Planning for retirement involves grasping the nuances of Spousal Social Security benefits, which play a crucial role in ensuring financial security during your golden years. These benefits act as a lifeline, particularly benefiting individuals with a limited work history or earnings. By exploring these benefits further, you can pave the way for a more secure and stable retirement.

One important aspect to consider when planning for retirement is understanding how Spousal Social Security benefits work. These benefits are designed to provide support for individuals who may have limited work history or earnings, such as stay-at-home parents or those who have taken time off from their careers.

Along with Medicare, Social Security plays a pivotal role in the landscape of U.S. social programs, serving as a vital income source for numerous retirees. It acts as a safety net, offering financial stability during the golden years. The process of earning Social Security benefits involves a culmination of years of contributions, guaranteeing a secure future post-career. This program reflects a commitment to safeguarding individuals’ financial well-being beyond their working years, providing a sense of security and peace of mind during retirement.

Social Security supports not only retirees but also individuals with disabilities and their familes. This includes benefits for disabled workers, as well as financial assistance for the dependents of disabled workers. Additionally, Social Security provides survivor benefits to the families of deceased workers, helping to alleviate financial burdens during difficult times.

In addition to its role in providing financial stability, Social Security also serves as a universal insurance program. It covers over 96% of American workers and their families, protecting them against loss of income due to retirement, disability, or death. This broad coverage ensures that individuals and families have an essential safety net in place to protect them from unexpected financial challenges.

Moreover, Social Security is funded through a combination of payroll taxes paid by workers and their employers. This means that the program is self-sustaining, with funds being used to pay current beneficiaries rather than being placed into a general fund. As such, Social Security has been a reliable source of income for many Americans over the years, providing financial stability and security during times of economic uncertainty.

The determination of monthly Social Security benefits involves a calculation based on an individual’s highest-earning 35 years. However, claiming benefits through a spouse’s earnings record serves as an alternative route to receiving these retirement benefits. This option provides flexibility and additional avenues for securing financial well-being in retirement.

Couples have the option to receive a spousal Social Security benefit based on their partner’s work history. This applies to individuals who do not qualify for benefits on their own or whose spouse earned more during their working years. The amount of this benefit is calculated as up to 50% of the higher-earning spouse’s full retirement age benefit. The spousal benefit is available starting at age 62 with the amount being dependent only on what age the individual begins collecting it, not the age of their spouse who filed for retirement benefits. Additionally, a person’s benefit amount can never exceed the highest single benefit to which that person is entitled.

One of the essential factors to consider when deciding on spousal Social Security benefits is timing. While an individual can begin receiving benefits as early as 62, doing so would result in a reduced amount. However, waiting until full retirement age (typically between 66-67) or even delaying until age 70 can lead to a higher benefit amount. The chart below shows when individuals reach Full Retirement Age based on their birth year.

| YEAR OF BIRTH | FULL RETIREMENT AGE |

| 1943-1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 and after | 67 |

Another key consideration is the impact on survivor benefits. If one spouse passes away, the surviving spouse can receive up to 100% of their late partner’s benefit, including any delayed retirement credits. These benefits can be complicated because the amount is dependent on several variables including the age that the deceased started collecting benefits, the age they died, if the survivor(s) is collecting other benefits, the age the survivor(s) begin collecting the benefit. For couples who were both collecting benefits the survivor inherits the higher of the two benefit amounts. Similar to the spousal benefit maximum amount, the survivor receives their own benefit first and the survivor benefit tops off to the maximum benefit available. There is also a one-time lump sum death payment of $255.00.

Carefully consider decisions regarding spousal Social Security Benefits due to their long-term implications.

For couples with significant age differences, it may be beneficial for the older spouse to delay claiming benefits until the highest earner reaches full retirement age. This can lead to a higher spousal benefit in retirement and potentially increase survivor benefits for the younger spouse.

Additionally, couples should consider coordinating their claiming strategies to maximize overall Social Security benefits. This could involve delaying one spouse’s claim while the other begins receiving benefits, or both delaying until reaching full retirement age.

While the above-mentioned factors are essential to keep in mind when considering spousal Social Security benefits, there are also other considerations to take into account.

For example, if a couple divorces but were married for at least 10 years, the lower-earning spouse may still be eligible to receive spousal benefits based on their ex-spouse’s work history. Divorced benefits apply equally to men and women so this option can provide a valuable source of income for those who may not have otherwise qualified. Ex-spousal benefits leave the retiree’s earnings benefits unaffected.

