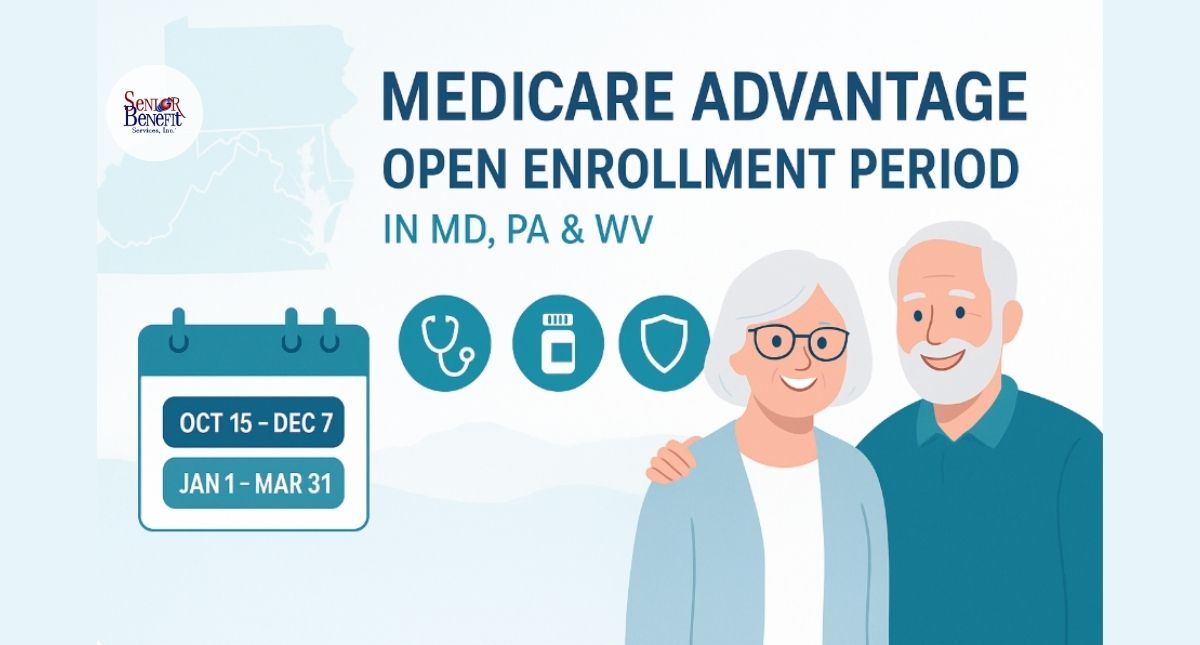

Medicare Advantage Open Enrollment Period In MD, PA & WV

The Annual Election Period runs October 15 through December 7 every year for everyone with Medicare, and the Medicare Advantage Open Enrollment Period runs January 1 through March 31 (but only if you’re already enrolled in a Medicare Advantage plan on January 1st).

Miss these windows, and you could be stuck paying hundreds more every month for coverage that doesn’t fit your needs until the next enrollment period opens.

We have seen thousands of seniors make costly mistakes simply because they didn’t understand when they could actually make changes to their coverage. It’s not your fault. The system isn’t exactly designed to be simple.

But here’s what matters: knowing when these enrollment windows open and close can literally save you thousands of dollars. Miss the deadline, and you might be stuck in a plan that doesn’t cover your doctors, makes your prescriptions unaffordable, or costs you far more than it should.

Let’s break this down in way that someone would explain it to thier own family members.

Here’s the reality: there are two separate times each year when you can evaluate and change your Medicare Advantage coverage. Most people confuse them or don’t realize they exist at all.

The Annual Election Period: that’s October 15 through December 7 every year. This is your big window. During these weeks, everyone with Medicare can make major changes. You can join a Medicare Advantage plan if you’re on Original Medicare. You can switch from one Medicare Advantage plan to another. You can drop your Medicare Advantage plan and go back to Original Medicare. You can add or change a standalone prescription drug plan. Whatever changes you make during this period kick in on January 1st of the next year.

The Medicare Advantage Open Enrollment Period: January 1 through March 31. Now here’s where people get tripped up. This window only works if you’re already in a Medicare Advantage plan when January 1st rolls around. If that’s you, you get one shot to either switch to a different Medicare Advantage plan or drop Medicare Advantage entirely and return to Original Medicare. And if you drop back to Original Medicare during this time, you can also pick up a standalone Part D drug plan right then.

The changes you make during this January-to-March window take effect on the first day of the month after your request gets processed. So if you make a change in early January, your new coverage might start February 1st.

Why does this matter? Because if your plan changed something important in January (maybe your doctor left the network, or your medications suddenly cost twice as much), you don’t have to wait until next October to fix it. You’ve got that January-through-March window to make it right.

