Part A Hospital Co-insurance |

Yes |

Yes |

Yes |

Yes |

Yes |

|

365 Hospital Reserve Days |

Yes |

Yes |

Yes |

Yes |

Yes |

|

Part B co-insurance / co-payment |

Yes |

50% |

75% |

Yes |

Yes |

|

Blood Benefit (first 3 pints) |

Yes |

50% |

75% |

Yes |

Yes |

|

Hospice coinsurance / co-pay |

Yes |

50% |

75% |

Yes |

Yes |

|

Skilled Nursing Facility co-insurance |

Yes |

50% |

75% |

Yes |

Yes |

|

Part A deductible |

Yes |

50% |

75% |

50% |

Yes |

|

Part B deductible |

No |

No |

No |

No |

No |

|

Part B excess charge |

Yes |

No |

No |

No |

No |

|

Foreign Travel Benefit |

80% |

No |

No |

80% |

80% |

|

Out-of-pocket limit |

N/A |

$5,240 |

$2,620 |

N/A |

N/A |

Medsup Plans In Massachusetts

Massachusetts is going to be one of the states that works a bit different when it comes to Medicare Supplement plans. Overall the plans will still work along side your Original Medicare which is Part A & Part B, to help cover specific expenses.

As you can see above, Medigap plans are usually grouped into 10 standardized plans but Massachusetts, along with Wisconsin and Minnesota have their own plans.

Unlike the other 47 states that have the 10 lettered plans, Massachusetts only has 2 different plans.

These plans both cover the basic benefits and one has more coverage than the other plan

Massachusetts MedSup Plan Chart | ||

|---|---|---|

Benefits |

Core Plan |

Supplement 1 |

|

Hospital coinsurance up to 365 days after Medicare Part A coverage is used up |

Yes |

Yes |

|

Medicare Part B Coinsurance |

Yes |

Yes |

|

Hospice coinsurance or copays (Part A) |

Yes |

Yes |

|

Blood Benefit (First 3 Pints) |

Yes |

Yes |

|

Benefits required by the state, such as annual Pap tests and mammograms |

Yes |

50% |

|

Inpatient days per year in a mental health hospital |

Yes (60 Days) |

Yes (120 Days) |

|

Part A deductible |

No |

Yes |

|

Part B deductible |

No |

Yes |

|

Part A skilled nursing facility coinsurance |

No |

Yes |

|

Limited emergency care during foreign travel |

No |

Yes |

As you can see, there aren’t many Medigap plans in Massachusetts, however both options give you the ability to have a strong amount of standard benefits that are covered in addition to Original Medicare.

Medsup Plans In Minnesota

Minnesota is another one of the states that doesn’t conform to the traditional standardized medicare supplement plans. Overall the plans will still work along side your Original Medicare which is Part A & Part B, to help cover specific expenses.

Unlike the other 47 states that have the 10 lettered plans, just like Massachusetts, Minnesota only has 2 plans.

These plans both cover the basic benefits and one has more coverage than the other plan

Minnesota MedSup Plan Chart | ||

|---|---|---|

Benefits |

Basic Plan |

Extended Basic Plan |

|

Hospital coinsurance and approved costs under Medicare Part A |

Yes |

Yes |

|

Medicare Part B Coinsurance |

Yes |

Yes |

|

Hospice coinsurance or copays (Part A) |

Yes |

Yes |

|

Blood Benefit (First 3 Pints) |

Yes |

Yes |

|

Medicare Part B excess charges |

No |

80% |

|

Coinsurance or copayments for certain home health services and supplies (Part A/ Part B) |

Yes |

Yes |

|

Part A deductible |

No |

Yes |

|

Part B deductible |

No |

Yes |

|

Part A skilled nursing facility coinsurance |

Yes (100 Days) |

Yes (120 Days) |

|

Limited emergency care during foreign travel |

Yes |

Yes |

As you can see, there aren’t many Medigap plans in Minnesota either, but both options give you the ability to have a strong amount of standard benefits that are covered in addition to Original Medicare.

