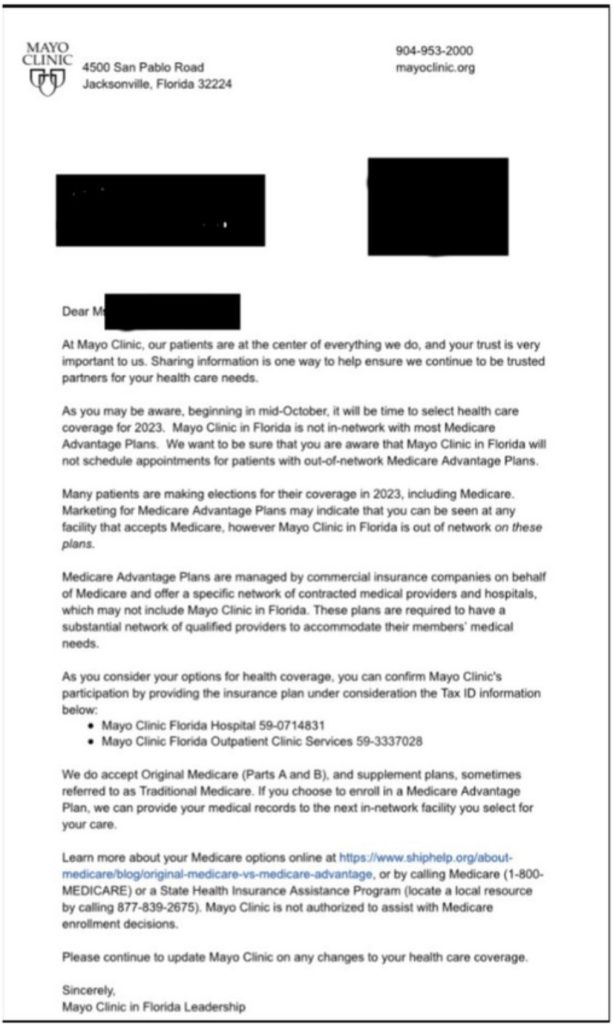

Medicare out-of-network confusion continues to remain a big issue with Medicare Advantage plans. A recent letter that was sent out by The Mayo Clinic (Florida location) has caused quite a bit of uproar due to the facility urging Medicare beneficiaries to reevaluate staying in a Medicare Advantage plan. In addition, the letter reminded Mayo Clinic patients that they do not participate as an in-network facility and will no longer schedule patients who have a Medicare Advantage plan that would classify The Mayo Clinic as ‘out-of-network”.

Earlier this year a survey released by MedicareGuide.com found that 4 out of 10 Medicare Advantage enrollees believed that they do not have to stay in-network for care. This is very alarming since the network restrictions are one of the key ways that Medicare Advantage plans keep overall costs down. Consumers are not understanding that you are trading the flexibility of provider access for low to no premiums and being restricted to use only providers in the plan’s network.

Many retirees who enroll in a Medicare Advantage plan do so for the low-cost premiums and ‘extra benefits’ they would receive not typically found in Original Medicare. A large percentage of those retirees do not understand that they are in essence signing over their Medicare benefits for Parts A & B to a private insurance company. Those amounts typically come in around $1,000 per month on average (before bonuses that the insurance company may get) for non-special needs plans (SNPs) or dual eligible plans (DSNPs). Both SNP and DSNP plans get paid an even higher amount from Medicare. According to the Medicare Trustees report, in 2019 payments to private Medicare Advantage plans were approximately $321 per enrollee higher than what Medicare would have spent on these same folks if they had been in traditional Medicare (Parts A & B). While $321 per enrollee for the year might not seem like a large amount of money, the total for increased spending by Medicare for these folks equates to an estimated $7,000,000,000.00 (seven billion dollars) in additional costs to the Medicare program. For 2022 it is expected to swell to $12,000,000,000.00

Be careful of going out of network in a Medicare Advantage plan!

Be careful of going out of network in a Medicare Advantage plan!

With this much additional money being spent, one would assume that more benefits are being paid out on behalf of enrollees. That assumption is wrong. In fact, one of the most common reasons for Medicare Advantage enrollees wanting to return to original Medicare comes when a prior approval for a procedure is delayed or even denied. In the 2022 Office of The Inspector General (OIG) report there was a concern for “the incentive for Medicare Advantage plans to deny beneficiary access to services and deny payments to providers in an attempt to increase profits.” One would think with all the additional money coming into Medicare Advantage plans that there would be a focus on reducing the out-of-pocket costs enrollees face. Sorry to say that is not always the case.

Did you know in a Kaiser Family Foundation report, over 50% of the Medicare Advantage enrollees would incur higher out of pocket costs for a 7-day hospital stay than those with Original Medicare?

As we have said many times over, Medicare Advantage plans are not bad if enrollees fully understand the tradeoffs. For those younger Medicare beneficiaries who are possibly in better health, the likelihood of them needing prior approval for a high costing procedure or facing a lengthy stay in the hospital are lower than older Medicare beneficiaries whose health is likely to continue to decline. It is vitally important that Medicare Advantage enrollees understand that their coverage is being provided by private insurance companies and not Medicare itself. Unlike Original Medicare, where they would not face having to get prior approval for most services or be limited to a certain network of doctors, Medicare Advantage plans use these to reduce costs and increase profits. We believe that there is nothing wrong with this since private insurance companies are a business that must make a profit. Where we find issues is when the enrollees do not fully understand the limitations and restrictions of these Medicare Advantage plans and how the benefits are affected in an out of network situation. To discuss what plan options work best for your individual needs, contact us at (800)924-4727 to get a dedicated advisor to review your current situation.