Navigating the complex world of Medicare can be daunting, especially for seniors in Frostburg, MD, who are stepping into retirement and seeking the best healthcare coverage. Understanding the variety of Medicare options available is crucial for making informed decisions that align with personal health needs and budgetary constraints. From the basics of traditional Medicare to the intricacies of Medicare Supplement Plans, this guide aims to demystify the process and provide you with the confidence and clarity needed to select the most suitable option. Armed with expert insights and tips, you can make informed healthcare choices with confidence and peace of mind. Contact Senior Benefit Services, Inc. for help finding a Medicare plan that suits your needs.

Introduction to Medicare in Frostburg, MD

Why Medicare Matters

Medicare is vital for seniors in Frostburg, MD. It provides access to essential healthcare services and protects seniors from overwhelming costs. As individuals transition into retirement, the stability of a reliable healthcare plan becomes increasingly important. Medicare offers coverage that encompasses hospital stays, outpatient services, and preventive care, which is crucial for maintaining overall health and managing chronic conditions. With the rising costs of healthcare, Medicare provides a financial safety net, especially for those living on a fixed income. Furthermore, understanding the various parts of Medicare, including Parts A, B, C, and D, empowers seniors to choose plans that best meet their medical needs. This knowledge not only enhances confidence in navigating healthcare decisions but also ensures that seniors can continue enjoying their golden years with the peace of mind that comes from knowing they have comprehensive coverage.

