Navigating the intricacies of Medicare can be daunting, particularly for seniors in LaVale, MD, who are approaching retirement and need to choose the right coverage for their healthcare needs. With options like Medicare Supplement plans, also known as Medigap, and Medicare Advantage plans available, understanding the differences is crucial for making an informed decision. In LaVale and the wider Allegany County, seniors have access to a variety of plans tailored to meet diverse healthcare requirements. This comprehensive guide aims to demystify the Medicare landscape, offering reassuring and supportive advice to help seniors confidently select the most suitable plan, ensuring peace of mind and security in their healthcare coverage.

When choosing between Medicare Advantage and Medicare Supplement plans in LaVale, MD, it’s important to understand their distinctions. Medicare Advantage plans, often referred to as Part C, are all-in-one alternatives to Original Medicare. These plans are offered by private insurance companies and typically include Part A, Part B, and often Part D coverage. They may also offer additional benefits like dental and vision care. However, these plans usually come with network restrictions, and you might need to use healthcare providers within the plan’s network.

On the other hand, Medicare Supplement plans, or Medigap, are designed to work alongside Original Medicare (Parts A and B), covering out-of-pocket costs like copayments, coinsurance, and deductibles. Medigap plans offer the flexibility of seeing any doctor who accepts Medicare without network limitations. Each option has its pros and cons, and the right choice depends on your healthcare needs and financial situation.

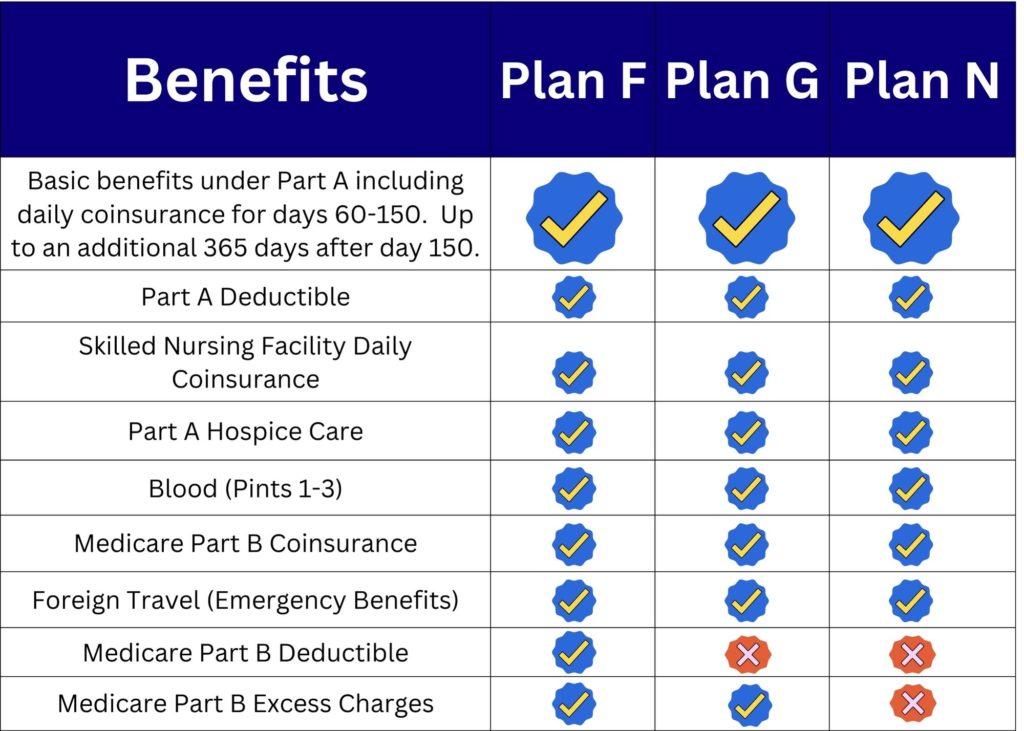

In LaVale, MD, seniors have access to a range of Medicare plans tailored to meet diverse healthcare needs. Medicare Supplement plans, also known as Medigap, are popular choices. Plan F, Plan G, and Plan N have been the most sought-after in recent years. These plans allow beneficiaries to access consistent rates across Maryland due to the absence of area factoring. Learn more about area factoring below and how it can affect rates in states where it is allowed.

Conversely, Medicare Advantage plans in LaVale are limited, with only two carriers offering a total of seven plans as of 2024. These plans may use either Preferred Provider Organization (PPO) or Health Maintenance Organization (HMO) networks, which can affect choices in healthcare providers. Understanding the availability and structure of these plans is crucial for making an informed decision that aligns with one’s healthcare preferences and financial capabilities.

