If you’ve been looking for the best Medicare Supplement Plans available near Keedysville, MD, we are here to help. Medicare definitely covers quite a bit, but it doesn’t cover everything.

That’s where Medicare Supplement Insurance (Medigap) comes in. If you live in or anywhere near Keedysville, MD, our Medicare team can help you compare plans and find coverage that fits both your budget and your health needs.

Medicare Supplement Insurance (or “Medigap”) is the clean, simple way to cover what Original Medicare doesn’t.

Here’s the reality: Medicare pays a lot, but not everything. You’re still on the hook for deductibles, coinsurance, and co-pays and that 20% Part B coinsurance has no cap. For someone on a fixed income, that’s a financial disaster waiting to happen.

A Medigap plan steps in to pick up those costs so you can budget your health care with confidence. You pay your monthly premium, and when you go to the doctor or hospital, there are no surprise bills waiting for you later.

One of the biggest advantages? Freedom of choice. Medigap is accepted not only near Keedysville, Maryland, but also nationwide. If a doctor or hospital takes Medicare, your plan works there. No networks. No prior authorizations. Just peace of mind knowing you’re covered anywhere in the U.S.

Bottom line: If you want predictable costs and zero surprises, a Medicare Supplement Plan is the cleanest, easiest way to get there.

Keedysville Seniors choose a Medicare Supplement Plan because they understand that it isn’t just about “extra coverage.” It’s about taking the guesswork out of healthcare costs so you can plan your budget with confidence each month.

With a Medicare Supplement, you’re not locked into any network. You can see any doctor or hospital that accepts Medicare, whether that’s your local provider downtown or a top specialist across the country.

The real win is how it shields you from big, unexpected medical bills. Hospital stays, outpatient treatments, or specialist visits can add up fast. A good Medigap plan steps in to cover those leftover costs that Medicare doesn’t pay, keeping your savings intact.

Here’s what most Keedysville retirees have found: Plan G and Plan N tend to strike the best balance. Strong protection, steady premiums, and predictable costs, with no surprises.

If you’re a senior in Maryland looking to keep your monthly premiums low without giving up solid coverage, the High Deductible Plan G is worth a close look.

It’s built on the same foundation as a standard Plan G, with the same core benefits, same nationwide freedom to see any doctor or hospital that accepts Medicare, but with one key difference: you trade a higher annual deductible for a much lower monthly premium.

Currently, you’ll pay the Medicare-set deductible out of pocket before your plan steps in to cover things like Part A and Part B coinsurance, hospital stays, and other medical costs. After that, it functions exactly like a traditional Plan G, giving you dependable protection for the rest of the year.

Practically speaking, this plan tends to be a great fit for folks who are healthy, don’t visit the doctor often, but still want to guard against those big “what if” expenses. It lets you budget smarter, saving money each month while keeping the safety net in place when you need it most.

Bottom line: The High Deductible Plan G provides Maryland retirees with a clean, affordable way to stay fully protected and in control of their healthcare costs, all without any network restrictions or surprises.

Meet Carol, a 68-year-old retiree living near Keedysville, Maryland. She’s active, enjoys gardening, and rarely visits the doctor beyond her annual wellness check.

When she first started comparing Medicare Supplement Plans in Maryland, Carol wanted two things: dependable coverage if something major happened and a lower monthly premium she could comfortably budget in retirement. After reviewing her options, she discovered the High Deductible Plan G.

Carol liked that this plan gave her the same full coverage benefits of a traditional Plan G, such as protection from Medicare Part A and B coinsurance once she met the deductible. Because she was healthy and had a savings account set aside for unexpected expenses, the higher deductible didn’t concern her. In fact, it made financial sense.

By choosing the High Deductible Plan G, she cut her monthly premium by nearly half compared to a standard Plan G, saving several hundred dollars a year. Those savings stay in her pocket month after month, while she still has the peace of mind knowing she’s protected if she ever faces a serious illness or hospital stay.

For retirees near Keedysville, Maryland, like Carol, who value flexibility, nationwide access to any doctor who accepts Medicare, and lower monthly costs, the High Deductible Plan G can be a practical, long-term solution. It rewards good health with real savings while ensuring that protection is always there if life takes an unexpected turn.

If you’re near Keedysville, most Medicare Supplement Plans cost somewhere between $120 and $180 per month. Your exact rate depends on things like age, gender, tobacco use, if you qualify for any household discounts, and which insurance company you go with.

To give you a real-world example, a 65-year-old female non-smoker near Keedysville would typically pay around $120 a month for Plan N. It’s one of the most popular choices among local retirees because it offers strong, predictable coverage without a lot of moving parts.

