The following is a very high-level overview of Medicare Advantage and stand-alone Medicare Part D prescription drug plans. To learn more be sure to read our more in-depth Medicare Advantage and Part D pages.

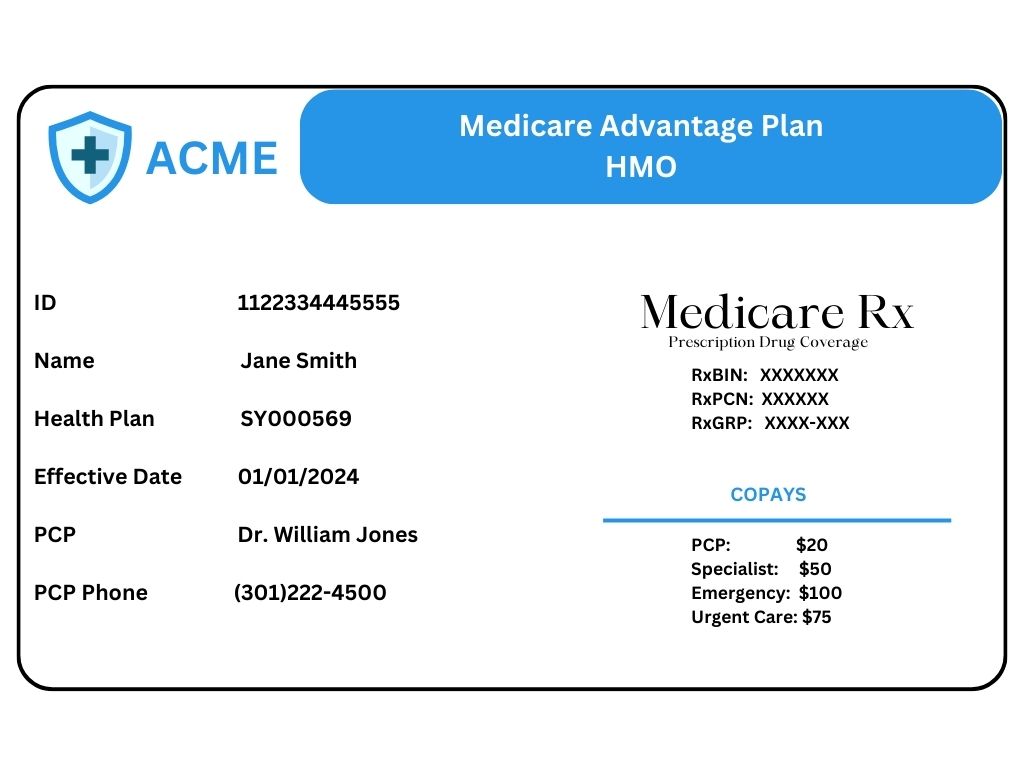

Medicare Advantage (MA) plans, approved by Medicare, offer a compelling alternative to traditional Medicare. Rather than relying on Original Medicare, these private insurance plans provide Part A, B, and D benefits, with a focus on quality and convenience. With access to an extensive network of doctors through HMO or PPO options, members receive their benefits from a trusted private insurance company. When you enroll in a Medicare Advantage plan, you are now insured under Part C of Medicare.

It’s important to note that Medicare Advantage plans are distinct from Medigap plans. While Medigap plans supplement Original Medicare, MA plans replace it entirely, offering a comprehensive and tailored healthcare experience. Keep in mind that unlike original Medicare with a Medicare Supplement where you have open access to any provider that accepts Medicare, with a Medicare Advantage plan, you must use a network to maximize your benefits.

Believe it or not, there is no one size fits all health insurance plan. Contrary to what some agents or companies will tell you, there is no such thing as the perfect plan for everyone.

There are pros and cons with having original Medicare plus a Medicare Supplement or having a Medicare Advantage plan. So how do you know which health insurance option is best for you?

While we know that original Medicare coupled with a Medicare Supplement gives the greatest flexibility in seeing providers, not everyone can afford a Medicare Supplement plan. So, let’s take a look at the some of the more Pros and Cons of a Medicare Advantage plan.

| Pros | Cons |

| All-in-One Coverage – most plans include coverage for Parts A, B, and D (prescriptions). | Limited Network – you will need to use doctors and hospitals within the plan’s network to get the most benefits from the plan. |

| Out-of-Pocket Maximum – limits the most you will pay out of pocket in a calendar year. | Prior Authorization – some services may require pre-approval from the insurance company which isn’t required under original Medicare. |

| Costs – most plans are relatively inexpensive and some even have $0 monthly premiums. | Availability – not all plans are available in all states and counties which can limit your choices depending on where you live. |

| Extra Benefits – some plans offer additional benefits for things like dental and vision care. | Out-of-Pocket Maximum – while we have this listed as a ‘pro’ it is also a ‘con’. The out-of-pocket maximum could be upwards of $10,000 for a calendar year. |

Medicare Advantage is Medicare Part C. With the passing of the Balanced Budget Act of 1997 Part C of Medicare was established. At this time, Part C was typically referred to as Medicare+Choice. It wasn’t until the passing of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 that the name Medicare Advantage came about.

In 2003, retirees were finally given financial relief with Medicare Part D. This part of Medicare allowed those folks on original Medicare to get prescription drug coverage without having to enroll in a Medicare Advantage plan. These stand-alone prescription drug plans allow retirees to keep the flexibility of being in original Medicare (with or without a Medicare Supplement) while being able to get a plan that covers all or most of their prescriptions.

In most states consumers have the so many plan choices it can feel a bit overwhelming. There might be upwards of 27 plans available in your state, so how do you choose?

There are a number of factors to consider, but here are the main ones to look out for:

Folks often ask us which plan is best. There is no such thing as ‘the best Medicare Advantage or Part D prescription plan’. Everyone has different needs, so one plan may work for you and another plan works better for someone else. Our advisors take the time to explain all of your options and help guide you to getting a plan that covers all your needs. Contact Senior Benefit Services, Inc. today at (800)924-4727 and find out why “We Make Medicare Easy!”