How Do I Get Medicare To Pay For Home Care?

This is why that’s devastating: the average cost of private home health care in Maryland runs thousands per month, which means missing out on Medicare coverage could cost you massive amounts annually for just basic nursing visits.

What You Will Learn About Medicare To Pay For Home Care

- Medicare covers way more home services than people realize

- One missing requirement kills your entire claim instantly

- Hidden eligibility rules could unlock thousands in benefits

- Maryland offers programs that work with Medicare coverage

- Most denials happen from easily avoidable mistakes

The good news? Once you understand how Medicare To Pay For Home Care coverage actually works, you can access skilled nursing care, therapy services, and medical equipment at zero cost when you meet the requirements.

The Hidden Truth About Medicare Home Health Coverage

Medicare covers eligible home health services at zero cost when you meet all the requirements. That’s right. Zero cost for covered services.

What trips up most people about Medicare To Pay For Home Care

They don’t cover someone to help you shower, cook meals, or do laundry unless you’re also getting skilled medical care.

Think of it like ordering a combo meal where you can’t just get the fries. You need the medical “burger” to get the personal care “fries.”

Most people assume Medicare To Pay For Home Care is just for people leaving the hospital. Wrong. You can qualify for Medicare home health services whether or not you’ve been hospitalized, as long as you meet the other requirements.

Hear From one of Our Happy Clients

What Medicare Actually Covers for Home Health in Maryland

We’re talking about medical professionals providing hospital-level care in your living room.

Physical therapy, occupational therapy, and speech therapy are covered when medically necessary.

If you’re recovering from a stroke, hip replacement, or other condition that affects your mobility or daily functioning, these services can be lifesavers.

More Community Resources for Medicare To Pay For Home Care

Home health aide services are covered, but only when you’re also receiving skilled nursing or therapy services. This is where people get confused. You can get help with bathing and personal care, but only as part of a broader medical treatment plan.

Medicare specifically doesn’t cover: custodial care that helps with daily living activities like bathing, dressing, or using the bathroom when this is the only care you need.

The Four Requirements That Make or Break Your Coverage

1st Requirement

2nd Requirement

3rd Requirement

4th Requirement

How Much Medicare Pays and for How Long

There’s no limit on the number of visits as long as you continue to meet eligibility requirements and your doctor continues to certify your need for care.

Each certification period lasts up to sixty days, and your doctor can recertify you for additional periods if medically necessary.

The only cost you might face? You pay twenty percent of the Medicare-approved amount for durable medical equipment like wheelchairs or walkers used at home.

Let me put this in perspective. Private nursing visits in Maryland cost significant amounts per hour.

Physical therapy runs substantial costs per session. If you need twice-weekly nursing visits and physical therapy for three months, you’re looking at thousands in costs that Medicare covers completely when you qualify.