Since prices can vary quite a bit from one company to the next, we do the shopping for you. We compare multiple top-rated carriers to make sure you’re getting solid protection at a fair price, no surprises, no pressure, just the best fit for your budget and peace of mind.

For more than 30 years, Senior Benefit Services has been helping Keedysville and many other Maryland seniors make smart, confident decisions about their Medicare coverage.

Our local office near Keedysville has earned the trust of thousands of Maryland retirees who count on us for clear guidance and long-term support, not sales pressure.

Our licensed advisors work independently, which means we’re not tied to any single insurance carrier. We review all the available plans to find what truly fits your needs and budget. And the relationship doesn’t stop once you enroll.

Each year, we sit down for an annual review to make sure your plan still delivers solid coverage at the best possible price. It’s the kind of ongoing service and local accountability that keeps our clients protected and confident year after year.

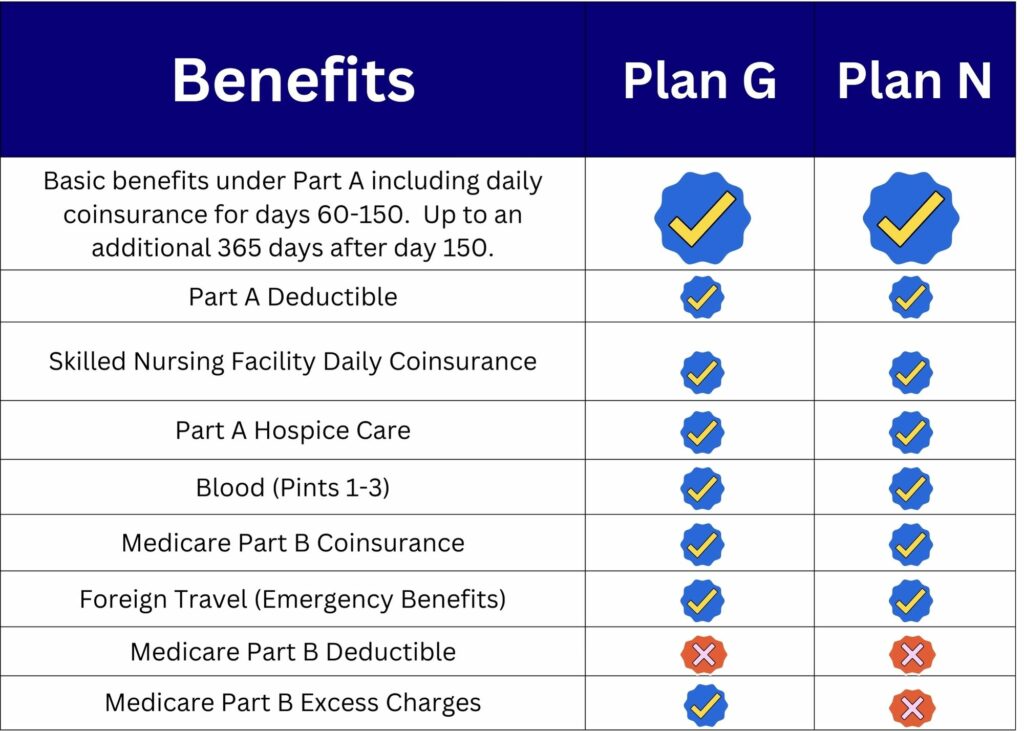

Medicare Supplement Plan G and Plan N are the go-to choices for a lot of folks, but the best plan really comes down to your personal health, budget, and what kind of peace of mind you’re looking for.

Most Medicare Supplement plans in Washington County run between $100 and $180 a month for a 65-year-old, depending on factors like age, gender, tobacco use, and the carrier you choose.

Yes, you can switch you Medicare Supplement Plan at a later time. Just keep in mind that in most cases you’ll need to pass health underwriting unless you qualify for a guaranteed issue period such as the “Maryland Birthday Rule”.

Each year you will receive a letter from your current insurance carrier approximately 30 days before your birthday notifying you that you will have a new open enrollment period that allows you switch from one carrier to another without medical underwriting.

This is for Medicare Supplement plans only and you cannot increase your benefits. You can obtain the exact same plan benefits (ie. move from Plan G to another Plan G) or reduce your benefits (ie. move from Plan G to Plan N).

We certainly do offer both Medicare Supplement and Medicare Advantage plans. Our team helps you compare plans so you can see the full picture and choose what truly fits your needs.