Selecting the best Medicare plan is crucial for seniors residing in Oakland, Maryland. As healthcare needs change with age, gaining a clear understanding of the Medicare options in Oakland, MD, becomes essential. Whether you’re approaching retirement or assessing your current plan, this guide will help you navigate the Medicare choices in Garrett County. By doing so, you’ll be empowered to make informed decisions that guarantee comprehensive coverage and peace of mind.

Understanding Medicare Options

Medicare Advantage vs. Medicare Supplement

In Oakland, MD, seniors choose between Medicare Advantage and Supplement plans, each offering unique health coverage paths. Medicare Advantage plans, often referred to as Part C, serve as an all-encompassing alternative to Original Medicare. These plans frequently bundle Medicare Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage) into a single plan. Many of these Advantage plans may also offer additional services such as dental, vision, and wellness programs, which can add significant value. However, they generally require the use of a network of healthcare providers, which can impact your choice of facilities and specialists.

Conversely, Medicare Supplement plans, commonly known as Medigap, are designed to complement Original Medicare by covering a variety of out-of-pocket costs, including copayments, coinsurance, and deductibles. One of the greatest advantages of Medigap is its exceptional flexibility, allowing beneficiaries to visit nearly any doctor or hospital that accepts Medicare, without the worry of network limitations. This freedom can be especially valuable if you have specific healthcare providers you trust or prefer to switch between providers freely. Selecting the right plan type depends largely on evaluating your specific healthcare needs, financial circumstances, and personal preferences for healthcare provider flexibility.

