These smart planners recognize that Medicare is more than just basic

government insurance. It’s a comprehensive healthcare foundation that you can build upon to create bulletproof retirement protection.

They know that with the right Medicare strategy, you can get excellent care while keeping every dollar you’ve worked decades to save.

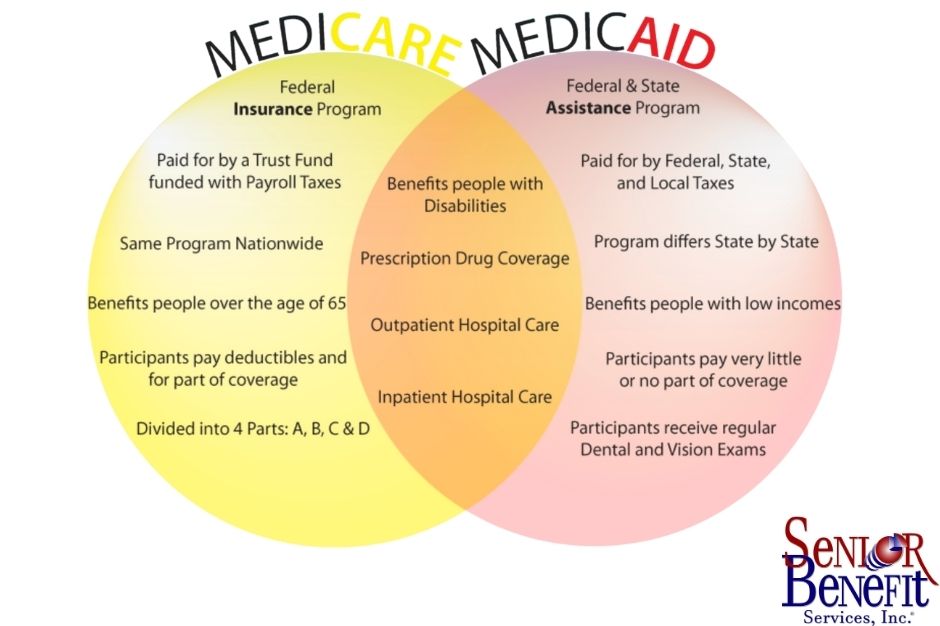

While others are crossing their fingers, hoping Medicaid will be there when they need it, Medicare-smart families are locking in predictable healthcare costs that follow them anywhere in America.

They’re choosing

Medicare Advantage plans with extras like dental and vision, or pairing original Medicare with

Medigap policies that eliminate surprise medical bills.

The difference is night and day. Medicaid hopefuls spend their golden years worrying about qualifying for poverty assistance. Medicare planners spend their retirement enjoying the security that comes from having earned benefits that can’t be taken away based on where they live or how their state’s politics change.

Most importantly, they understand that Medicare planning isn’t just about healthcare coverage. It’s about maintaining the independence and choice that comes from keeping your assets while getting the care you deserve.