Navigating the world of Medicare can feel a bit like learning a new language, especially when you’re trying to figure out which supplemental plan suits your needs the best.

Among the Medigap plans available, Plan G and Plan N stand out as two compelling options, each with its own set of benefits and costs.

Are you curious about the differences between Plan G and Plan N and how they could impact your healthcare expenses? You’re not alone! Many seniors are weighing the pros and cons of these plans to make an informed choice.

In this guide, we’ll break down the essentials of Plan G vs. Plan N, helping you understand the nuances of each so you can decide which plan provides the best fit for your lifestyle and budget.

Medigap insurance, also known as Medicare Supplement Insurance, is designed to fill the “gaps” in Original Medicare (Part A and Part B) coverage. These gaps often include copayments, coinsurance, and deductibles that can add up over time.

Medigap plans, like Plan G and Plan N, offer additional financial coverage to help manage these out-of-pocket costs. It’s important to note that Medigap plans are standardized, meaning each plan offers the same basic benefits regardless of the insurer.

However, Medigap does not cover prescription drugs, dental care, or vision. For those who want to avoid unexpected medical expenses, Medigap can offer peace of mind and predictable costs.

Understanding the nuances of plans like Plan G and Plan N can empower you to make informed decisions about your healthcare needs and financial priorities.

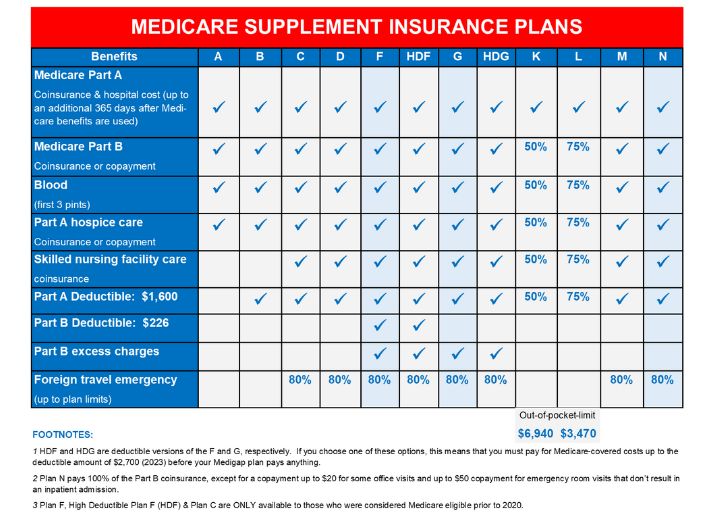

Medicare Supplement Plans, or Medigap, offer standardized options that provide consistent benefits across all insurance providers.

There are ten standardized plans, identified by letters, each offering a different level of coverage. This standardization ensures that a Plan G from one company offers the same basic benefits as a Plan G from another.

However, premiums may vary based on the insurer and location. These plans help cover costs that Original Medicare doesn’t, such as deductibles and coinsurance.

While plans like Medigap Plan G provide comprehensive coverage, Plan N offers a budget-friendly alternative with lower premiums but some additional out-of-pocket costs.

This standardization allows you to focus on finding the plan that best meets your medical needs and financial situation.

Understanding the standardized nature of these plans can simplify your decision-making process, helping you choose a plan that fits your healthcare and budgetary needs.

Supplement plans, like Medigap, play a crucial role in managing healthcare costs for those on Medicare.

Original Medicare often leaves beneficiaries with significant out-of-pocket expenses due to copayments, coinsurance, and deductibles. These can quickly accumulate, especially for those with chronic conditions or unexpected medical needs.

By bridging these gaps, Medigap plans offer financial protection and help maintain predictable healthcare costs. Plans like Plan G or Plan N can offer peace of mind by covering various expenses that Original Medicare doesn’t, ensuring fewer surprises when medical bills arrive. For seniors on a fixed income, this predictability is vital.

Are you considering how to best manage your healthcare expenses? Understanding the importance of supplement plans can empower you to take control of your healthcare finances, allowing you to focus on your well-being rather than worrying about costs.