Comparing Medicare Plans

Medicare Plan Options and Carriers in Oakland, MD

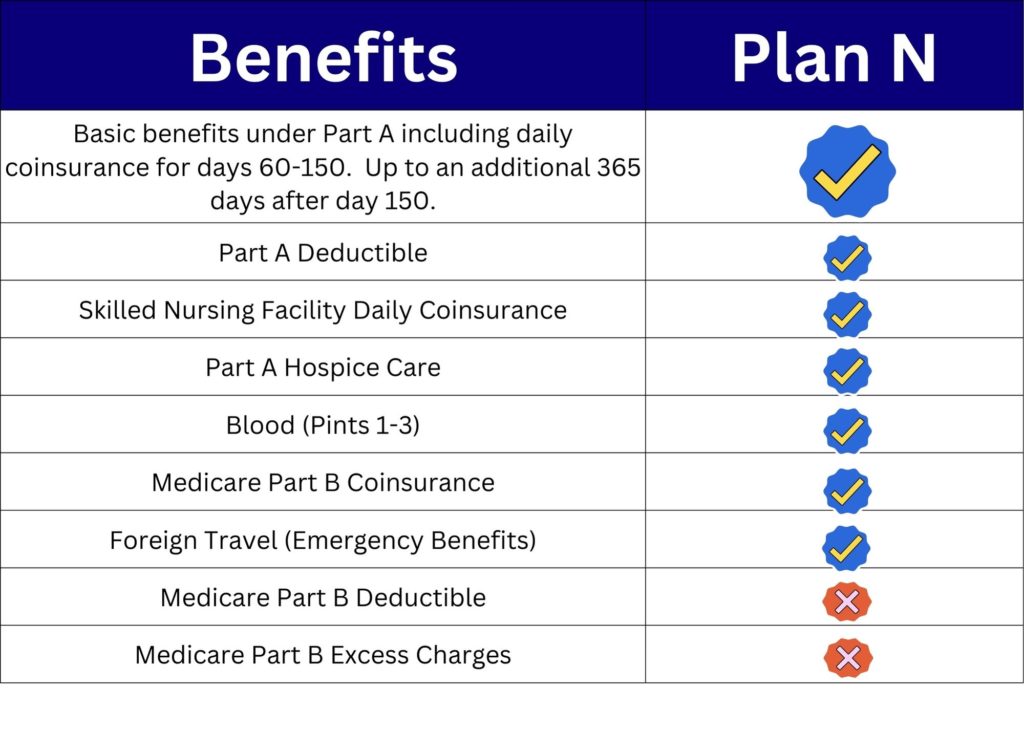

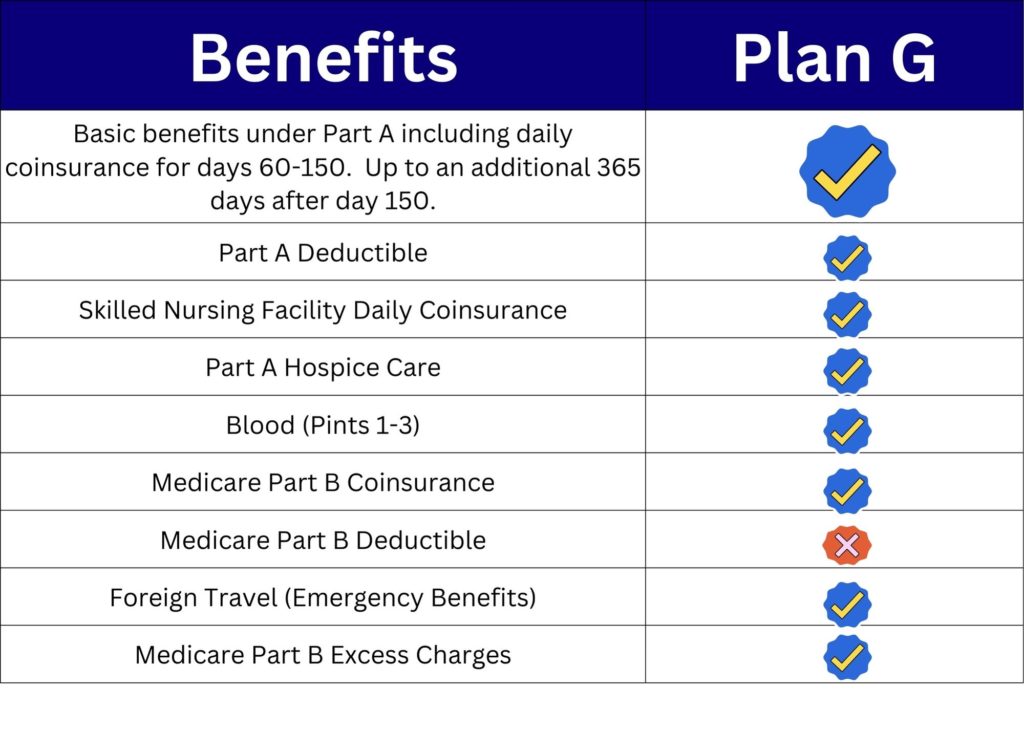

Seniors in Oakland, MD, have access to a variety of plans tailored to diverse healthcare needs. Prices can vary widely for identical benefits despite having multiple carriers to choose from. Two options include popular Medicare Supplement plans such as Plan G and Plan N, known for their comprehensive coverage and predictability in costs. Currently these two particular Medicare Supplement plans are the most popular in Oakland, MD.

| Plan N | Plan G | |

| Female | $105.00 | $137.00 |

| Male | $121.00 | $157.00 |

Get Your FREE Customized Medicare Supplement Quote

Medicare Advantage plans in Garrett County may be more limited, with a smaller selection but potentially lower premiums. In fact, there is actually a $0 premium plan available in Oakland!

Garret County offers 10 Medicare Advantage plans, all utilizing a PPO network instead of an HMO.

When considering Medicare Advantage plans, it’s crucial to understand that these are cost-sharing plans, which means you’ll share in the costs each time you receive services from a healthcare provider. Payments could include small co-pays or co-insurance amounts, based on the specific services received. A common concern for many clients is the daily hospital co-payment, typically ranging from $295 to $320 per day during the initial 4 to 6 days of an inpatient stay. These costs can accumulate quickly, but there’s a solution that many overlook.

Get Your FREE Customized Medicare Advantage Quote

By adding a hospital indemnity plan to your insurance portfolio, you can shield yourself from these high expenses. These plans are affordable, and they pay benefits directly to the policyholder. Moreover, this additional coverage offers peace of mind, ensuring seniors aren’t overwhelmed by financial stress during hospital stays, so they can concentrate on recovery instead of worrying about costs. We recommend researching hospital indemnity plans to bridge the coverage gaps left by Medicare Advantage, thereby alleviating financial pressures and enriching your healthcare experience.

Key Differences and Considerations

When deciding on these plans, carefully consider crucial factors like network restrictions. Also, evaluate coverage details and out-of-pocket costs. Medicare Advantage plans may offer enticing additional benefits. However, they often include network limitations that restrict provider choices. Medigap plans provide greater freedom for seniors to choose any healthcare provider accepting Medicare. This allows extensive healthcare options.

Important Factors to Evaluate Medicare Choices in Oakland, MD

Assessing Personal Needs

Initiate your plan selection process by meticulously evaluating your current health status and any regular medical services you anticipate needing. Visiting specialists frequently or managing ongoing health conditions requires careful planning. Opting for a plan with a broad network and lower out-of-pocket costs may prove highly beneficial. This will help ensure that your healthcare needs are consistently and efficiently met.

Price Assessment for Medicare in Oakland, MD

Consider financial aspects such as premiums, deductibles, and copayments that can accumulate over time in their entirety. Some plans require higher upfront costs, but they may save more long-term by offering extensive coverage for frequent medical needs. Striking a balance between cost and coverage is key to maximizing your healthcare investment value.

Get The Help You Need Now!

Numerous factors determine which Medicare plan best suits you and aligns with your monthly budget. Senior Benefit Services, Inc has been helping folks just like you keep more money in your own pocket each month. We have local agents servicing the Oakland, MD area. Give us a call at (800)924-4727 or fill out one of the easy contact request form above.