Have you heard the big news that there is going to be a large Social Security Increase (COLA) in 2023? It is estimated that it could come in around 10.5% due to rising inflation. What does this mean for the average retiree?

The average retired worker receives about $1,665.00 each month. If the full 10.5% increase takes place, then that same retiree will start receiving an extra $174.83 each month. This would bring their payment to around $1,839.83. As you can imagine this will be very beneficial in helping offset the rising costs of goods due to inflation. This increase will be the largest increase since 1981 which was 11.2%.

To view the Automatic Cost of Living Adjustments since 1975 click here and scroll to the bottom of the page.

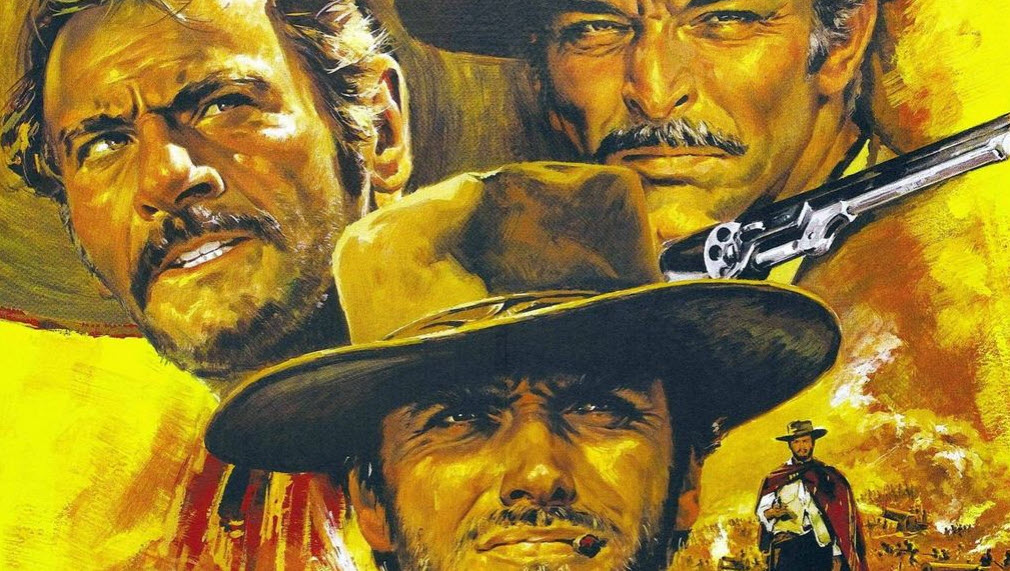

If you are like me and really enjoy the old Clint Eastwood cowboy movies, you will remember the classic…The Good, The Bad, and The Ugly. While we have just discussed The Good about the increase, now we must take a look at the other areas.

For those retirees that receive lower than the average Social Security payment each month and qualify for other benefits due to having a lower income, could be pushed out of those programs with a large Social Security increase to their check. Here are just a few income based programs that could be impacted:

Finally, many states also have pharmaceutic assistance programs along with programs from drug manufacturers that offer assistance as well based on income.

The amount of Social Security benefits that are exempt from taxes is still the same since 1984. This means that any increase above the payment threshold is going to end up being taxable. So if the monthly payment increase pushes an individual above $25,000 or a married couple above $32,000 for the year then this will trigger a taxable event on the income above these thresholds.

While such a large increase (if the full amount goes thru) seems like there is going to be so much extra money going into a retiree’s pocket, that simply is not the case. With the current inflation rate being around 8.6%, the increase is pretty much a wash. In addition, while inflation is coming in at 8.6%, certain primary goods such as food costs have climbed at a much higher rate, so there really will not be any ‘extra’ money going into anyone’s pocket.

Maybe your concern is simply having as much money in your pocket at the end of the month as possible. With the rise of inflation we have also started seeing the rise of interest rates. While savings account interest rates are still extremely low, there are CD type annuities that are paying much higher interest rates. Many of our 5 year multi year guaranteed annuities are paying out over 4.00% which can help bring in additional income if needed. To get a personalized annuity quote click below.

Another way to increase your monthly income is by seeing if you can lower your current Medicare Supplement rates. Many of our clients have been able to lower their older Medicare Supplement plan rates by a substantial amount. As always with Senior Benefit Services there is no cost or obligation to get a quote from us. It’s FREE and you have absolutely nothing to lose.