If you are looking into Medicare Advantage plans near Funkstown, MD, this will help you understand your local options and how they compare. Choosing Medicare shouldn’t feel like solving a riddle.

Looking for a Medicare Advantage advisor near Funkstown, MD? Our licensed advisors at Senior Benefit Services, Inc. sit down with local seniors every day to make sense of their options, especially when it comes to comparing Medicare Advantage (Part C) plans that fit their doctors, prescriptions, and budget.

If you’re turning 65 or just reviewing what you already have, here’s the clean way to look at it: Medicare doesn’t have to be stressful or confusing.

Our job is simple, make it easy to understand, easy to use, and built around your peace of mind.

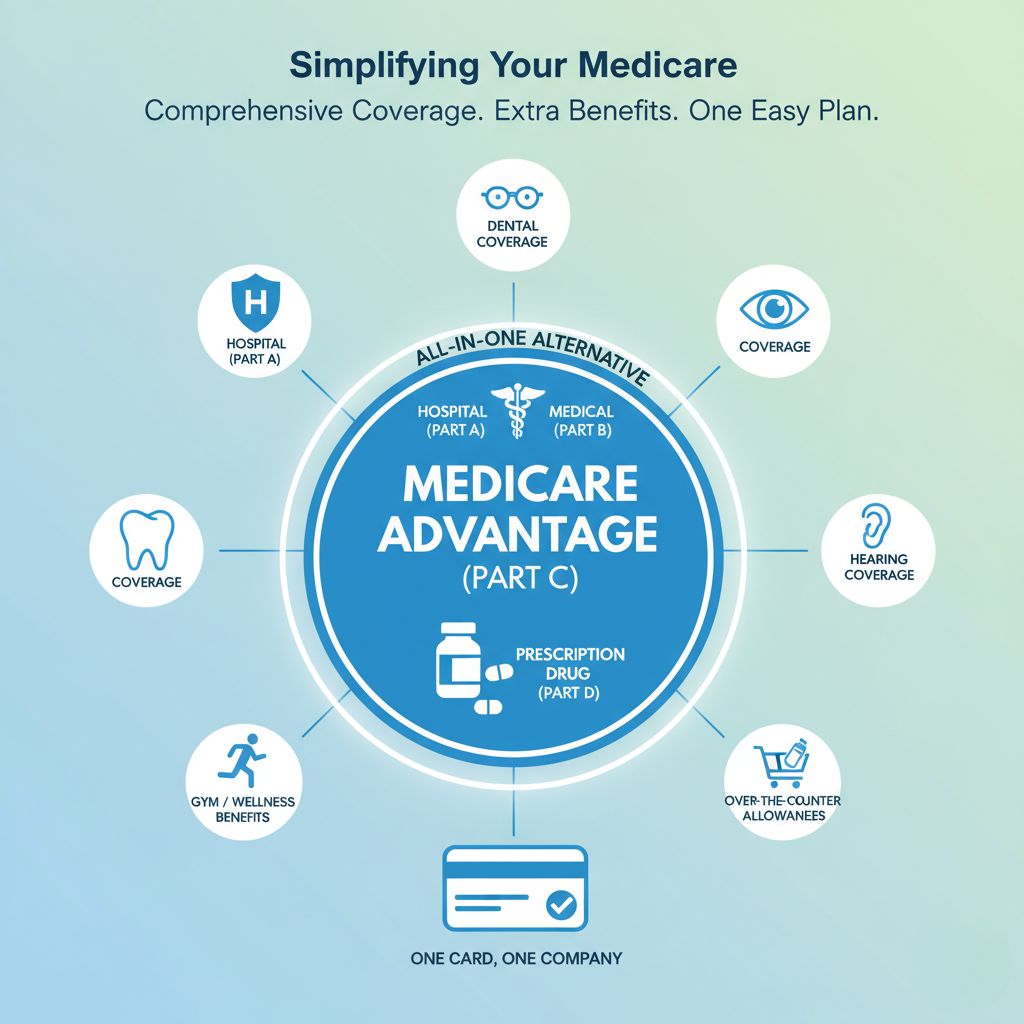

A Medicare Advantage plan is an all-in-one alternative to Original Medicare that often includes extra benefits like prescription, dental, and vision coverage in addition to your health insurance coverage.

Medicare Advantage (Part C) is simply another way to get your Medicare benefits through a private insurance company that Medicare approves.

It combines your hospital coverage (Part A) and your medical coverage (Part B), and in most cases, it also rolls in your prescription drug coverage (Part D).

Many plans even go a step further by adding extras like:

Dental, vision, and hearing coverage

Gym or wellness benefits

Over-the-counter allowances

Practically speaking, it’s an all-in-one plan that keeps things simple with one card and one company handling your care.