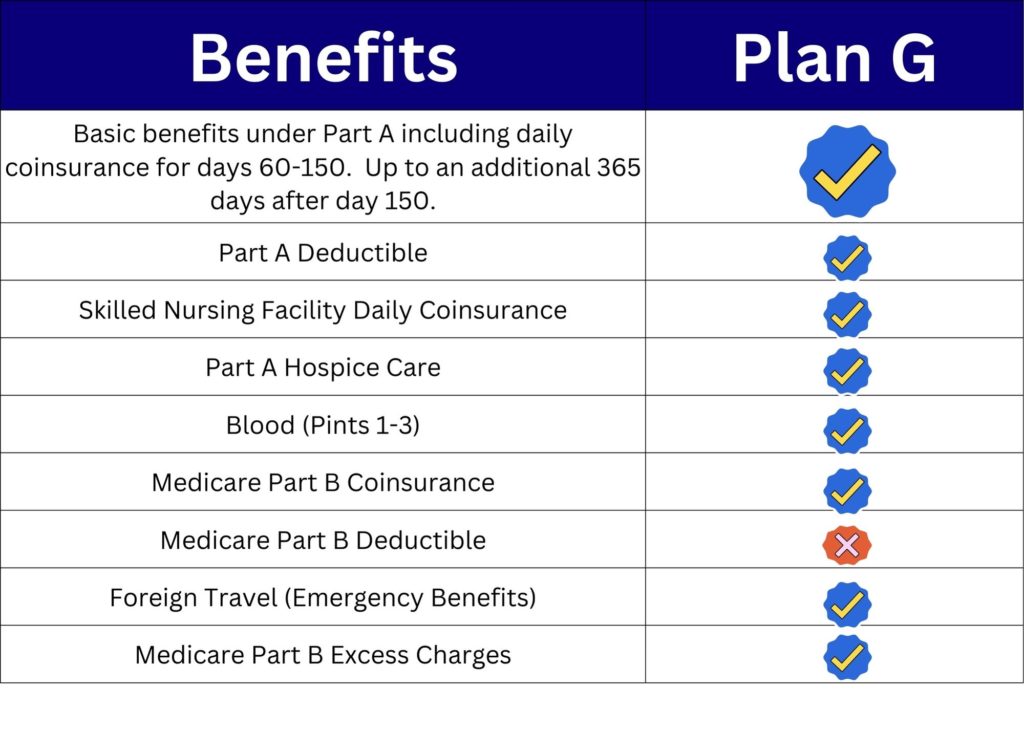

Medigap Plan G is often lauded for its comprehensive coverage, making it a popular choice among Medicare beneficiaries seeking extensive financial protection. This plan covers virtually all out-of-pocket costs associated with Original Medicare, aside from the Medicare Part B deductible.

Once you pay this deductible, Plan G takes over, covering expenses such as the Part A deductible, coinsurance, and copayments. It even includes coverage for skilled nursing facility care coinsurance and foreign travel emergency care. This broad coverage ensures that beneficiaries face minimal out-of-pocket expenses for medical services.

Are you looking for peace of mind with predictable healthcare costs?

Plan G could be the right fit, especially if you value comprehensive coverage without worrying about additional charges or unexpected expenses. By choosing Plan G, you can focus on your health rather than financial concerns.

Medigap Plan G stands out for its ability to offer predictable costs, a significant benefit for those managing healthcare expenses on a fixed income.

Once you meet the Medicare Part B deductible, Plan G covers 100% of the remaining eligible out-of-pocket costs. This includes Medicare Part A deductibles, hospital coinsurance, and even the first three pints of blood, which Original Medicare does not cover.

Additionally, Plan G covers Part B excess charges, ensuring you aren’t surprised by extra fees when visiting healthcare providers. This predictability allows beneficiaries to budget their healthcare expenses more effectively, removing the stress of unexpected costs.

Are you seeking a reliable plan that provides extensive coverage while minimizing financial surprises? Plan G’s structure may offer the peace of mind you need, allowing you to focus on your health without the worry of fluctuating expenses.

Medigap Plan G offers several key advantages that make it an attractive option for many Medicare beneficiaries.

One of its primary strengths is comprehensive coverage. With Plan G, once you’ve paid the Medicare Part B deductible, you can expect virtually no other out-of-pocket costs for covered services. This means you won’t face unexpected medical expenses, providing financial peace of mind.

The plan also covers Part B excess charges, ensuring that even if your healthcare provider charges more than Medicare’s approved amount, you’re protected. Additionally, Plan G includes coverage for foreign travel emergency care, a benefit for those who frequently travel abroad.

Are you looking for a plan that balances cost with comprehensive benefits? The extensive coverage provided by Plan G can offer security and predictability, making it a suitable choice for those who want to avoid financial surprises while maintaining robust healthcare coverage.