You are also able to purchase additional rider benefits for the Basic plan if you want additional coverage but don’t need all of the benefits in the Extended Basic Plan.

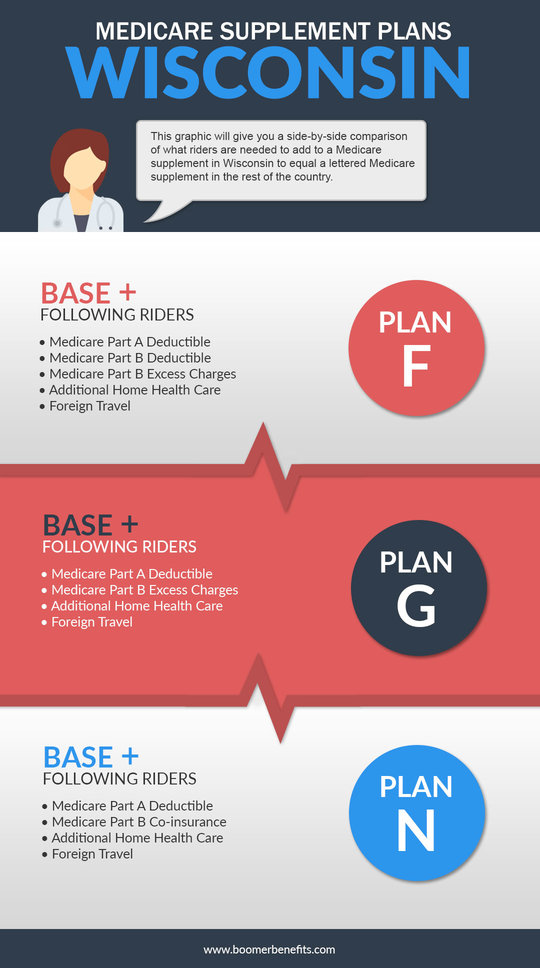

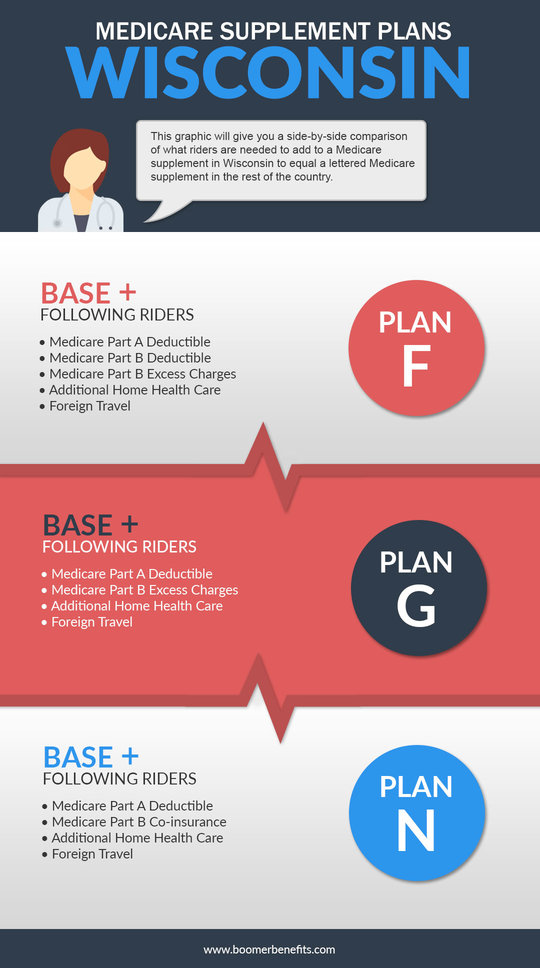

Medsup Plans In Wisconsin

Wisconsin is the third and final state where you won’t see the 10 standard Medicare Supplement plans.