Many Funkstown, MD seniors choose Medicare Advantage because it combines hospital, medical, and often prescription coverage into one convenient, budget-friendly plan.

Here’s why it makes sense for so many folks:

✔ One easy-to-use card for hospital, medical, and prescription coverage

✔ Low or even $0 monthly premiums

✔ Extra perks that Original Medicare doesn’t include

✔ Built-in annual out-of-pocket limits to protect your budget from big surprises

Bottom line: it’s designed to make Medicare simpler, more predictable, and easier on your wallet.

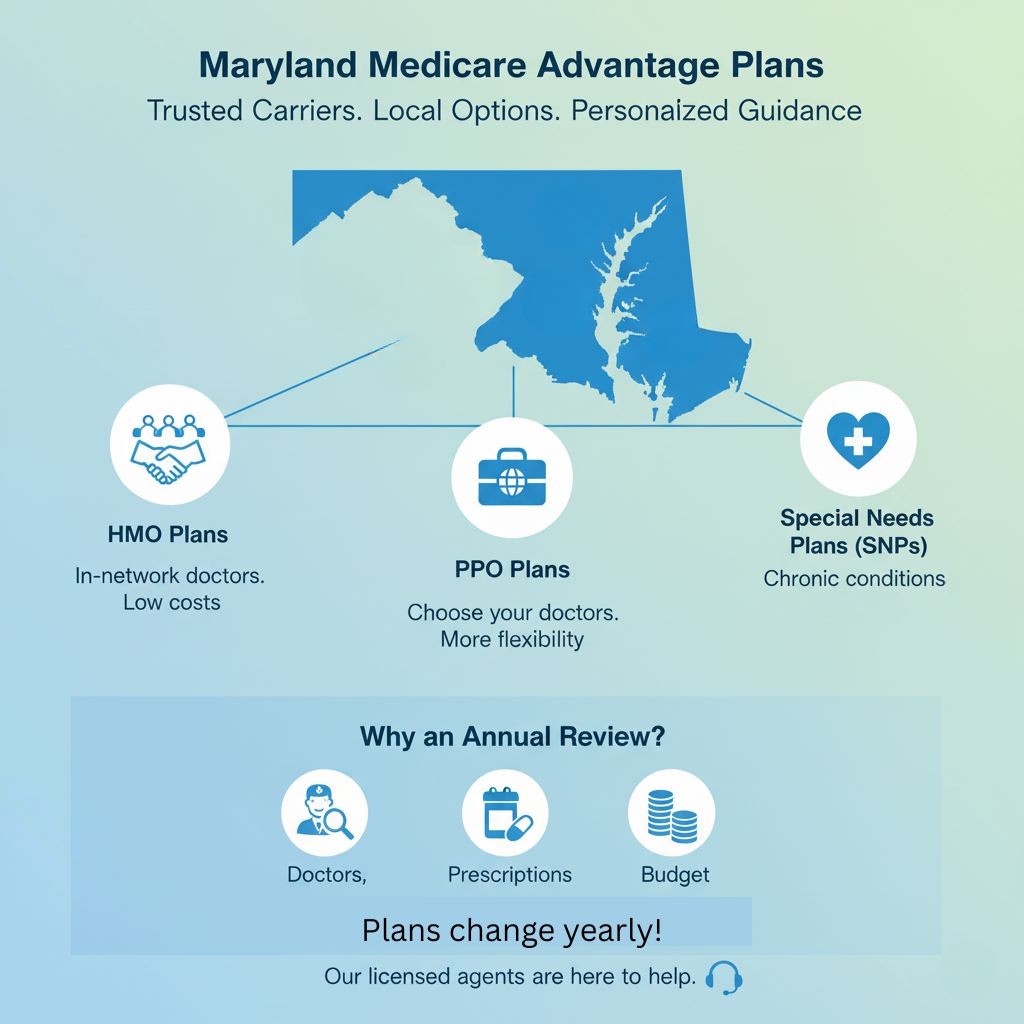

When it comes to Medicare Advantage options in Maryland, residents can choose from a variety of trusted carriers and plan types tailored to their local healthcare needs.

We work with top-rated Medicare Advantage companies so you don’t have to sort through the noise on your own.