Overview of Medicare Options in Frostburg, MD

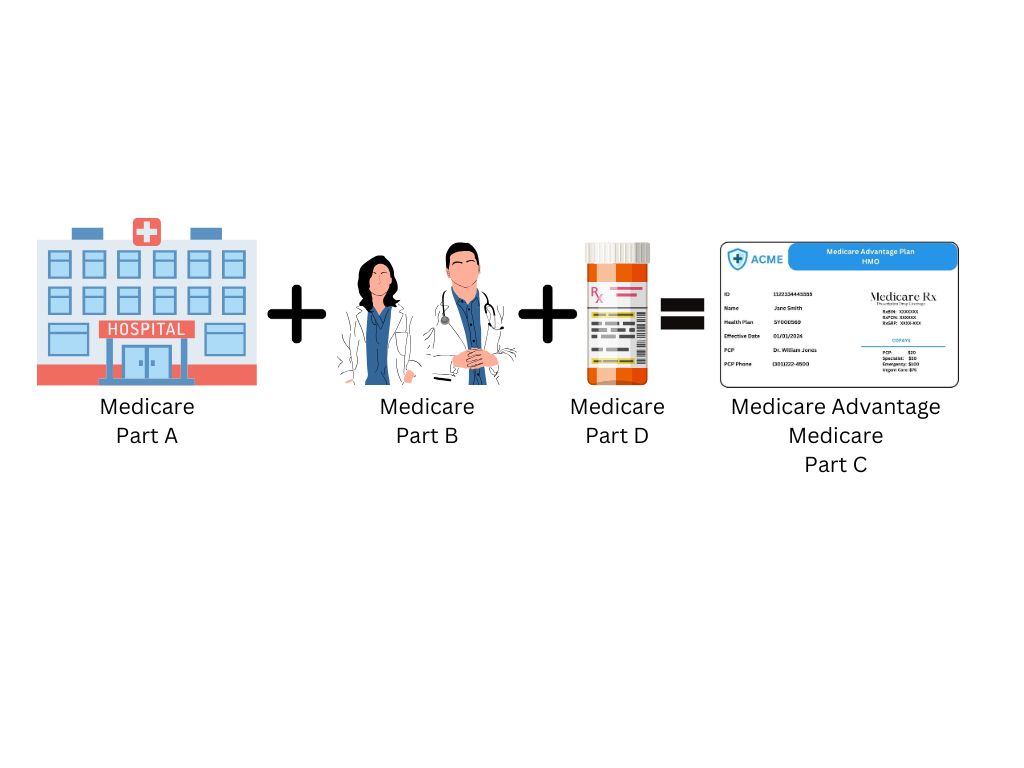

Understanding the different Medicare options is crucial for seniors in Frostburg, MD, as they seek coverage that aligns with their healthcare needs. Medicare is divided into several parts, each offering unique benefits. Part A, often referred to as hospital insurance, covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health services. Part B provides medical insurance, covering outpatient care, doctor visits, and preventive services. These two are the foundation of traditional Medicare. For those looking for more comprehensive coverage, Medicare Advantage Plans (Part C) offer an alternative. They include Parts A and B and often additional benefits like dental and vision care. Part D focuses on prescription drug coverage, which is essential for managing medication costs. Lastly, Medicare Supplement Plans, also known as Medigap, help cover additional costs not included in traditional Medicare, providing added financial security.

Importance of Local Expertise

Local expertise is invaluable when navigating Medicare options in Frostburg, MD. Our advisors understand the specific needs and circumstances of the community and can offer tailored advice and solutions. We are familiar with local healthcare providers, understand regional cost structures, and can guide seniors through the nuances of Medicare plans specific to the area. This personalized approach ensures that every senior receives a plan that not only fits their health requirements but also aligns with their financial situation. Furthermore, local advisors can provide face-to-face consultations, making the process more comfortable and less intimidating for those unfamiliar with digital communication.

Original Medicare vs. Medicare Advantage

Understanding Original Medicare

Original Medicare, comprising Part A and Part B, serves as the cornerstone of Medicare coverage. Part A, often considered hospital insurance, primarily covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care services. Meanwhile, Part B acts as medical insurance, covering outpatient care, doctor visits, preventive services, and some home health care. This combination provides comprehensive healthcare coverage, allowing beneficiaries to choose any doctor or hospital that accepts Medicare anywhere in the United States. One of the key aspects of Original Medicare is its flexibility, as it does not require referrals for specialists and does not restrict beneficiaries to a network of providers. However, it’s important to note that Original Medicare does not cover everything; beneficiaries might need additional coverage for services like dental, vision, or prescription drugs, which can be obtained through Medicare Supplement Plans or Part D plans.

Original Medicare, comprising Part A and Part B, serves as the cornerstone of Medicare coverage. Part A, often considered hospital insurance, primarily covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care services. Meanwhile, Part B acts as medical insurance, covering outpatient care, doctor visits, preventive services, and some home health care. This combination provides comprehensive healthcare coverage, allowing beneficiaries to choose any doctor or hospital that accepts Medicare anywhere in the United States. One of the key aspects of Original Medicare is its flexibility, as it does not require referrals for specialists and does not restrict beneficiaries to a network of providers. However, it’s important to note that Original Medicare does not cover everything; beneficiaries might need additional coverage for services like dental, vision, or prescription drugs, which can be obtained through Medicare Supplement Plans or Part D plans.