Like in other states, the plans will still work along side your Original Medicare which is Part A & Part B, to help cover specific expenses.

The way things work in Wisconsin is that they have a Basic Plan that offers specific benefits that have been outlined by the state.

You then have the option to add riders to that Basic Plan to expand your plan’s coverage.

As you can see above, Medigap plans are usually grouped into 10 standardized plans but Massachusetts, along with Wisconsin and Minnesota have their own plans.

Wisconsin Medsup Mandated Benefits

Wisconsin requires that Medicare Supplement policies have a few “mandated or required” benefits.

The mandates were put into place to make sure you had enough coverage when you purchase a Medsup Plan in Wisconsin.

Skilled Nursing:

Wisconsin Medigap plans must cover 30 days of skilled nursing care in a skilled nursing facility (SNF).

No prior hospital stay is required and the facility doesn’t need to be certified by Medicare, but must be a licensed skilled nursing facility.

Care must meet medically necessary standards of the insurance company.

Home Health Care:

Medsups in Wisconsin have to also cover up to 40 home care visits each year beyond those provided by Medicare.

To qualify, your doctor must certify that you would need to be in a hospital or skilled nursing facility if home care was not available to you.

Home nursing and necessary home health aide care is also covered, along with other kinds of physical therapy.

Wisconsin Medigap plans have to also offer coverage for 365 home health care visits in a policy year.

Kidney Disease:

Expenses for dialysis, transplants, and donor-related services must be covered by Medigap plans in the state of Wisconsin.

To ensure that there is enough benefit to last through each year, the coverage can’t be less than $30,00 per year.

Diabetes:

Costs for installation and use of an insulin infusion pump or other supplies for treating diabetes must be covered in a Wisconsin Medicare Supplement Plan.

Self-management training is also a covered expense and this benefit has to be made available even if Medicare doesn’t cover the claim.

Wisconsin Basic Plan Covers | ||

|---|---|---|

| Part A Coinsurance – the daily copays you begin to incur after 60 days in the hospital | ||

|

Part B Coinsurance – the 20% that Medicare does not cover for outpatient services.

| ||

|

Blood – As Needed For Medicare-approved surgeries and other procedures. | ||

|

Hospice and Skilled Nursing Facility copayments | ||

|

175 Days Of Inpatient Mental Health Care – beyond the benefit covered under Medicare.

| ||

|

40 Extra Home Health Care Visits – beyond what Medicare already covers.

|

Wisconsin Medsup Riders | ||

|---|---|---|

|

Riders can be purchased to add additional benefits to your basic plan like:

In Wisconsin each insurance company can decide which riders they choose to offer. |

Infographic Provide By Boomerbenefits.com

As you can see, there aren’t many Medigap plans in Wisconsin; however, if you use the basic plan with specific riders you can create yourself a strong plan that functions like one of the more popular standardized plans.

Go With The Most Affordable Medsup Company

Since all of the policies have to be the same, and your current doctor has to accept a Medicare Supplement plan if they currently accept Original Medicare, the company you choose isn’t as important as you think.

When you are purchasing a Medigap policy it is very easy to think that you need to go with the most known companies like a Blue Cross Blue Shield or Mutual Of Omaha.

However this isn’t the case, the only difference they can have will be price, but your standard benefits don’t change at all.

It just doesn’t make sense to pay more money on a month to month basis just to say that you are with “Company A or Company B”.

Think about what is the most affordable option for you as you prepare to retire.

Get A Free Quote

15 States With The Lowest Medsup Rates

Georgia (GA)

Average annual Medigap plan cost: $1,618

Average monthly Medigap plan cost: $134.87

Georgia Medicare State Website.

Hawaii (HI)

Average annual Medigap plan cost: $1,343

Average monthly Medigap plan cost: $111.89

Hawaii Medicare State Website.