The Medicare Advantage Open Enrollment Period exists because life happens. Plans change their networks. Drug formularies get updated. That plan that looked great in November might feel like a terrible fit by January when you’re actually using it.

But (and this is important) you cannot use the January-through-March window to join a Medicare Advantage plan if you’re currently on Original Medicare. That move only happens during the October-to-December Annual Election Period, or when you’re first eligible for Medicare.

I’ve had clients call me in February saying they want to switch from Original Medicare to an Advantage plan they just heard about. And I have to tell them the hard truth: you’ll need to wait until October. That’s eight months of waiting, and it’s frustrating.

The flip side? If you act during that January-March window and you’re already in a Medicare Advantage plan, your new coverage can start much faster than waiting for the next annual cycle.

Let me tell you what I see happen year after year in Maryland, Pennsylvania, and West Virginia.

Someone realizes in April that their Medicare Advantage plan isn’t covering their prescriptions the way they thought it would. Maybe they’re paying $200 a month out-of-pocket for medications that would cost $30 on a different plan. But they missed both enrollment windows. Now they’re looking at six more months (until October) before they can switch. That’s $1,200 in unnecessary prescription costs.

Or I meet with someone in August who just found out their cardiologist dropped out of their plan’s network back in January. They’ve been going out-of-network and paying higher copays for seven months. If they’d acted during that January-March window, they could have switched to a plan that covered their doctor.

These aren’t small inconveniences. We’re talking about real money and real health consequences for folks on fixed incomes.

Kachele Aleshire is the representative who helped me. I can’t say enough good things about her. She drove to my home for the appointment and then explained everything to me. Originally I was not going to go with a Medicare suppliment, but after talking with Kachele I decided that a suppliment would be in my best interest. I’m so glad that I did. Before her visit it was very nervous. I did not know what to expect, but now I’m very relieved and grateful for her help. I do not know what I would have done if it was not for Kachele’s help. – Donna Buell

Look, the government understands that life doesn’t always wait for October. That’s why Special Enrollment Periods exist.

If you move (especially if you move outside your current plan’s coverage area), that opens up a Special Enrollment Period. This matters a lot in our region. I work with families where someone in rural Pennsylvania moves to be closer to their kids in Maryland. Or someone in West Virginia relocates to assisted living in a different state. That move gives you sixty days to enroll in a new plan or make changes.

Losing other coverage triggers a Special Enrollment Period too. When you or your spouse retires and you lose that employer group coverage, you’ve got options to enroll outside the standard windows.

Changes in Medicaid eligibility create qualifying events. So does being released from a nursing home or rehabilitation facility.

These periods typically give you sixty days from when the qualifying event happens. But here’s the catch: you need documentation. You’ll need to prove you moved, prove you lost coverage, prove whatever event triggered your eligibility. Keep your paperwork organized.

Here’s what I tell everyone: start preparing three to four months before October 15th rolls around.

First, get your hands on your current plan’s Annual Notice of Change. Every plan sends this out in September. It tells you exactly what’s changing next year: premiums, deductibles, which doctors are in the network, which drugs are covered. Don’t throw this away. Read it carefully.

Make a list of every doctor you see. Your primary care physician, specialists, the hospital you’d go to in an emergency. Then check which Medicare Advantage plans available in your specific county include all those providers in their networks. And I mean your specific county: plans vary dramatically even within the same state.

Write down every prescription medication you take. Include the exact dosage and how often you take it. Then look at how different plans cover those drugs. What tier are they on? What’s the copay? Does the plan require prior authorization? Is your pharmacy in the plan’s network?

Two months out from enrollment, start calculating your total annual costs for each plan you’re considering. Not just the monthly premium (that’s not the whole story). Add in the deductible, the copays for doctor visits, the specialist costs, your prescription expenses. A zero-premium plan might actually cost you more if you’re paying $50 copays every time you see a specialist.

And please, talk to someone who knows this stuff. Each of our states (Maryland, Pennsylvania, West Virginia) has free counseling programs to help seniors navigate Medicare. Use them. Our advisors at Senior Benefit Services work with clients throughout all three states, and we’ve spent decades learning how these plans actually work in our communities.

When you’re reviewing your Medicare Advantage plan or thinking about switching, here are the questions that actually matter.

Are your doctors still in the network for next year? Networks change annually. I’ve seen people assume their longtime physician is covered, only to find out in January that the doctor dropped out of the network or the plan dropped the doctor.

Are your prescriptions still covered at the same cost? Plans move drugs between tiers or add new restrictions all the time. A medication that cost you $10 this year might jump to $75 next year on the same plan.