Exploring Medicare Advantage Plans

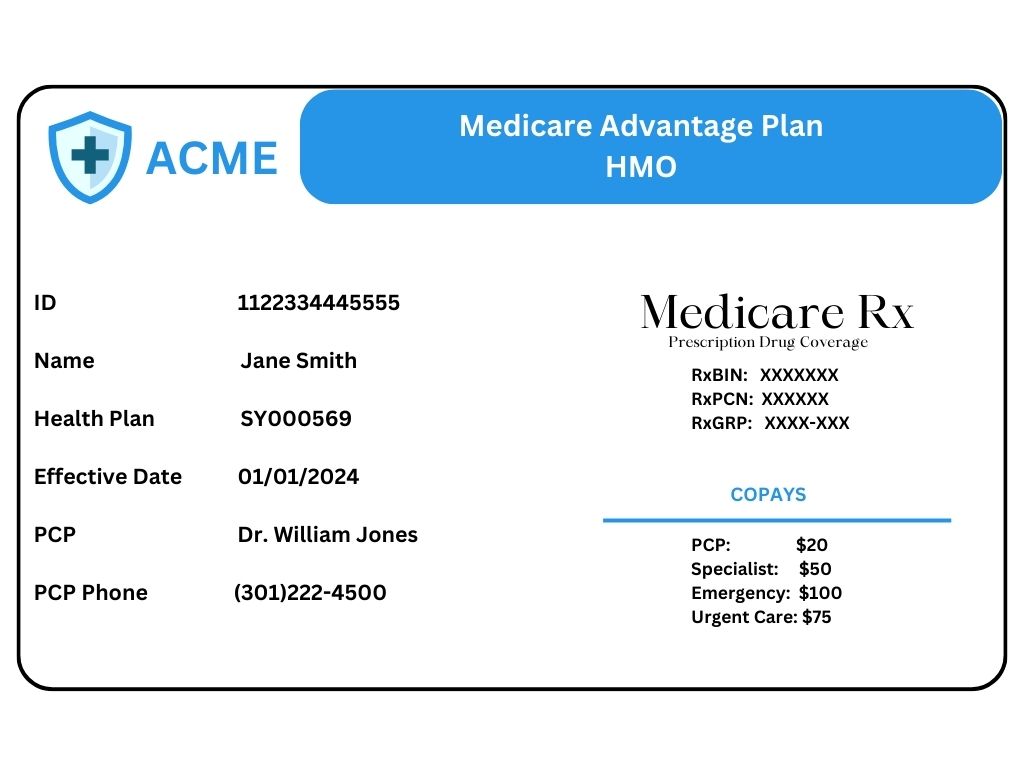

Medicare Advantage Plans, also known as Part C, provide an alternative to Original Medicare by bundling Part A and Part B coverage along with additional benefits. These plans are offered by private insurance companies approved by Medicare and often include services like vision, dental, hearing, and even gym memberships. A significant appeal of Medicare Advantage Plans is their inclusion of prescription drug coverage, which eliminates the need for a separate Part D plan. However, unlike Original Medicare, these plans typically require beneficiaries to use a network of doctors and hospitals, which could limit provider choice. They may also necessitate referrals for specialist visits. It’s crucial for seniors considering Medicare Advantage to evaluate the plan’s network restrictions and out-of-pocket costs, as these can vary widely. Despite these considerations, many find the comprehensive nature of Medicare Advantage Plans to be a cost-effective and convenient option for managing their healthcare needs.

Choosing the Right Medicare Advantage Plan

Just like in Cumberland, MD there are currently 7 Medicare Advantage plans available. Selecting the ideal Medicare Advantage Plan is crucial for maximizing your healthcare benefits while managing costs effectively. Start by evaluating your specific healthcare needs and preferences. Consider factors such as your preferred doctors, hospitals, and any medications you regularly take, ensuring they are included in the plan’s network and formulary. It’s essential to assess the plan’s costs, including premiums, copayments, and out-of-pocket maximums, to ensure it aligns with your budget.

Medicare Advantage Plans, also known as Part C, often offer additional benefits not covered by Original Medicare, such as vision, dental, and hearing services, which can be significant for maintaining overall health. Evaluate these extra benefits and how they match your lifestyle and healthcare priorities. Also, consider the plan’s flexibility in accessing out-of-network care if needed.

Key Differences to Consider

When deciding between Original Medicare and Medicare Advantage, it’s important to consider several key differences. Original Medicare offers flexibility in choosing healthcare providers. This allows beneficiaries to see any doctor or visit any hospital that accepts Medicare nationwide. In contrast, Medicare Advantage plans often require members to use a network of providers. In addition the plan may necessitate referrals for specialist care. Another distinction lies in coverage options; while Original Medicare does not typically cover services such as vision, dental, or hearing, Medicare Advantage plans often include these additional benefits. Cost is another factor, as Original Medicare may involve higher out-of-pocket costs for services without supplemental coverage. Medicare Advantage plans, however, often have lower premiums but may come with copayments and coinsurance. Lastly, the structure of prescription drug coverage differs, with Original Medicare requiring a separate Part D plan. Whereas most Medicare Advantage plans integrate this coverage into their overall benefits. These particular Medicare Advantage plans are known as a MAPD plan. Evaluating these differences helps beneficiaries choose the plan that best aligns with their healthcare and financial needs.