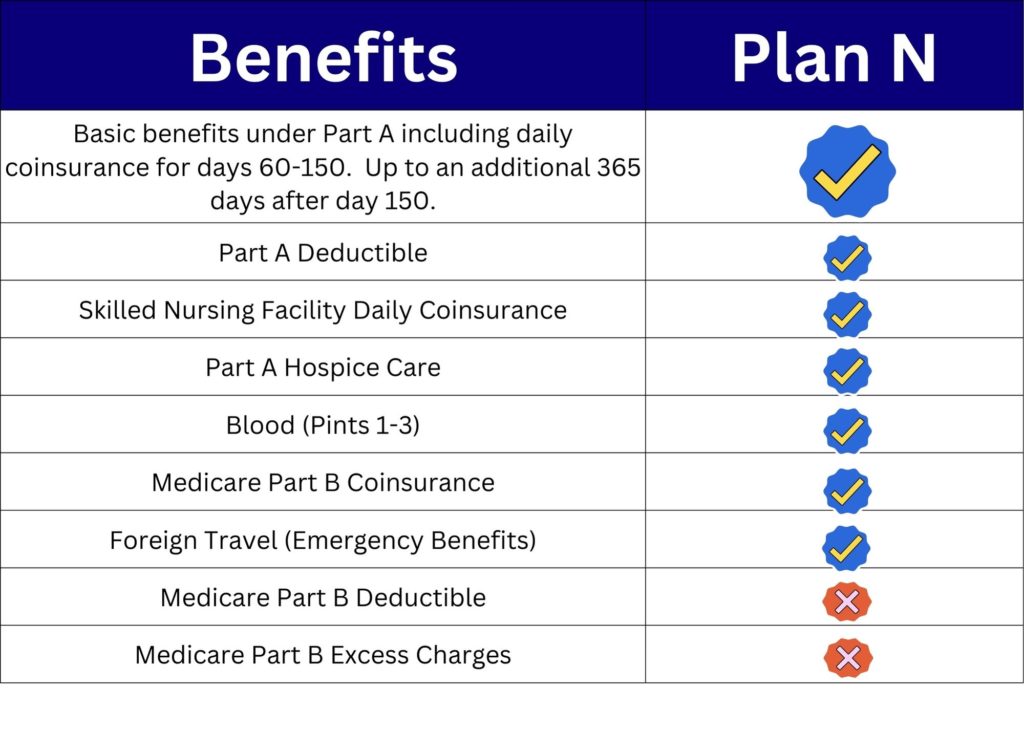

Medigap Plan N is designed for those who prefer a balance between coverage and cost savings. While it shares many similarities with Plan G, Plan N comes with lower monthly premiums.

This makes it an appealing option for budget-conscious individuals. However, Plan N requires beneficiaries to pay certain out-of-pocket costs, such as copayments for doctor visits and emergency room visits, which can be up to $20 and $50, respectively.

