Navigating the world of health insurance for seniors can be daunting, but understanding the differences between Medicare Advantage plans and traditional Medicare is a crucial step in making informed decisions about healthcare coverage options. Medicare Advantage, often seen as a comprehensive alternative to traditional Medicare, offers a range of benefits that may include cost savings Medicare options, additional healthcare services, and unique perks tailored to individual needs. As a trusted advisor on Medicare plans, my goal is to provide clear, supportive guidance to help you compare Medicare plans effectively. In this discussion, we will explore the distinctive features of Medicare Advantage and how they can enhance your Medicare benefits, ensuring you feel confident and relieved in your healthcare choices.

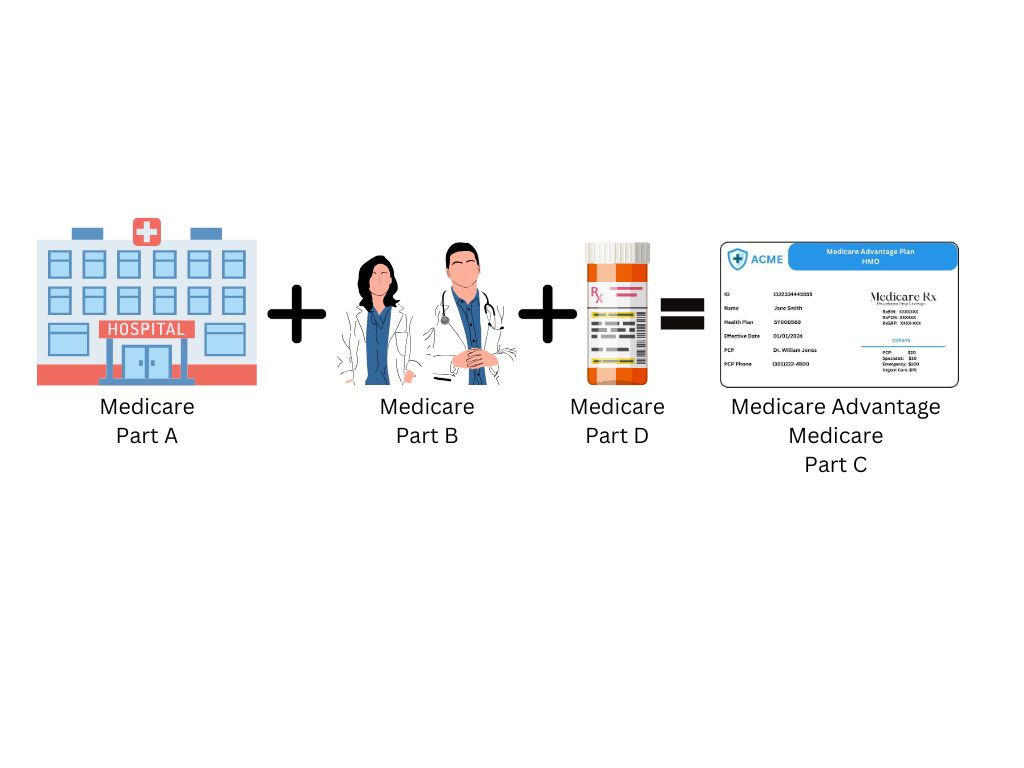

Medicare Advantage plans, sometimes known as Part C, are a type of health insurance offered by private companies approved by Medicare. These plans provide an all-in-one alternative to traditional Medicare by including Part A (hospital insurance) and Part B (medical insurance). Many plans also offer Part D (prescription drug coverage), which is a significant benefit for those needing regular medications. One of the notable advantages is the potential for cost savings in Medicare options due to the plan’s capped out-of-pocket expenses, unlike traditional Medicare. Additionally, Medicare Advantage plans may offer extra benefits such as vision, hearing, dental, and wellness programs, tailored to meet individual needs. By understanding these features, you can better compare Medicare plans and determine which plan aligns with your health goals and budget.

When comparing Medicare Advantage plans with traditional Medicare, it’s essential to consider coverage, flexibility, and additional benefits. Traditional Medicare consists of Part A and Part B, offering broad access to healthcare providers nationwide without network restrictions. However, it doesn’t typically cover services like prescription drugs, vision, or dental care without additional coverage through separate plans such as Medigap or Part D. In contrast, Medicare Advantage plans often include these services within a single, integrated plan. Although they might require choosing healthcare providers within a specific network, they often provide additional benefits and a cap on out-of-pocket costs. This can lead to potential cost savings in Medicare options. Understanding these key differences can help you make informed decisions about the best healthcare coverage options, ensuring your Medicare benefits align with your health needs and financial situation.