Medicare Supplement Plans Explained

Benefits of Supplement Plans

Medicare Supplement Plans, commonly known as Medigap, offer significant benefits for those enrolled in Original Medicare. These plans are designed to cover the “gaps” in coverage, such as copayments, coinsurance, and deductibles, which can result in substantial out-of-pocket expenses. One of the primary advantages of Medigap is that it allows beneficiaries to predict their healthcare costs more accurately, providing financial peace of mind. Additionally, Medigap policies enable seniors to seek medical care from any doctor or hospital that accepts Medicare, offering flexibility and eliminating network restrictions. This is particularly beneficial for those who travel frequently or live in rural areas where provider options may be limited. Furthermore, some Medigap plans offer coverage for services that Original Medicare does not cover, such as medical care during foreign travel. By reducing unexpected expenses and providing greater choice in healthcare providers, Medigap plans enhance the overall Medicare experience.

Choosing the Right Supplement Plan

Selecting the right Medicare Supplement Plan involves careful consideration of individual healthcare needs and financial circumstances. Since Medigap plans are standardized and labeled from Plan A to Plan N, each offers a different combination of benefits. It’s crucial to assess which out-of-pocket costs you want covered, such as copayments, coinsurance, and deductibles. For instance, Plan F, which covers almost all gaps in Original Medicare, might be suitable for those who prefer comprehensive coverage but is only available to those eligible before 2020. Meanwhile, Plan G offers similar benefits, except for the Part B deductible. Seniors should also consider their health condition and potential future medical needs, ensuring the chosen plan aligns with their long-term healthcare strategy. Additionally, comparing premiums from different insurance companies is essential, as costs can vary. Consulting with a local Medicare expert in Frostburg, MD, can provide valuable guidance, ensuring you make an informed decision that offers both coverage adequacy and financial comfort.

How Medicare Supplement Plans Work in Frostburg, MD

In Frostburg, MD, Medicare Supplement Plans function similarly to how they do across the United States, offering coverage for the additional costs not covered by Original Medicare. These plans, sold by private insurance companies, allow beneficiaries to access any healthcare provider that accepts Medicare, providing significant flexibility. For seniors in Frostburg, this means they can choose from a variety of healthcare providers in the area without worrying about network restrictions. It’s important to note that while the benefits of Medigap plans are standardized, premiums may vary based on the insurer and the specific plan chosen. Additionally, residents of Frostburg should consider the timing of their enrollment, as purchasing a plan during the Medigap Open Enrollment Period ensures access to coverage without medical underwriting. This period begins when you turn 65 and are enrolled in Part B. Consulting with local Medicare advisors can provide personalized insights, helping you find a plan that best fits your healthcare needs and budget.

Here are some sample rates of Medicare Supplement plans for a 67 year old (non-tobacco user) in Frostburg, MD:

| Plan N | Plan G | |

| Female | $105.00 | $137.00 |

| Male | $121.00 | $157.00 |

Prescription Drug Coverage Options

Importance of Part D Coverage

Part D coverage is essential for managing prescription drug costs, which can be a significant financial burden for seniors. As a standalone plan or part of a Medicare Advantage Plan, Part D helps cover the cost of prescription medications. These plans help ensure that beneficiaries can afford necessary treatments without depleting their savings. For seniors in Frostburg, MD, having Part D coverage is particularly important given the increasing costs of medications and the potential need for chronic disease management. This coverage provides access to a wide range of prescription drugs. It is important to remember that formularies, or lists of covered drugs, can vary by plan. It’s crucial to review these formularies annually, as plan details may change, affecting coverage for specific medications. Enrolling in a Part D plan when first eligible helps avoid late enrollment penalties, ensuring continuous access to affordable medications. Consulting with a Medicare advisor can help navigate the available plans, ensuring optimal drug coverage tailored to individual health needs.