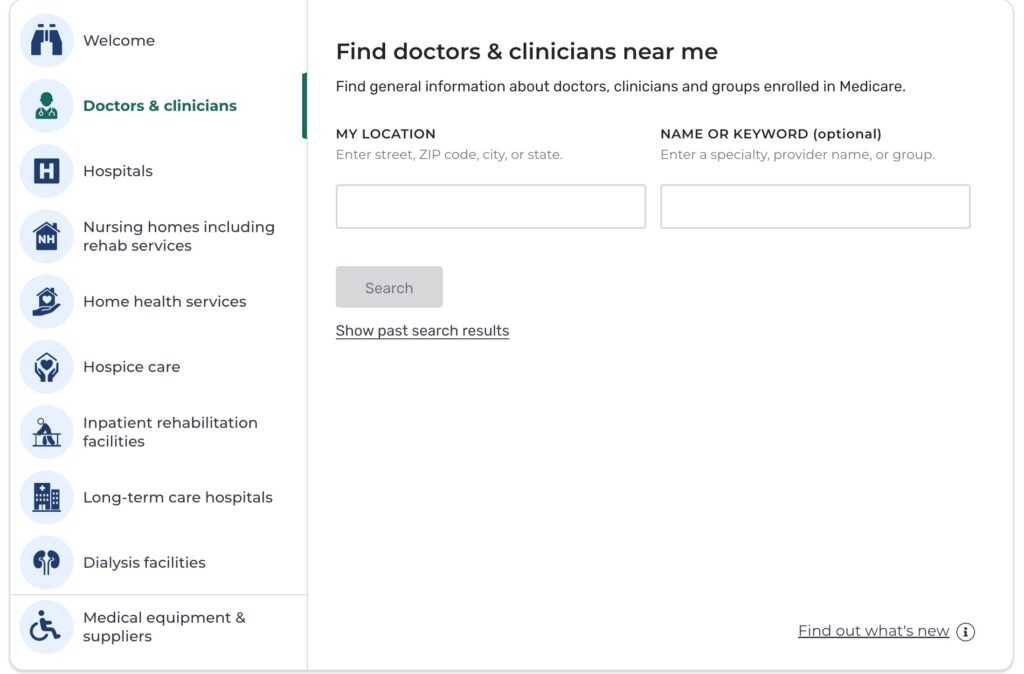

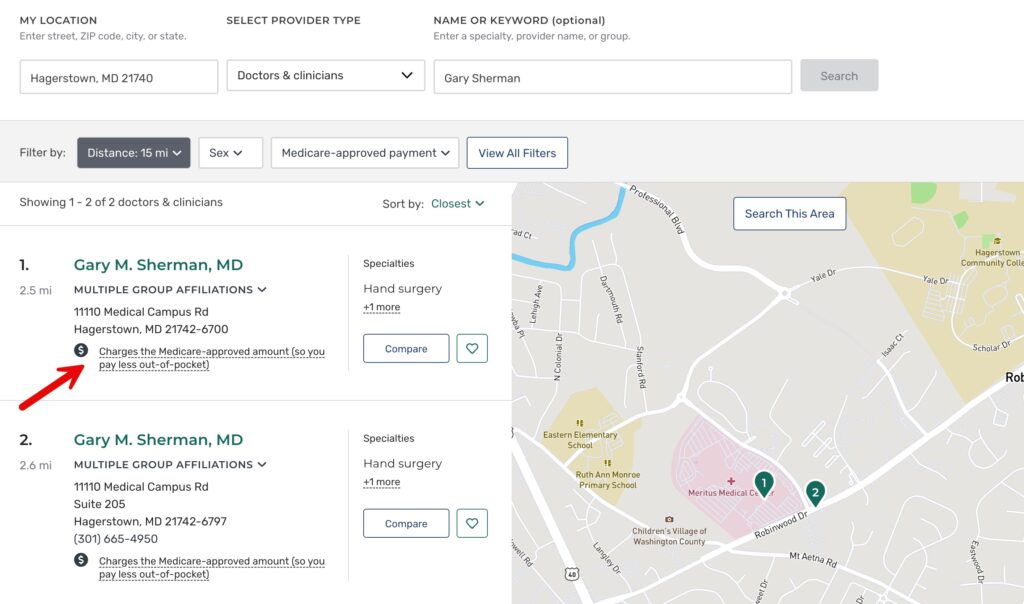

Additionally, Plan N does not cover Part B excess charges, meaning you might pay more if your healthcare provider charges above the Medicare-approved amount. If you are unsure about whether a provider you currently use or are thinking about using, you can actually check online to see if they accept the Medicare-approved amount or if they charge excess charges. Simply go to Medicare.gov and select Find Care Providers or simply click here. Once you are on the Find Care Providers page, you can easily select on the left side of the page what type of provider you are looking for. So let’s say we are wondering if a particular physician in the area accepts Medicare-approved amounts. All you need to do is click on ‘Doctors & Physicians’ from the left side of the page and then you will be prompted to enter some information.

