Are you trying to find Medicare Plans in Cumberland, MD? Medicare Supplement plans (also known as Medigap plans) are not the same as Medicare Advantage plans. To understand better the differences between Medicare Supplement and Medicare Advantage plans read our article here.

Let’s look at popular Medicare plans in Cumberland, Maryland. Both Medicare Supplement and Medicare Advantage plans are available in Cumberland and all of Allegany County, Maryland.

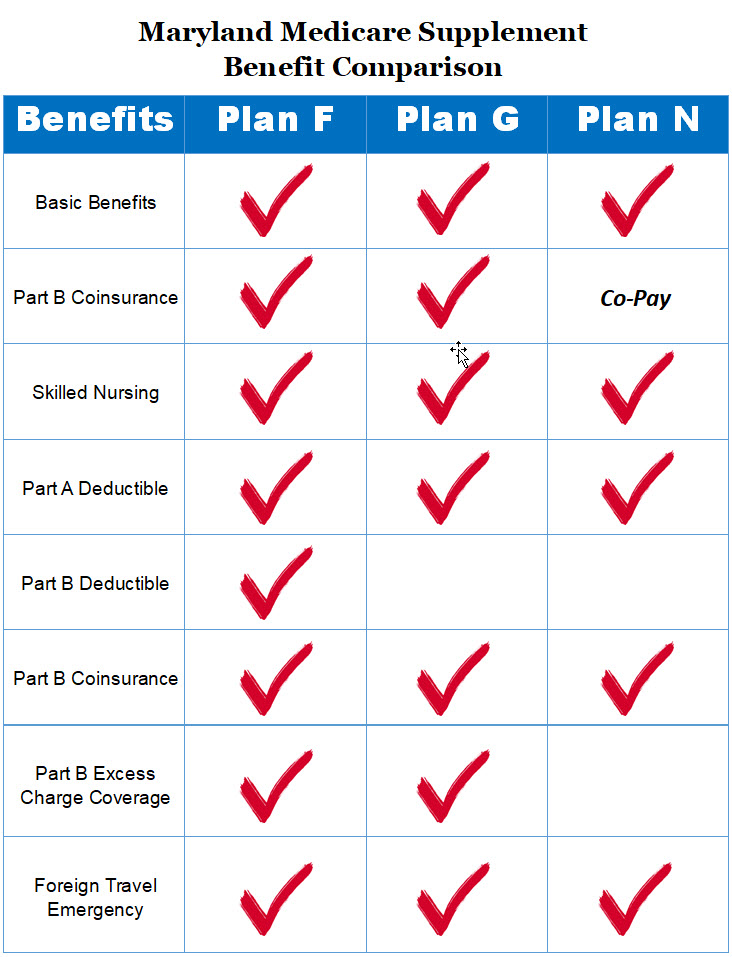

In Cumberland when you’re looking for a Medicare Supplement plan, knowing the top picks can be super useful. , Plan F, Plan G, and Plan N have been the most purchased plans over the years.

Got some awesome news for folks in Maryland—your state does not allow a thing called area factoring. Okay, so that might sound like gibberish, but here’s the information you need in plain speak:

In certain states, insurers may set varying rates based on a person’s residence, though all other factors remain constant. Thus, residents of one zip code could find themselves paying more than neighbors a few districts over due to geographical differences. However, Maryland forbids this practice.

Maryland enforces a rule where two individuals sharing the same age, gender, and tobacco habits get to pay the identical price for an equivalent Medicare Supplement scheme regardless of their hometown or city.

Take this case:

A woman aged 70, who steers clear of tobacco, and calls Cumberland home will be charged the exact regular cost for a Plan F just like another 70-year-old lady who also avoids tobacco and resides in Hagerstown or Annapolis.

Starting January 1, 2020, new Medicare members can no longer buy a Medigap Plan F. This rule means that if someone joined Medicare on or after that date, they are not allowed to enroll in Plan F.

Now, let’s take a look at how much Plan F costs in Cumberland in 2025 for someone who is already allowed to have it. We’ll use the example of a 68-year-old woman who doesn’t use tobacco.

For her, the lowest average monthly price for Medigap Plan F is about $160. That means she would pay around $160 every month in 2025 to keep this plan.

Keep in mind:

Prices can be different depending on the insurance company.

Rates can also change based on your age, gender, health, and whether or not you use tobacco.

Even though Plan F is no longer available to new Medicare enrollees, people who had Medicare before 2020 might still be able to keep or change their Plan F if they already have it.

While we do not have the restrictions in place for Plan G that we do on Plan F, let’s look at the same age as we used in the earlier example. So, a Medicare Supplement Plan G for a 68-year-old female, non-tobacco user is going to come in around $137 per month in 2025.

Just like the Plan G, there are no restrictions on the Plan N. This means that just like a Plan G, you can purchase a Plan N when going onto Medicare at age 65. To compare apples to apples, we are going to look at the rate once again for a 68-year-old female, non-tobacco user. The average premium is going to run about $108 per month.

Currently, in 2025 about 30 insurance carriers are offering various Medigap plans.

Unlike Medicare Supplement plans in Maryland, Medicare Advantage plans do not have to be made available in all counties. Due to this, there are only a couple of Medicare Advantage Plans available in Cumberland and the rest of Allegany County. Currently, in 2022 only 2 carriers are offering Medicare Advantage plans in Cumberland, MD. These plans will either use a PPO or HMO network.

Many factors go into determining which type of Medicare plan would be the right one. Once again, there is no one size fits all. The most efficient and easiest way to decide would be to get help from a knowledgeable agent. Call us today at (800)924-4727 to get the advice you deserve. You can also request a quote below.