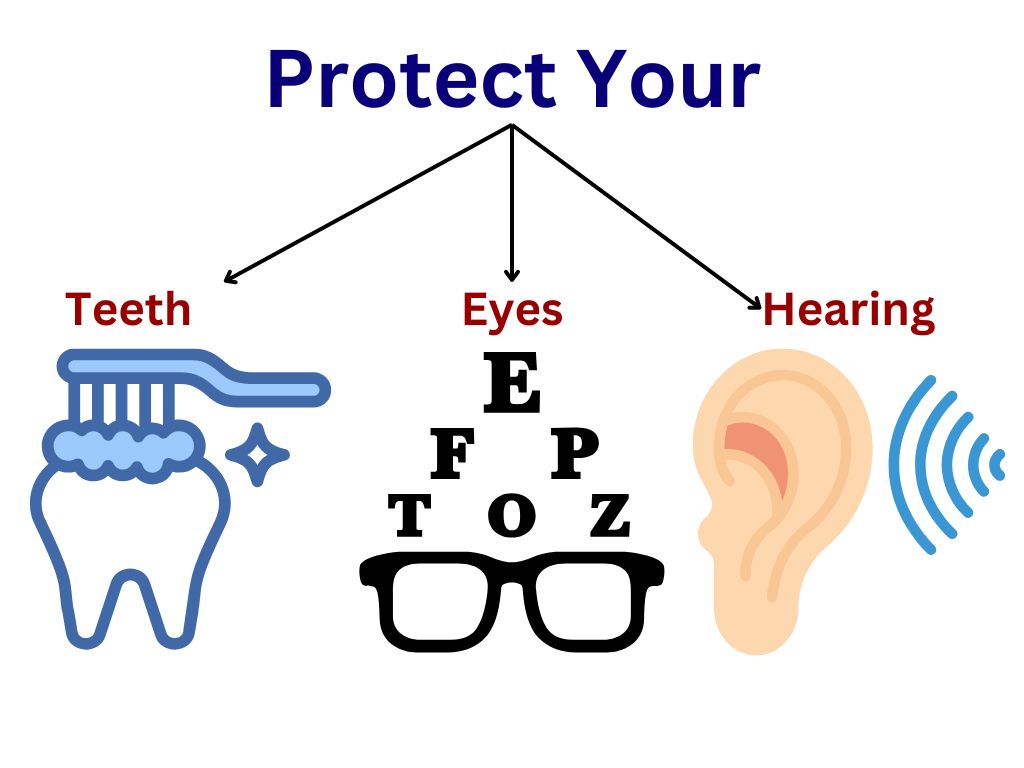

Medicare Advantage plans provide diverse healthcare coverage options beyond what traditional Medicare offers. These plans can include additional services that are crucial for maintaining overall health. For instance, many Medicare Advantage plans cover vision, dental, and hearing care—services not typically covered under traditional Medicare. This comprehensive approach ensures that beneficiaries receive holistic care, addressing a broader spectrum of health needs under a single plan. Furthermore, some plans offer wellness programs and fitness memberships, which can be a boon for seniors looking to maintain an active and healthy lifestyle. While these plans require choosing healthcare providers within a network, they often come with the advantage of coordinated care, ensuring that all aspects of a beneficiary’s health are managed efficiently. Understanding these diverse options can empower individuals to compare Medicare plans and select coverage that best supports their personal health goals and financial constraints.

One of the appealing aspects of Medicare Advantage plans is the potential for cost savings, particularly when compared to traditional Medicare. These plans often feature lower premiums and include a cap on out-of-pocket expenses, which can provide financial predictability and relief for those living on a fixed income. Unlike traditional Medicare, which lacks an out-of-pocket maximum, Medicare Advantage plans ensure that once you reach a certain spending threshold, you won’t incur additional costs for the rest of the plan year. Additionally, since many plans bundle services like prescription drug coverage, vision, and dental care into a single package, beneficiaries may experience overall savings compared to purchasing separate supplemental policies. By evaluating these cost-saving features, seniors can make informed decisions about their healthcare coverage options, ensuring that their Medicare benefits align not only with their health needs but also with their financial circumstances.

Medicare Advantage plans frequently offer an array of extra benefits that traditional Medicare does not. These additional perks can significantly enhance the quality of healthcare for seniors. Many plans include wellness programs, which might encompass gym memberships, nutritional advice, or even classes aimed at improving mental health. Some plans extend coverage for transportation to medical appointments, which can be invaluable for those with mobility challenges. Furthermore, certain Medicare Advantage plans provide over-the-counter medication allowances, enabling beneficiaries to purchase essential items without out-of-pocket expenses. These extra benefits cater to a holistic approach to health, emphasizing preventative care and overall well-being. By taking advantage of these features, beneficiaries can enjoy a more comprehensive healthcare experience, tailored to their unique needs. Understanding these offerings is crucial when you compare Medicare plans, as selecting a plan with the right mix of benefits can lead to improved health outcomes and greater peace of mind.