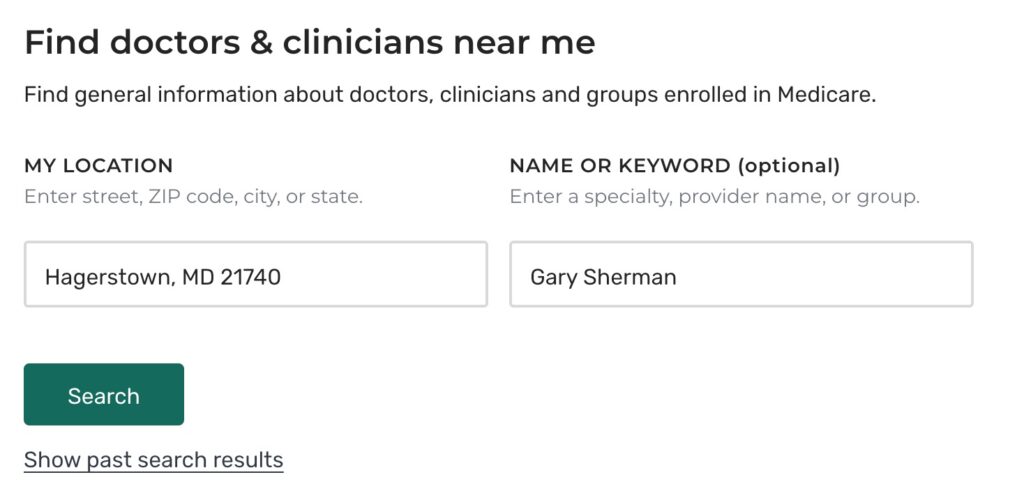

So all we need to do now is put in some information about the provider. For the section “My Location” you could simply enter the zip code of where the doctor has their practice and then in the section for “Name or Keyword” you can put the doctor’s name. For this example I am going to use a zip code in Hagerstown, MD where we have one of our offices and choose a very well respected orthopedic surgeon by the name of Dr. Gary Sherman.

From here we simply click on the Search button and here is what we get:

You will see that Dr. Sherman accepts the Medicare-approved amounts and does not charge excess charges. Anytime you see the notation we have a red arrow pointing to, this will tell you that the provider accepts the Medicare-approved amounts. Use this free Medicare tool anytime you want to search for a provider or see if they charge excess charges or not.

Are you looking to save on premiums while still receiving substantial coverage? Plan N allows you to do just that while assuming a bit more responsibility for some out-of-pocket expenses. This trade-off can make Plan N a financially attractive choice for those who don’t mind occasional copayments in exchange for lower premiums.

Choosing Medigap Plan N can be a strategic decision for those who prioritize lower monthly premiums and are comfortable with occasional out-of-pocket costs. Plan N offers a solid coverage foundation by taking care of major expenses, such as hospital stays and skilled nursing facility care, similar to other comprehensive plans.

However, unlike Plan G, Plan N’s cost-sharing approach requires beneficiaries to pay copayments for certain services, which can be manageable for those with infrequent doctor visits.

Additionally, if you reside in a state where Part B excess charges are prohibited, Plan N becomes even more appealing since you won’t encounter these extra costs.

Are you seeking a balance between premium savings and coverage?

Plan N is particularly suitable for individuals who expect moderate medical needs and prefer to save on monthly premiums while managing minor expenses. This plan can effectively fit your budgetary and healthcare requirements, offering a cost-efficient path to supplement Medicare.