What’s the out-of-pocket maximum, and does it make sense for how much healthcare you actually use? If you see specialists regularly or manage chronic conditions, a plan with a lower out-of-pocket max can save you significant money even if the monthly premium is slightly higher.

Does the plan offer benefits you’ll genuinely use? Some Medicare Advantage plans include dental coverage, vision benefits, hearing aids, gym memberships, or over-the-counter allowances. If you need dental work done, that benefit has real value. If you’re never going to use it, don’t let it be the deciding factor.

Has the plan’s star rating changed? The Centers for Medicare & Medicaid Services rates plans from one to five stars based on quality and performance. A plan that’s dropping stars is showing you warning signs about service quality and member satisfaction.

No, and this trips people up constantly. If you’re on Original Medicare and want to join a Medicare Advantage plan, you need to do it during the Annual Election Period (October 15 through December 7) or during your Initial Enrollment Period when you first qualify for Medicare. You might also be able to make the switch during a Special Enrollment Period if you have a qualifying life event.

That January-through-March Medicare Advantage Open Enrollment Period? It only works if you’re already in a Medicare Advantage plan. You can’t use it to join one from Original Medicare. I know it seems backwards, but that’s how the rules work. Understanding this saves you months of frustration trying to make a change during the wrong window.

Moving to a new address (especially if it’s outside your current plan’s service area) qualifies you for a Special Enrollment Period. You’ll have sixty days from your move date to enroll in a new plan that serves your new location.

Keep your documentation handy. You’ll need proof of your move: utility bills showing your new address, a lease agreement, driver’s license updates. Medicare wants to verify that you actually moved and aren’t just trying to game the system.

I work with clients across Maryland, Pennsylvania, and West Virginia all the time who need to make these cross-state moves. We help ensure there’s no gap in your coverage during the transition.

Do Medicare Advantage plans work the same way in Maryland, Pennsylvania, and West Virginia?

Absolutely not. This is one of the biggest misconceptions out there.

Medicare Advantage plans are regional. The plans available in Baltimore County are different from what’s offered in Allegheny County, Pennsylvania, which are different from what you’ll find in Monongalia County, West Virginia. The premiums differ. The benefits differ. The provider networks are completely different.

I’ve had clients move from Maryland to Pennsylvania and assume their plan would just transfer. It doesn’t work that way. You need to look at what’s available specifically in your ZIP code.

That’s why getting advice from someone who works in your specific area matters. What works great for your friend in Hagerstown might not even be available where you live.

How do I know if my current plan is still my best option?

Every September, your plan sends you an Annual Notice of Change. That document shows you what’s different for the next year. Don’t ignore it.

Look at whether your premium is going up. Check if your deductible or copays are changing. See if any doctors or hospitals are leaving the network. Review whether your prescriptions are still covered the same way.

Then ask yourself: has my health situation changed? New diagnoses, different medications, increased doctor visits. All of these might mean a different plan structure serves you better now.

During the Annual Election Period, compare at least two or three other plans available in your area. You might discover better options you didn’t know existed. Our advisors help clients do exactly this kind of comparison every enrollment season, looking at plans from multiple insurance companies to find the best fit.

You won’t pay direct penalties like you would for missing your initial Part B enrollment. But you can absolutely lose money in other ways.

If you miss the window and you’re stuck in a plan with higher costs, you’re paying more every month in premiums, copays, or prescriptions until the next enrollment period opens. That’s real money coming out of your pocket unnecessarily.

And here’s something critical: if you drop a Medicare Advantage plan that included prescription drug coverage and you don’t enroll in a standalone Part D plan right away, you can face late enrollment penalties for Part D that permanently increase your premiums. Those penalties last for as long as you have Medicare.

The point is to understand which enrollment period applies to your situation and act during the right timeframe. That’s how you avoid leaving money on the table.

After thirty-plus years helping seniors navigate Medicare, I can tell you this: the enrollment periods matter because they determine whether you have the healthcare coverage you actually need or whether you’re just stuck with whatever you have.

We have offices throughout the region (Hagerstown, Cumberland, Thurmont, Mt. Pleasant) because Medicare isn’t one-size-fits-all. What works in one county doesn’t necessarily work in another. Provider networks are different. Plan availability is different. Costs are different.

At Senior Benefit Services, we work with all the major carriers. We’re not tied to one insurance company pushing one set of plans. We look at everything available in your specific area and help you understand what actually makes sense for your healthcare needs and your budget.

The enrollment windows are going to open again. The question is whether you’ll be prepared or whether you’ll be making rushed decisions under pressure. Taking the time now to understand your options, review what’s changing with your current plan, and get expert guidance makes all the difference.

Your health and your financial security are too important to leave to chance. Make sure you know when you can act, what your options are, and how to make the choice that serves you best.