Of course, you want to get one of the best Maryland Medicare plans! Before you can get a Medicare Supplement or Medicare Advantage plan in Maryland you will first need to have both Medicare Parts A & B already. If you are turning 65 and will be drawing social security benefits then you will automatically be enrolled into traditional Medicare. Those folks who are 65 and older, and who continue to work for a company with 20 or more employees will still need to sign up for Medicare Part A but can delay enrolling in Medicare Part B. The company health insurance plan will still be your primary insurance and your Medicare Part A coverage will be secondary. The same would go for an individual who is covered under a spouse’s health insurance policy.

For those individuals under the age of 65 who qualify for Medicare due to disability, you will have an initial enrollment period (when you first qualify for Medicare benefits) and then you will have an Open Enrollment period when you turn 65.

Below are the steps that need to be followed to obtain either a Medicare Supplement or Medicare Advantage Plan in the state of Maryland. In addition, if you decide to proceed with a Medicare Supplement, you will need to get a stand-alone Part D Prescription Drug plan.

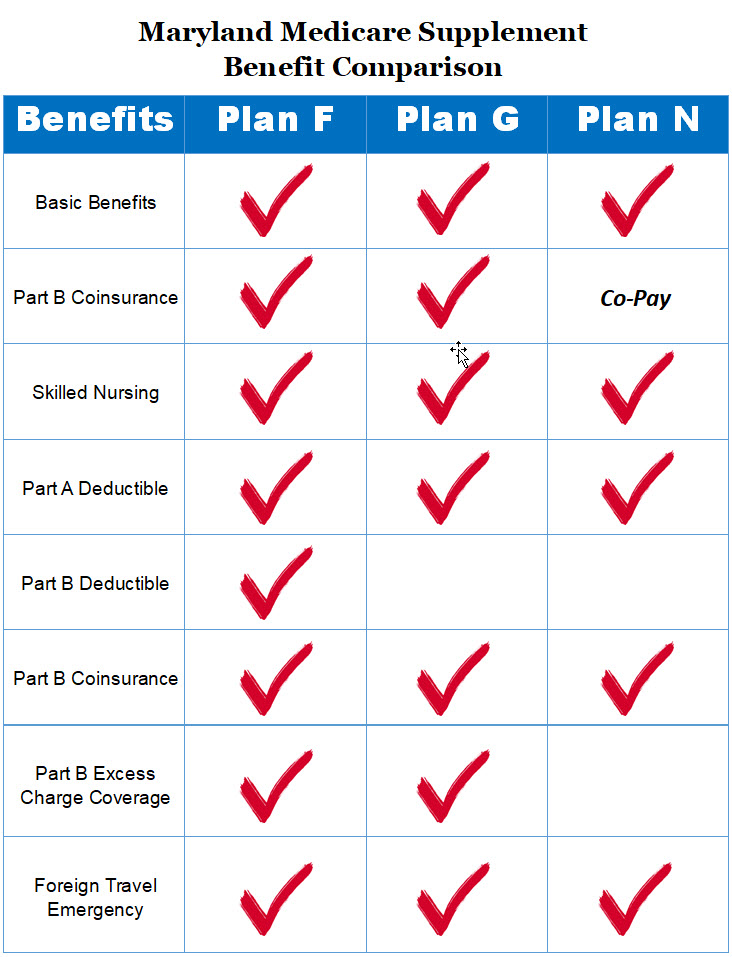

While insurance companies can offer up to 10 standardized Medicare Supplement plans, most will elect to only offer 4-6 plans. Currently, the most popular Medicare Supplement plans being purchased in Maryland are:

It is important to remember that only those Medicare beneficiaries whose effective dates for Part A and Part B were before January 1, 2020, can purchase a Plan F.

Medicare Supplement Plan F Benefits

Medicare Supplement Plan G Benefits

Medicare Supplement Plan N Benefits

The state of Maryland does not have as many Medicare Advantage plans to choose from as other states. The carriers that do have a Medicare Advantage plan available in the state of Maryland typically offer them with either a PPO or HMO network. While an HMO network is the most restrictive by limiting benefits to only be paid to a provider in the network, a PPO network provides coverage to pay providers who are not part of the plan’s network. These non-participating providers will still be paid at a lower rate, so there will be more out-of-pocket expenses for the policyholder to pay. When considering a Medicare Advantage plan it is very important to understand what services charge a co-pay and what services will be charged at a co-insurance amount. While one service might be a $20 co-pay, another service or procedure might be a 20% co-insurance payment. On a $1,000 charge, a 20% co-insurance would be $200.

One of the most important parts of a Medicare Advantage Plan with Prescription Drug Benefit (MAPD) is the formulary. While a Medicare Advantage plan premium may be much less than getting a Medicare Supplement plan with a stand-alone Prescription Drug Plan (PDP), those savings can quickly disappear if your prescriptions are not covered or they fall into a higher pricing ‘Tier‘. This is not to say that a Medicare Advantage plan is a poor choice. There are many times when a Medicare Advantage plan can be a great fit. Maryland Medicare Advantage plans while limited, do offer many folks in several counties a solid option of affordable benefits.

If considering a Maryland Medicare Advantage plan it is imperative to first make sure that your doctors, hospitals, and local skilled nursing facilities participate in the plan’s network before enrolling. In addition, it is extremely important to understand that not all plans have the same maximum out-of-pocket limits (so you could have more expenses in one plan compared to another), and plans also differ on how much you must pay for each night you are in the hospital. Many times the daily hospital co-pay is $300 or more per day. Most of our Medicare Advantage clients choose to offset the expensive daily hospital co-pay with a hospital indemnity plan. Our advisors can help with this and make your research that much easier.

Don’t go at it alone or with an agent who only works with Medicare Supplements or Medicare Advantage plans. Get help from one of our highly experienced advisors who understand the details of both Medicare Supplement and Medicare Advantage plans available in Maryland.