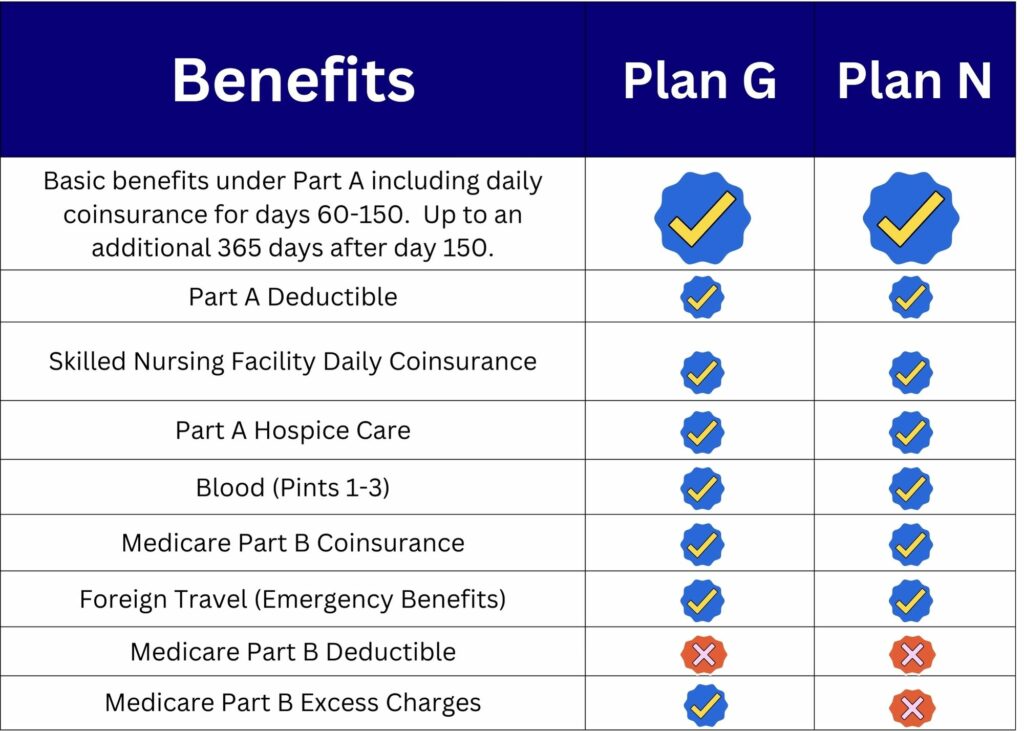

Medicare Plan G and Plan N both offer robust coverage options but with some notable differences and similarities in their benefits. Both plans provide comprehensive coverage for Medicare Part A expenses, including hospital deductibles and coinsurance, as well as skilled nursing facility care coinsurance and hospice care.

They also cover the first three pints of blood needed for medical procedures. However, the key differences lie in how they handle Medicare Part B costs.Plan G covers Part B excess charges and requires beneficiaries only to pay the Part B deductible.

In contrast, Plan N requires copayments for doctor visits and emergency room visits and does not cover Part B excess charges, potentially leading to higher costs if your provider charges more than the Medicare-approved amount.

Are you trying to decide which plan aligns with your financial and healthcare needs? Understanding these coverage nuances can help you make a more informed choice between Plan G and Plan N.

When comparing Plan G and Plan N, cost considerations play a pivotal role in determining the best fit for your healthcare needs. Plan G typically comes with higher monthly premiums but offers the advantage of minimal out-of-pocket expenses once the Medicare Part B deductible is met.

This makes it ideal for those who value predictability in healthcare costs and want to avoid unexpected charges. On the other hand, Plan N offers lower monthly premiums, which can be appealing if you’re looking to save on upfront costs.

However, with Plan N, be prepared for additional out-of-pocket expenses such as copayments for doctor visits and emergency room visits, and the potential for Part B excess charges if your provider bills above the Medicare-approved amount.

Are you weighing your budget against your healthcare requirements? Understanding these cost dynamics will help you decide which plan offers the most financial security and aligns with your economic priorities.

When deciding between Medicare Plan G and Plan N, several factors should be carefully considered to ensure you make the best choice for your healthcare needs and financial situation.

Firstly, evaluate your healthcare usage; if you frequently visit doctors or anticipate needing medical services, Plan G’s comprehensive coverage can minimize out-of-pocket expenses. On the other hand, if you have fewer medical visits, Plan N might offer savings with its lower premiums.

Consider your financial situation and how comfortable you are with potential unexpected costs. Are you willing to trade higher premiums for the peace of mind that comes with minimal additional charges? Also, think about whether you live in a state that prohibits Part B excess charges, which could make Plan N more viable.

By weighing these factors, you can align your choice with your healthcare needs and budgetary constraints, ensuring a plan that fits your lifestyle and provides the coverage you need.

Evaluate Medicare Plan G and Plan N by considering potential rate increases and the insurer’s financial stability for reliability. Medigap plans are subject to annual premium changes, which can impact your long-term budget.

Reviewing an insurance company’s history of rate increases can provide insight into how stable your premiums might remain over time. A company with a track record of moderate rate adjustments is often more reliable. Additionally, consider the insurer’s financial stability.

Companies with strong financial ratings are better equipped to manage claims efficiently and sustain their operations, ensuring continued coverage without significant disruptions.

Are you concerned about the future affordability of your plan? Assessing these factors can help you predict and prepare for potential cost changes, ensuring your chosen plan remains viable and aligns with your financial goals.

By understanding rate increases and financial stability, you can make a more informed decision that safeguards your healthcare needs in the long term.

Choosing between Plan G and Plan N requires carefully considering your healthcare needs and financial situation for the best fit. Each plan offers a distinct blend of coverage and cost-sharing, catering to different preferences and situations.

Plan G offers comprehensive coverage with predictable costs, while Plan N suits those preferring lower premiums with some out-of-pocket expenses. As you evaluate your options, it’s essential to consider your healthcare usage, budget, and potential for future medical needs. Understanding rate increases and insurers’ financial stability helps you choose a sustainable Medicare Supplement Plan for long-term peace of mind.

Are you ready to make an informed choice that aligns with your priorities? Analyze these factors to choose a Medicare Supplement Plan that provides peace of mind and supports your health and finances.

Call Senior Benefit Services, Inc. at (800)924-4727 to connect with your own personal advisor. If you are wanting a FREE, No Obligation personalized quote, simply complete the form below.