The Medicare Part B premium costs more for high income earners, and is known as the Medicare Income Related Monthly Adjustment Amount (IRMAA). These individuals or couples will pay a higher premium each month for their Part B of Medicare due their adjusted gross income being higher than the typical Medicare Beneficiary.

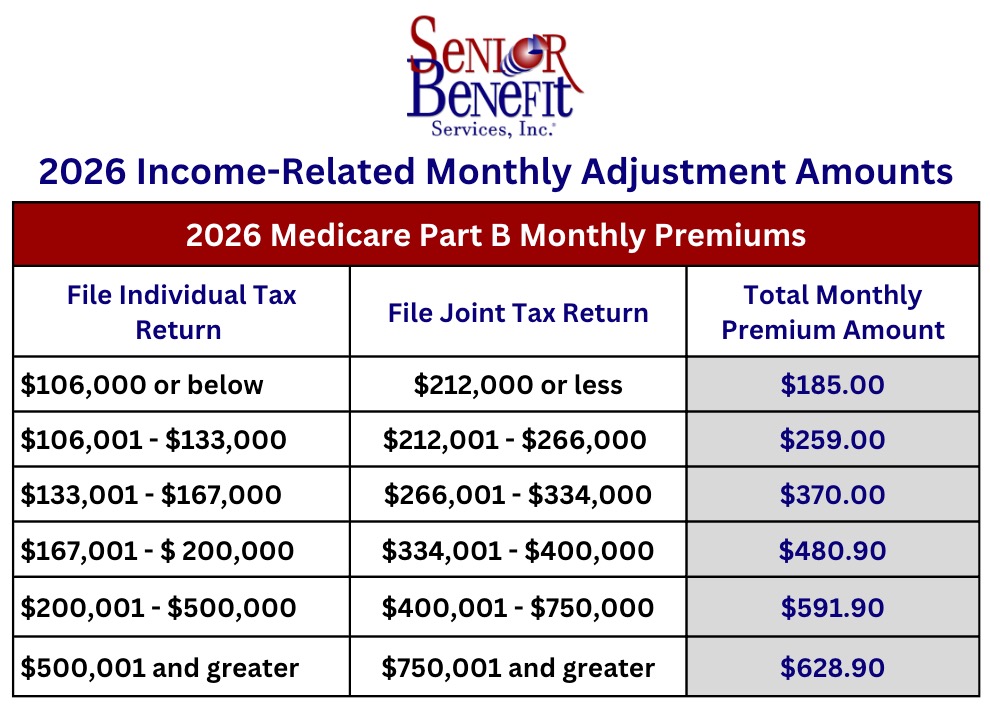

The Social Security Administration each year will adjust the income brackets shown below that will determine whether or not you will incur an additional premium charge for your Part B costs.

It is important to keep in mind that the determination of whether or not your Medicare Part B costs will be higher than the average Medicare Beneficiary, the income bracket is based on your IRS tax returns from 2 years ago that includes the adjusted gross income reported plus any other tax-exempt income.

If you have to pay a higher amount for your Medicare Part B Premium, you will receive an official notification from the Social Security Administration with the amount. Keep in mind that whether you have original Medicare with a Medicare Supplement or opt to go with a Medicare Advantage plan, you will still be required to pay the increased Part B premiums if you are deemed to be a higher income earner.

If you are not sure whether or not you fall into the category of paying additional premium for Part B you can reach out to Senior Benefit Services, Inc and you will be connected to one of our knowledgeable advisors for assistance. You can call (800)924-4727 or submit a request to be called back below.

Senior Benefit Services, Inc. does not make the final determination of whether a Medicare Beneficiary is classified as a high income earner nor what the final monthly premium will be for Part B of Medicare. The Social Security Administration will make the sole determination based on previous tax returns. If you feel there is an error in your income calculations then you can appeal by following the instructions found here.