Idaho (ID)

Average annual Medsup plan cost: $1,556

Average monthly Medsup plan cost: $129.74

Iowa (IA)

Average annual Medigap plan cost: $1,505

Average monthly Medigap plan cost: $125.38

Maine (ME)

Average annual Medsup plan cost: $1,548

Average monthly Medsup plan cost: $129.00

Maine Medicare State Website.

Minnesota (MN)

Average annual Medigap plan cost: $1,620

Average monthly Medigap plan cost: $135.00

Minnesota Medicare State Website.

Missouri (MO)

Average annual Medigap plan cost: $1,604

Average monthly Medigap plan cost: $133.68

Missouri Medicare State Website.

Montana (MT)

Average annual Medigap plan cost: $1,564

Average monthly Medigap plan cost: $130.33

Montana Medicare State Website.

New Mexico (NM)

Average annual Medigap plan cost: $1,500

Average monthly Medigap plan cost: $125

New Mexico Medicare State Website.

North Carolina (NC)

Average annual Medigap plan cost: $1,613

Average monthly Medigap plan cost: $134.43

North Carolina Medicare State Website.

North Dakota (ND)

Average annual Medigap plan cost: $1,564

Average monthly Medigap plan cost: $130.33

North Dakota Medicare State Website.

Oregon (OR)

Average annual Medigap plan cost: $1,468

Average monthly Medigap plan cost: $122.33

Oregon Medicare State Website.

Virginia (VA)

Average annual Medigap plan cost: $1,596

Average monthly Medigap plan cost: $133.00

Virginia Medicare State Website.

For more information, please see our guide on VA Med Sup plans and pricing.

Wisconsin (WI)

Average annual Medigap plan cost: $1,532

Average monthly Medigap plan cost: $127.70

Wisconsin Medicare State Website.

15 States With The Highest Medsup Rates

Alaska (AK)

Average annual Medigap plan cost: $1,897

Average monthly Medigap plan cost: $158.10

Alaska Medicare State Website.

California (CA)

Average annual Medigap plan cost: $1,862

Average monthly Medigap plan cost: $155.20

California Medicare State Website.

Connecticut (CT)

Average annual Medigap plan cost: $1,908

Average monthly Medigap plan cost: $159.00

Connecticut Medicare State Website.

Florida (FL)

Average annual Medigap plan cost: $1,877

Average monthly Medigap plan cost: $156.39

Florida Medicare State Website.

Also see our guide on Medicare Supplements in Florida.

Illinois (IL)

Average annual Medigap plan cost: $1,836

Average monthly Medigap plan cost: $153.00

Illinois Medicare State Website.

Louisiana (LA)

Average annual Medigap plan cost: $1,944

Average monthly Medigap plan cost: $162.00

Louisiana Medicare State Website.

Maryland (MD)

Average annual Medigap plan cost: $1,912

Average monthly Medigap plan cost: $159.30

Maryland Medicare State Website.

We’ve also written this specific post for Maryland Medicare plans.

Massachusetts (MA)

Average annual Medigap plan cost: $1,996

Average monthly Medigap plan cost: $166.30

Massachusetts Medicare State Website.

Mississippi (MS)

Average annual Medigap plan cost: $1,836

Average monthly Medigap plan cost: $153.00

Mississippi Medicare State Website.

Nevada (NV)

Average annual Medigap plan cost: $1,951

Average monthly Medigap plan cost: $162.62

Nevada Medicare State Website.

New Jersey (NJ)

Average annual Medigap plan cost: $1,939

Average monthly Medigap plan cost: $161.60

New Jersey Medicare State Website.

New York (NY)

Average annual Medigap plan cost: $1,838

Average monthly Medigap plan cost: $153.15

New York Medicare State Website.

Rhode Island (RI)

Average annual Medigap plan cost: $1,860

Average monthly Medigap plan cost: $155

Rhode Island Medicare State Website.