Our licensed agents help you compare options like:

HMO Plans – a good fit if your doctors are in-network and you want to keep costs low

PPO Plans – more flexibility if you’d rather choose your own doctors, even out-of-network

Special Needs Plans (SNPs) – built for folks with certain health conditions or Medicaid coverage

Here’s the thing plans and benefits change every year. That’s why we always recommend an annual review to make sure your coverage still fits your doctors, prescriptions, and budget.

| Feature | Medicare Advantage (Part C) | Medicare Supplement (Medigap) |

|---|---|---|

| Coverage Type | Replaces Original Medicare | Works alongside Original Medicare |

| Network | Usually HMO or PPO | Any doctor who accepts Medicare |

| Prescription Coverage | Often included | Separate Part D plan required |

| Extras | May include dental, vision, and hearing | Basic medical coverage only |

| Monthly Premium | Often $0–$50 | Usually $100 or more |

| Annual Review | Should be reviewed each year | Rarely changes once in place |

Our licensed advisorsnear Funkstown walk you through both options, so you can choose the plan that fits your doctors, prescriptions, and budget. A Medicare Advantage plan may work for you, but a Medicare Supplement plan may work better. This is why we take the time to provide you with the needed information to allow you to choose what is best for your needs and budget.

Working with Senior Benefit Services, Inc. means having a trusted local team that’s been helping Maryland seniors compare and enroll in the right Medicare coverage for over 30 years.

As an independent agency, we represent multiple top-rated carriers, not just one company. That means our recommendations are based on what’s best for you, not anyone’s quota.

You’ll get a personalized plan review before and after enrollment, so there are no surprises down the road.

Trusted by tens of thousands of seniors across Maryland, Pennsylvania, West Virginia, and Virginia—because doing what’s right for folks never goes out of style.

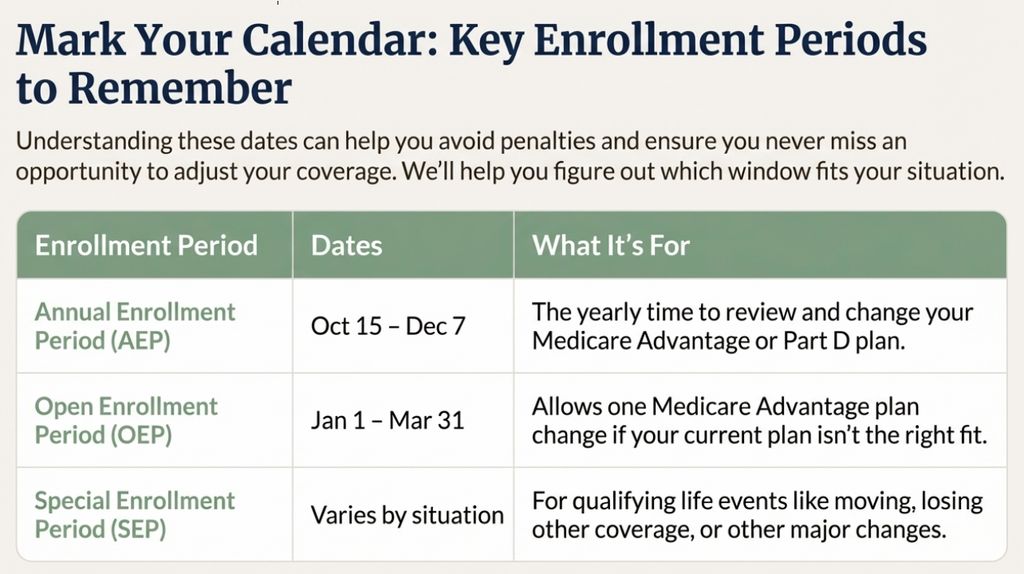

| Enrollment Period | Dates | What It’s For |

|---|---|---|

| Annual Enrollment Period (AEP) | Oct 15 – Dec 7 | Time to review and change your Medicare Advantage or Part D plan for the upcoming year |

| Open Enrollment Period (OEP) | Jan 1 – Mar 31 | Allows one Medicare Advantage plan change if your current plan isn’t the right fit |

| Special Enrollment Period (SEP) | Varies by situation | For qualifying life events like moving, losing coverage, or other major changes |

Understanding the key Medicare enrollment periods can help you avoid penalties and ensure you never miss an opportunity to adjust your coverage when needed. Our local team will walk you through which enrollment window fits your situation—so your coverage is always on track and there are no surprises.

Most folks enroll during the Annual Enrollment Period (October 15 – December 7). If you’ve had a major life change, like moving or losing coverage, you may qualify for a Special Enrollment Period. We’ll walk you through your exact window so you don’t miss your chance.

In most cases, yes. Many plans include your Part D prescription coverage automatically, so your medications and doctor visits are handled under one card.

Keeping your doctor with Medicare Advantage plans depends on the plan’s network. Some use PPOs, others HMOs, but don’t worry, we’ll help you find a plan that includes your preferred doctors and hospitals so you’re not stuck starting over.

Some plans start at $0 per month, while others come with a small premium. We’ll compare all your options side by side to find what fits your budget, prescriptions, and peace of mind.

📞 Call Senior Benefit Services, Inc. at (301) 733-0085 or click below to request your FREE plan comparison.