Trying to understand Medicare Plan G and how it works with Medicare Parts A and B can sometimes be a bit confusing. The good news is that our simple to understand article below will make it much easier. When reading this article keep in mind that Medicare Plan G is the same as Medigap Plan G or Medicare Supplement Plan G.

As you age, your healthcare needs change, and investing in a Medicare plan is crucial to ensure that medical expenses don’t become a financial burden. With so many Medigap plans to choose from, deciding which one is best for you can be overwhelming, especially when it comes to deciphering the differences between Plan F and Plan G. Plan G has been gaining popularity among seniors in recent years, so let’s dive into what it is, what it covers, and why it might be worth investing in.

What is Medicare Plan G?

Medicare Plan G is a Medigap policy that covers various out-of-pocket medical expenses that are not covered by original Medicare parts A and B. Plan G covers deductibles, copayments, and coinsurance for parts A and B, along with other healthcare services, such as skilled nursing facility care, hospice care, and blood transfusions.

What does it cover?

Plan G provides comprehensive coverage, including:

- Coinsurance for Part A hospital expenses for up to an additional 365 days after Medicare benefits are exhausted.

- Coverage of all copayments and coinsurance for Medicare Part B.

- 100% coverage for Excess Charges (these are charges over and above what Medicare approves and are billed by the provider when they do not participate in the Medicare Assignment program). These charges cannot exceed 15% above the Medicare Approved amounts.

- An additional 365 days for inpatient mental health care after using up Medicare benefits.

- 80% coverage for care abroad during travel (there is a separate plan deductible for this benefit since Medicare does not typically provide benefits outside the United States).

- Part A hospice care coinsurance or copayments.

- Skilled nursing facility care.

Is Med Supp Plan G worth it?

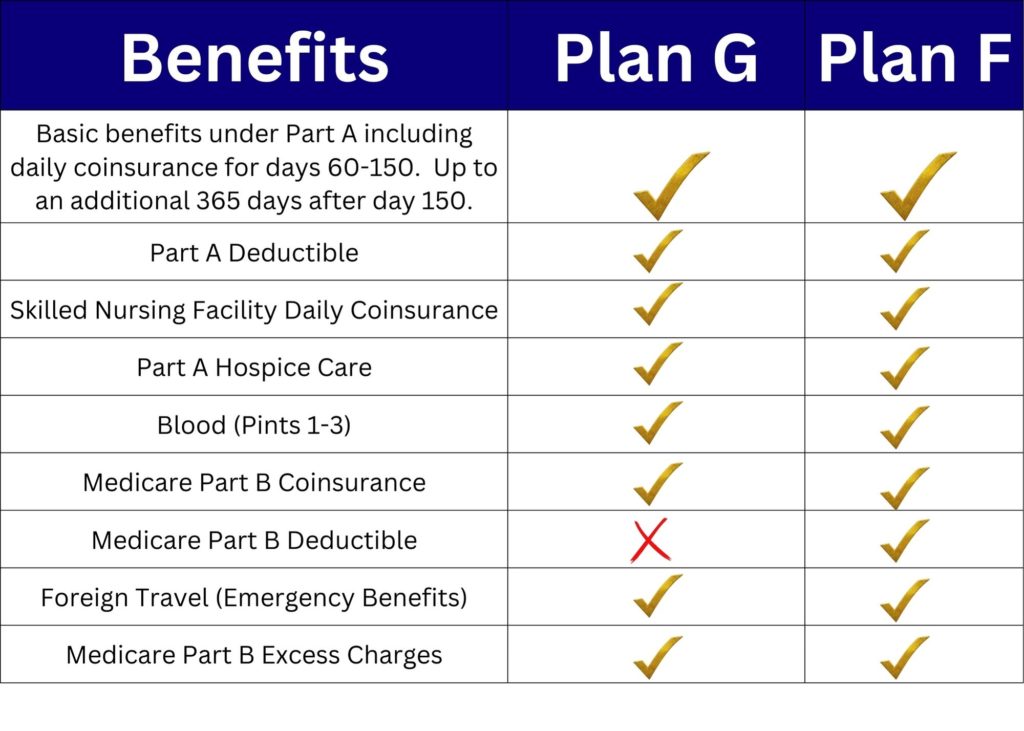

Med Supp Plan G offers all the same benefits than Plan F offers, minus coverage for the Part B deductible. However, Plan F is no longer available to new enrollees as of January 1, 2020. If you were eligible for Medicare prior to January 1, 2020 then you can still purchase a Plan F as long as you can pass medical underwriting. In certain states there is a birthday rule provision that will allow you to switch to another carrier’s Plan F during your birthday month with no medical underwriting.