Maryland’s Secret Weapon: Dual Coverage Strategy

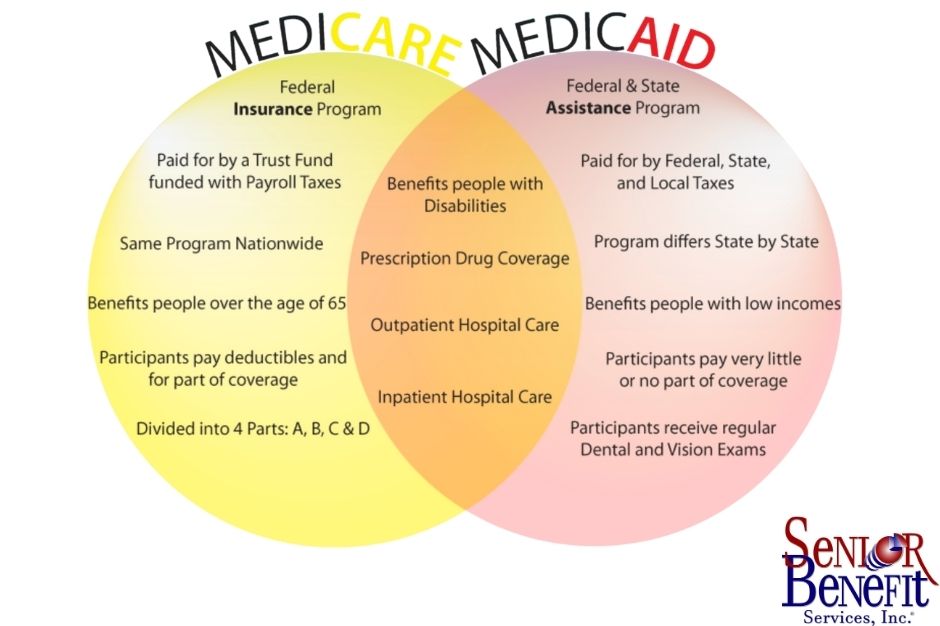

Medicare focuses on skilled medical services. Medicaid provides coverage for low-income seniors who are also enrolled in Medicare.

When you qualify for both programs (called dual eligibility), Medicaid can pick up services Medicare doesn’t cover. Medicaid covers additional services beyond those provided under Medicare.

How it works in practice: Medicare covers your skilled nursing visits for wound care. Maryland Medicaid might help with personal care services, like help with bathing or meal preparation, that Medicare won’t cover alone.

Services covered by both programs are first paid by Medicare, with Medicaid filling in the difference up to the state’s payment limit.

What if you do not qualify for dual eligibility? If your current household income levels do allow you to qualify for Medicaid benefits, then you should be considering a stand-alone home health care plan.

These plans are more affordable than a traditional long-term care insurance plan and provide benefits to allow you to recover in the comfort of your own home.

It is important to keep in mind that Medicare does not cover your typical custodial home health care services, such as general supervision, homemaker services, or help with activities of daily living, such as eating, bathing, dressing, and mobility.

This is where a stand-alone home health care insurance plan or a long-term care insurance plan will come into play. Want to learn more about home health care expenses, be sure to read our post here.

Finding Quality Providers in Maryland

Look for agencies with four or five-star ratings and read their detailed quality measures.

Ask about their experience with your specific medical conditions.

The agency should explain exactly what Medicare will and won’t cover before starting services. Before you start getting your home health care, the home health agency should tell you how much Medicare will pay and tell you both verbally and in writing if Medicare won’t pay for any items or services. Start your search using the Medicare’s Medicare Compare website to begin your search.

Common Mistakes That Kill Claims

The biggest mistake? Not getting proper physician certification. Your doctor needs to create a detailed plan of care that explains why you need skilled services and why you’re homebound.

Second biggest mistake?

Assuming you don’t qualify because you can still get around sometimes. The homebound requirement allows for occasional outings as long as leaving home requires considerable and taxing effort.

Third mistake? Waiting too long to apply. Start the process as soon as you realize you might need home health services. Getting everything approved and coordinated takes time.

Your Next Steps

You might find yourself dealing with a chronic condition that requires ongoing medical management, but ask your physician if home health services might be appropriate for your situation.

Sometimes, you can think you automatically qualify if you have been denied Medicare home health coverage, but don’t assume you don’t qualify. Many denials get overturned on appeal when the paperwork is done correctly

Understanding Medicare home health coverage isn’t just about getting care at home. It’s about maintaining your independence and avoiding unnecessary nursing home placement that could cost you everything you’ve worked to build.

We know which home health agencies provide the best care, how to appeal wrongful denials, and how to coordinate Medicare with other programs to maximize your benefits.

If you’re facing decisions about home health care, don’t navigate this complex system alone.

The key to successful Medicare home health coverage is understanding the rules before you need the services. The families who plan ahead get better care at lower costs.

The ones who wait until emergencies end up paying unnecessarily or going without needed care.

Your health and independence are too important to leave to chance. Don’t go through this process alone when you have questions about Medicare home health coverage. Senior Benefit Services has helped thousands of Maryland families understand their Medicare benefits. Get your free consultation today at (800) 924-4727.