Medicare Advantage plans are designed with the diverse needs of seniors in mind, offering tailored health insurance solutions that align with individual lifestyles and health requirements. These plans often provide flexibility in choosing coverage options that address specific health concerns, such as chronic conditions, which may require specialized care or medication. By allowing seniors to select plans that include services most relevant to their situation, Medicare Advantage ensures that each beneficiary can maximize their Medicare benefits effectively. This tailored approach extends to networks and providers, enabling seniors to maintain relationships with preferred doctors and specialists when possible. Furthermore, many plans offer personalized care management services that assist in coordinating care, understanding benefits, and accessing resources. As you compare Medicare plans, considering how well a plan can be customized to fit personal health needs is crucial for optimizing both care quality and convenience, ultimately leading to a more satisfying healthcare experience.

One key differentiator of Medicare Advantage plans is the focus on managed care, which involves coordinating all aspects of a beneficiary’s healthcare. This coordination ensures that healthcare providers work together to provide integrated care, preventing fragmented or duplicate services and enhancing overall care efficiency. This concept of managed care can be particularly beneficial for seniors with multiple health conditions, allowing for a more streamlined and comprehensive approach to their healthcare management. This often leads to better health outcomes, reduced hospital readmissions, and ultimately, a higher quality of life for beneficiaries. In addition to improving health services delivery, managed care models may result in cost savings due to fewer unnecessary services and more effective usage of healthcare resources. The coordination of care also promotes informed, proactive disease management, better-enabling beneficiaries to take charge of their health and wellness.

While Medicare Advantage plans provide a wealth of benefits, it’s important for seniors and their families to carefully consider the potential limitations of these plans as well. The choice should be guided not only by the array of benefits and coverage offered but also by other factors such as the plan’s cost, availability of trusted healthcare providers within the plan’s network, and the suitability of the plan to the individual’s health status and needs.

In addition to these, considerations should also include the flexibility of the plan in covering prescription medications, availability of home health and long-term care services, and any experiences of the beneficiaries with the plan. Careful evaluation can lead to a more informed selection of a plan that best caters to the individual’s health requirements.

When exploring Medicare Advantage plans, it’s important to understand the different types that are available and how they operate. The three main types of plans include the Health Maintenance Organization (HMO), the Health Maintenance Organization with Point of Service option (HMO-POS), and the Preferred Provider Organization (PPO). Here’s a closer look at each of these plans:

A Health Maintenance Organization (HMO) plan typically requires members to receive their healthcare services from a network of designated providers. Here’s how it generally works:

An HMO-POS plan combines features of HMOs with more flexible usage options, allowing members to access some services outside the network. Here’s how it functions:

A Preferred Provider Organization (PPO) plan offers the most flexibility when it comes to choosing healthcare providers and facilities. Here’s how it operates:

Each of these Medicare Advantage plans offers distinct advantages, and the best choice will depend on individual health needs, budget considerations, and preferences for accessing healthcare services. Understanding these types of plans can help beneficiaries make informed decisions and optimize their Medicare benefits.

The Centers for Medicare and Medicaid Services (CMS) describes Medicare Advantage plans as “an all-in-one alternative to original Medicare.” Often called “Part C,” these plans are operated by private insurance companies that receive government funding to provide them at little or no extra cost. It is important to keep in mind that in certain states where the reimbursement rate (funding) from CMS is lower, $0.00 premium plans will be hard to come by.

While Medicare Advantage benefits can be quite robust, it is important to keep in mind that they are designed to be a “cost-sharing” plan. This means that you will have co-pays and co-insurance that you will be responsible for when receiving care. Typically your highest co-pays are for hospitals with daily co-pays being $200+ per day. Many of our clients use a hospital indemnity plan to budget these costs for a very low premium.

Medicare Advantage plans typically incorporate prescription drug coverage. They commonly offer benefits such as gym memberships, over-the-counter benefits, annual physicals, and vision, dental, and hearing care.

Many of our customers have multiple questions and Senior Benefit Services is here to help answer all of your questions and help you choose the right Medicare coverage plan for you.

The best decision you can make is to simply give us a call at 1.800.924.4727 or fill in the “Speak to an Agent” request on the right side of your screen and one of our knowledgeable agents will reach out to you.