Selecting a Plan for Your Needs

Choosing the right Part D plan requires careful evaluation of your current and anticipated prescription drug needs. Start by listing your medications and comparing them against the formularies of different Part D plans available in Frostburg, MD. Each plan has a unique formulary, and it’s vital to ensure that your medications are covered to avoid unexpected costs. Consider the plan’s monthly premiums, deductibles, and copayments, as these factors influence your overall expenses. Some plans may offer lower premiums but higher overall out-of-pocket costs. Other Part D plans might have higher premiums with reduced costs per prescription. Additionally, pay attention to the plan’s pharmacy network, as restrictions may apply to where you can fill prescriptions. Reviewing these elements annually is important, as plans and personal health needs can change. Engaging with one of our local advisors can provide personalized advice. They will help you select a plan that offers comprehensive drug coverage at a manageable cost.

Common Questions About Drug Coverage

Navigating prescription drug coverage can be confusing, and seniors in Frostburg, MD, often have several common questions. One frequently asked question is about the coverage gap, or “donut hole,” which refers to a temporary limit on what the drug plan will cover. Understanding how this affects medication costs is crucial for budgeting. Another common inquiry is about the late enrollment penalty for Part D plans. A penalty applies if there’s a gap of 63 days or more after your Initial Enrollment Period without creditable prescription drug coverage. This penalty emphasizes the importance of timely enrollment. Seniors also often ask whether all pharmacies are covered under every Part D plan. Plans can have preferred pharmacy networks, which may affect where prescriptions can be filled at the best cost. Changes in drug pricing and coverage from year to year are common. This highlights the need for annual plan reviews to ensure optimal coverage. Your personal advisor at Senior Benefit Services, Inc. provides this to you at no cost each year.

Finding the Best Plan for You

Steps to Evaluate Your Needs

Evaluating your Medicare needs involves a few critical steps to ensure you choose the most suitable plan. Begin by assessing your current health status and any chronic conditions that may require ongoing care or medication.

1.) Make a comprehensive list of your preferred healthcare providers and verify if they accept Medicare or are part of Medicare Advantage networks. Next, review your prescription drug needs and compare them with the formularies of available Part D or Medicare Advantage plans to ensure coverage.

2.) Consider your budget, including monthly premiums, deductibles, and out-of-pocket costs, to identify a plan that aligns with your financial situation. Additionally, think about any anticipated healthcare needs, such as planned surgeries or therapies, which may affect your choice.

3.) Finally, consult with one of our Medicare advisors in Frostburg, MD. This will ensure you receive personalized guidance, insights into local plan options and help with clarifying any uncertainties. This thorough evaluation ensures you select a plan that supports your health and financial well-being.

Medicare Resources for Frostburg, MD Residents

Collaborating with Senior Benefit Services, Inc. offers a personalized approach to navigating Medicare options in Frostburg, MD. Our company is dedicated to helping seniors understand the complexities of Medicare. We strive to find plans that align with your health and financial needs. By working with one of our professional advisors, you gain access to tailored advice that considers your personal circumstances. The needs could include current health conditions, preferred healthcare providers, and/or budget constraints. Senior Benefit Services, Inc. provides one-on-one consultations to discuss all available Medicare plans, outlining the benefits and limitations of each. Our expertise extends to guiding you through the enrollment process, ensuring you meet all necessary deadlines and avoid penalties. Additionally, they remain a resource for ongoing support, helping you manage any changes to your plan. This partnership ensures that you make informed decisions with confidence, securing the best possible healthcare coverage for your needs. Call the local office of Senior Benefit Services, Inc. in Cumberland, MD at (301)722-1414 to speak to an advisor today.