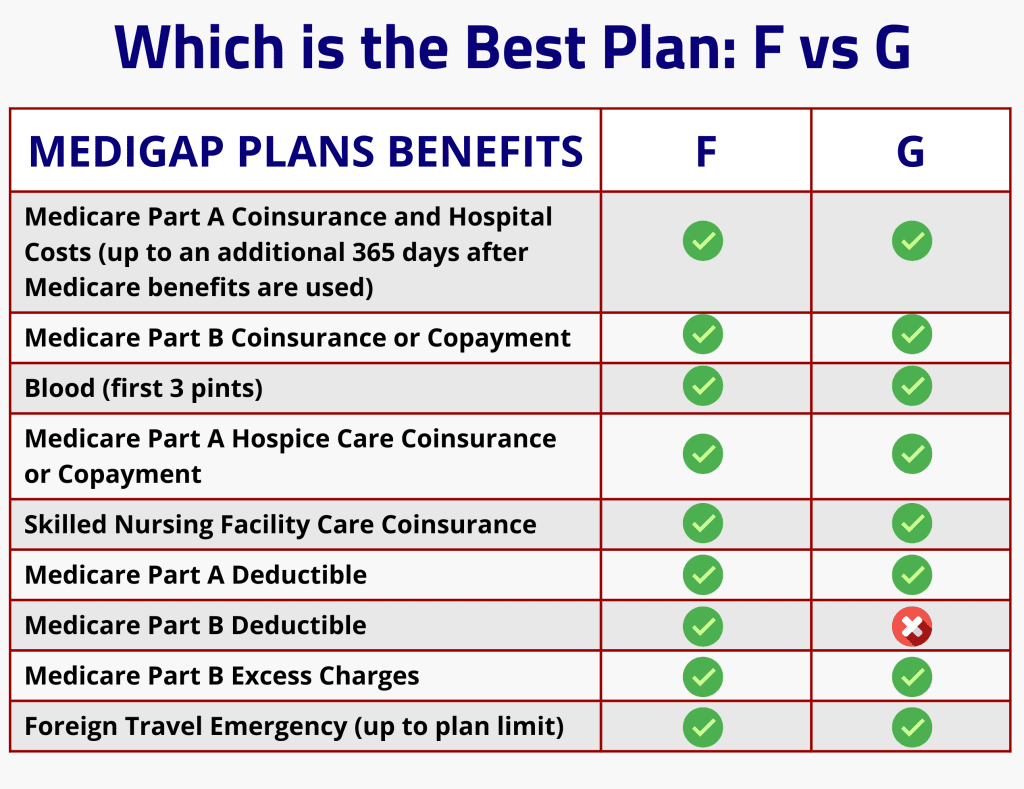

If you went on Medicare after January 1st of 2020 then you cannot buy a Medicare Supplement Plan F. What is the best alternative for Medicare Supplement Plan F? Research you may have conducted on your own has likely returned results on Medicare Supplement Plan G.

Prior to January 1, 2020 the most popular Medicare Supplement plan being sold was Plan F. This plan was considered by many to be ‘Cadillac Coverage’ since the policyholder had no deductibles, co-pays, or co-insurance payments that they would be paying out of pocket.

If you went onto Medicare prior to January 1, 2020 you can still get a Plan F, but many choose to switch to a Plan G since it is typically lower priced than Plan F. If you went onto Medicare January 1, 2020 or later, then you are not allowed to purchase a Plan F so this is another reason why the Plan G has risen to be the most popular Medicare Supplement right now.

So, what does a Medicare Supplement Plan G cover?

Let’s start with Part A of Medicare and how the Plan G works with this part.

If you go into the hospital as an inpatient Medicare says that you will be responsible for the first $1600. This amount is the Part A deductible for 2023. After you meet the deductible, Medicare will cover for the first 60 days of your semi-private room and board, general nursing and miscellaneous services and supplies. Medicare Supplement Plan G will cover that Part A deductible for you. Keep in mind that the Part A deductible is not a calendar year deductible. It is very possible to incur that same deductible again if you were to go back into the hospital during the same calendar year. If this happens, then the Plan G will cover the Part A deductible again.

Blood

If you were to need pints of blood while in the hospital, Medicare says that you are responsible for the costs of the first 3 pints. Keep in mind that you can have blood donated directly to you. The Plan G will pay for those first 3 pints and Medicare will cover all amounts above that.

Skilled Nursing Facility Care

Many folks become a bit confused when it comes to receiving Skilled Nursing Facility benefits. Medicare says that if you spend 3 days in the hospital then need rehab that they will cover the first 20 days in a Skilled Nursing Facility. It is important to keep in mind that your date of discharge does not count towards the 3-day minimum requirement. The easiest way to keep track of this is to understand you really need to spend at least 3 nights in the hospital as an inpatient. After Medicare covers the first 20 days, it will now pay all but the first $200 per day for days 21 through 100. The Medicare Supplement Plan G will cover those 80 days of co-pays in full for the policyholder.

What About Medicare Excess Charges?

Another area that sets the Plan G apart from other Medicare Supplement plans is that it covers excess charges. In fact, with Plan G covering 100% of the excess charges, it is a perfect alternative for Medicare Supplement Plan F. So, what are excess charges? Excess charges are amounts that a provider can charge you in addition to what Medicare approves. They can only do this if they don’t participate in the Medicare Assignment program.

“A non-participating physician does NOT accept what Medicare approves as full payment.”

Let us look at an example of this. You go to a physician who does not participate in the Medicare Assignment program. He/She bills you $500 for a specific service and Medicare only approves $400 for this. Years ago, the physician could bill you for the full $100 that Medicare did not approve, but that is no longer the case.

Excess Charge Limits

The maximum a provider can bill you for can be no more than 15% above the amount that Medicare approves. This means that the physician could charge an additional $60. Medicare Supplement Plan G will cover 100% of the excess charge amount. It is important to keep in mind that around 95% of today’s providers participate in the Medicare Assignment program. This means they do NOT charge excess charges.

What’s Not Covered

The final area of benefits that we are going to touch on is the Part B deductible. Currently in 2023 the Part B deductible is $226. This amount is a calendar year deductible. Medicare Supplement Plan G does not cover the Part B deductible. This one area is the only difference between Plan F and Plan G. The Plan F covers the Part B deductible whereas the Plan G does not.

The good news is that with current policy pricing the Plan G is typically at least $226 per year less in cost than the Plan F. This means that your premium savings are more than enough to cover the Part B deductible for the year.

When you see how close in benefits the Plan G and Plan F are to one another, it is easy to see why the Plan G has now become the most popular Medicare Supplement for complete coverage.