Additionally, individuals who are still working and have not yet claimed their own Social Security benefits may be able to receive spousal benefits while continuing to work and delay claiming their own benefits. This strategy can maximize overall retirement income and potentially lead to higher benefit amounts in the future.

It’s also important to note that spousal Social Security benefits are not available for couples who have married within the past 12 months. Authorities implemented this rule to stop marriages soley aimed at gaining higher benefits.

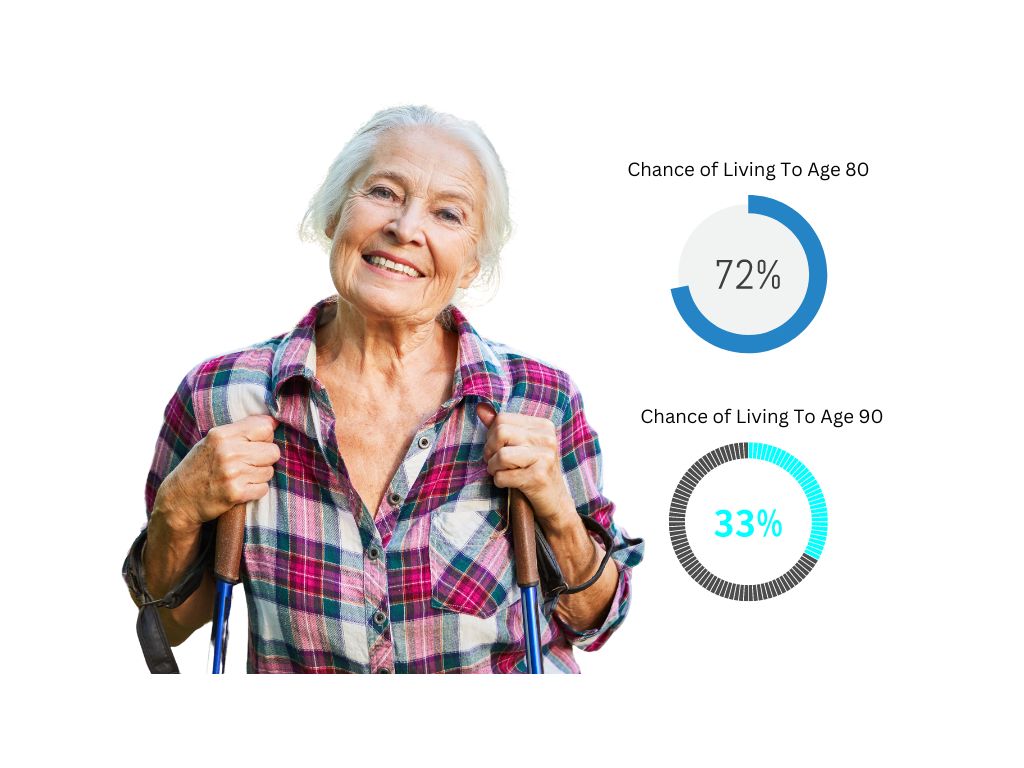

Did you know that women have a 72% chance of living to age 80 and a 33% chance of living to age 90? Those numbers are 62% and 21% for men, respectively. On the whole women live 4-5 years longer but typically spend more time out of the workforce than men. This generally translates into lower lifetime earnings and thus a lower Social Security benefit amount.

When considered together, life expectancy and women earning less and typically living longer than men, you can see how poor claiming decisions can cause real harm to one’s retirement finances in many cases hundreds of thousands of dollars over a lifetime.

Overall, understanding all of the rules and options surrounding spousal Social Security benefits can help couples make informed decisions about their retirement finances. It’s essential to carefully consider all factors and consult with a Registered Social Security Analyst to ensure maximum benefits for both partners in the long run. With careful planning, couples can make the most out of their spousal Social Security benefits and enjoy a more financially secure retirement together. Keep learning and stay informed about your options to make the best decisions for your future. Your retirement years should be enjoyable and stress-free, so take the time now to plan for a secure financial future with spousal Social Security benefits. So don’t wait, start exploring your options today! Happy retiring! Stay financially secure and live life to the fullest with your spouse by your side. Cheers to a happy and prosperous retirement together!

Not sure where to turn for Social Security planning options? Don’t worry, Senior Benefit Services, Inc has you covered. Our company has a Registered Social Security Analyst (RSSA) available in-house. To find out more about working with our RSSA, simply click on the information request button below.