Texas (TX)

Average annual Medigap plan cost: $1,908

Average monthly Medigap plan cost: $159

Wyoming (WY)

Average annual Medigap plan cost: $1,827

Average monthly Medigap plan cost: $152.29

Wyoming Medicare State Website.

22 States With Mid-Range Medsup Rates

Alabama (AL)

Average annual Medigap plan cost: $1,668

Average monthly Medigap plan cost: $139.00

Alabama Medicare State Website.

Arizona (AZ)

Average annual Medigap plan cost: $1,757

Average monthly Medigap plan cost: $146.40

Arizona Medicare State Website.

Arkansas (AR)

Average annual Medigap plan cost: $1,636

Average monthly Medigap plan cost: $136.32

Arkansas Medicare State Website.

Colorado (CO)

Average annual Medigap plan cost: $1,664

Average monthly Medigap plan cost: $138.63

Colorado Medicare State Website.

Delaware (DE)

Average annual Medigap plan cost: $1,773

Average monthly Medigap plan cost: $147.76

Delaware Medicare State Website.

Indiana (IN)

Average annual Medigap plan cost: $1,710

Average monthly Medigap plan cost: $142.47

Indiana Medicare State Website.

Kansas (KS)

Average annual Medigap plan cost: $1,648

Average monthly Medigap plan cost: $137.35

Kansas Medicare State Website.

Kentucky (KY)

Average annual Medigap plan cost: $1,712

Average monthly Medigap plan cost: $142.64

Kentucky Medicare State Website.

Michigan (MI)

Average annual Medigap plan cost: $1,779

Average monthly Medigap plan cost: $148.27

Michigan Medicare State Website.

Nebraska (NE)

Average annual Medigap plan cost: $1,692

Average monthly Medigap plan cost: $141.00

Nebraska Medicare State Website.

New Hampshire (NH)

Average annual Medigap plan cost: $1,747

Average monthly Medigap plan cost: $145.55

New Hampshire Medicare State Website.

Ohio (OH)

Average annual Medigap plan cost: $1,688

Average monthly Medigap plan cost: $140.68

Oklahoma (OK)

Average annual Medigap plan cost: $1,755

Average monthly Medigap plan cost: $146.22

Oklahoma Medicare State Website.

Pennsylvania (PA)

Average annual Medigap plan cost: $1,729

Average monthly Medigap plan cost: $144.09

Pennsylvania Medicare State Website.

Also see our guide for the best Med sup rates in Pennsylvania.

South Carolina (SC)

Average annual Medigap plan cost: $1,665

Average monthly Medigap plan cost: $138.80

South Carolina Medicare State Website.

South Dakota (SD)

Average annual Medigap plan cost: $1,656

Average monthly Medigap plan cost: $138.00

South Dakota Medicare State Website.

Tennessee (TN)

Average annual Medigap plan cost: $1,657

Average monthly Medigap plan cost: $138.11

Tennessee Medicare State Website.

Utah (UT)

Average annual Medigap plan cost: $1,636

Average monthly Medigap plan cost: $136.33

Vermont (VT)

Average annual Medigap plan cost: $1,616

Average monthly Medigap plan cost: $134.66

Vermont Medicare State Website.

Washington (WA)

Average annual Medigap plan cost: $1,629

Average monthly Medigap plan cost: $135.72

Washington Medicare State Website.

Washington D.C. (DC)

Average annual Medigap plan cost: $1,719

Average monthly Medigap plan cost: $143.24

Washington D.C. Medicare State Website.

West Virginia (WV)

Average annual Medigap plan cost: $1,636

Average monthly Medigap plan cost: $136.32

West Virginia Medicare State Website.

Please see our guide for the best Med Sup rates in WV.

Taking Action

Once you have learned the basics, Medicare Supplement plans by state should no longer hard to understand.

Let us help you navigate though the different plan options based on the state that you currently live in because we pride ourselves on helping you though the purchasing process.

There is no reason to wait, get a quote using our widget above or give us a toll free call today at 1.800.924.4727.