When comparing Plan G to other Medigap Plans, policyholders can save more on their premiums and healthcare expenses overall. Compared to Plan F, premiums for Plan G may be less expensive.

What is the difference between F and G Medicare plans?

The main difference between Medicare Plan F and G is that Plan F covers the Part B deductible, which is $226 in 2023 and will increase to $240 in 2024; whereas Plan G does not. In many situations, the annual premium difference between the Plan F and the Plan G will be at least $240 if not more.

Why is Plan F more expensive than Plan G?

Since Plan F covers the Part B deductible, it comes at a higher cost. Starting in 2020, insurance companies can no longer sell new Medigap policies, including Plan F, that cover the Part B deductible to new enrollees. With no more younger Medicare beneficiaries entering Plan F, existing policyholders premiums will rise to cover increasing claim losses. History has shown that as a Medicare Supplement plan ages and has no younger policyholders entering the plan, the rates will typically rise faster than plans that still enroll folks entering Medicare for the first time.

What is the difference between Plan G and Medicare Advantage plan?

While Medigap Plan G works with original Medicare, Medicare Advantage is a private health plan that replaces it. In contrast, Medicare Advantage plans have networks of providers, and you may be required to get a referral or use specific providers to receive care. Medigap Plan G provides access to any healthcare provider who accepts Medicare.

To make this a bit easier to understand, look at Plan G as a overall budgeting tool. Let’s say that your monthly premium is $135 per month. This means that you know each month no matter how many times you have to see a doctor, have a surgery, or incur a hospital stay, your Medigap plan will pick up all the remaining Medicare approved charges (minus the first $240 in 2024) after your Part B deductible has been met for the year.

With a Medicare Advantage plan, you will typically have much lower monthly premiums (or possibly no premiums at all), but you are basically sharing the overall costs of care with the private insurance company. Consider a scenario where your Medicare Advantage plan charges a $300 per day hospital co-pay, and you require a hospital stay of 5 days. This means for that hospital stay you would be out of pocket $1,500. With a Medigap G you would not incur these co-payments. If you have a zero premium Medicare Advantage plan and only see your primary care physician 4 times a year with a $20 co-pay, then you will save $1,540 for the year.

Example:

$135 per month x 12 months = $1,620 in Medigap premiums – $80 (4 visits to PCP) = $1540 in savings for that year.

Is Medigap G better than an Advantage plan?

For many individuals, Medigap Plan G is a better choice than a Medicare Advantage plan because it offers more comprehensive coverage with lower out-of-pocket costs and fewer restrictions. The more comprehensive the plan’s coverage is, the more costly it will be. It is important to keep in mind that an individual should always purchase a plan that they can truly afford. Keep in mind that, in evaluating the affordability of a Plan G, you must also consider the necessity to buy a separate prescription drug plan for filling your prescriptions. Most Medicare Advantage plans provide this coverage integrated into their plan. In addition, a Medicare Advantage plan may offer additional benefits such as dental, vision, and hearing coverage. If these benefits are important to you, then you will also need to purchase a stand-alone dental, vision, and hearing plan.

Conclusion

Medicare Plan G is a comprehensive health plan that covers many out-of-pocket expenses that original Medicare does not. Plan G is worth considering for seniors who want comprehensive coverage at a manageable cost. With the right Medigap policy, seniors can breathe a little easier, knowing that their healthcare expenses won’t leave them financially burdened. Does this mean that you should not consider any other Medigap plan or Medicare Advantage plan? Absolutely not! This is why it is important to talk to one of our knowledgeable advisors. Call us today at (800)924-4727 or click the ‘Get Help Request’ form below. Tell us about the coverage type that interests you.