Understanding the key differences between Medicare Advantage and Medicare Supplement plans can help seniors in LaVale, MD, make informed decisions. Medicare Advantage plans encompass all-in-one coverage, combining Parts A, B, and often D. They might offer additional benefits like dental or vision care, but usually limit healthcare provider choices to a specific network. This can result in lower premiums but potentially higher out-of-pocket costs if services outside the network are needed.

Medicare Supplement plans, or Medigap, complement Original Medicare (Parts A and B) by covering out-of-pocket expenses like deductibles and coinsurance. These plans offer more extensive provider flexibility, allowing seniors to visit any doctor or hospital that accepts Medicare. While Medigap plans generally have higher monthly premiums than Medicare Advantage plans, they provide more predictable healthcare expenses and fewer network restrictions.

Ultimately, the decision between these plans hinges on individual healthcare needs, financial considerations, and personal preference for provider access.

Medicare Supplement Plans F, G, and N are among the most popular choices for seniors in LaVale, MD, each offering distinct benefits. Plan F, often regarded as the most comprehensive option, covers all deductibles, coinsurance, and copayments, minimizing out-of-pocket expenses. However, it’s only available to those who were eligible for Medicare before January 1, 2020.

Sample rates for 66 year old (non-tobacco user) in LaVale, MD:

| Plan N | Plan G | |

| Female | $105.00 | $137.00 |

| Male | $121.00 | $157.00 |

Plan G serves as an excellent alternative to Plan F, covering nearly all the same benefits except the Part B deductible. For those comfortable paying the Part B deductible, Plan G offers considerable coverage and is more widely available.

Plan N, while more affordable, requires beneficiaries to pay copayments for some doctor visits and emergency room trips that don’t result in inpatient admission. It also doesn’t cover the Part B excess charge. Each plan suits different financial situations and healthcare needs, making it crucial for seniors to evaluate their priorities when selecting a plan.

When considering Medicare Supplement plans in LaVale, MD, understanding the cost implications for 2024 is essential. Plan F, despite its broad coverage, might not be available to all seniors due to eligibility constraints imposed after January 1, 2020. For a typical 68-year-old female non-tobacco user, the average monthly premium for Plan F is approximately $150.

Plan G, offering nearly comprehensive coverage with the exception of the Part B deductible, has a lower average monthly premium, estimated at around $125 for the same demographic. Meanwhile, Plan N, which includes some copayments and doesn’t cover the Part B excess charge, presents a more budget-friendly option, averaging $98 per month.

These comparisons highlight the financial trade-offs between comprehensive coverage and lower premiums. Seniors must weigh these factors in light of their personal healthcare needs and budgetary constraints to select the most appropriate plan for their circumstances.

In Maryland, area factoring is not permitted, which significantly benefits seniors considering Medicare Supplement plans. Area factoring is a pricing strategy where insurance companies adjust premiums based on the zip code of the policyholder. In states where this practice is allowed, seniors might face varied costs for the same plan depending on their location, leading to disparities in healthcare affordability.

In Maryland, the cost of a Medicare Supplement plan is the same for specific age, gender, and tobacco status. This rule means a 70-year-old female non-tobacco user in LaVale pays the same premium as someone identical in Baltimore or Frederick. This uniformity offers predictability in budgeting and allows seniors to choose plans based on coverage, not location-based price changes.

In LaVale, MD, Medicare Advantage plans are relatively limited in availability compared to other areas. As of 2024, only two insurance carriers offer a total of seven Medicare Advantage plans in Allegany County. This restricted selection means that seniors need to carefully consider the options to ensure they find a plan that best suits their healthcare needs and preferences.

These plans typically operate within either a Preferred Provider Organization (PPO) or Health Maintenance Organization (HMO) network. PPO plans offer more flexibility, allowing beneficiaries to see both in-network and out-of-network providers, albeit at different cost levels. In contrast, HMO plans usually require members to stick to a specific network of doctors and hospitals, which can limit provider choices but often at a lower premium.

Understanding these network types and their implications is crucial for choosing a Medicare Advantage plan that aligns with personal healthcare needs.

When comparing Medicare Advantage plans in Allegany County, including LaVale, seniors must consider several critical factors. With only two carriers providing a total of seven plans, the decision-making process involves:

Plans may vary in terms of covered services and potential out-of-pocket costs. Some Advantage plans might offer additional benefits beyond Original Medicare, such as vision, dental, and hearing services, which could be a deciding factor for many seniors.

Network type is another essential consideration. PPO plans offer greater flexibility by allowing visits to both in-network and out-of-network providers, though out-of-network care often comes at a higher cost. On the other hand, HMO plans might be more cost-effective but require members to receive care within their network, except in emergencies.

Ultimately, comparing these plans involves balancing cost, coverage, and convenience to select a plan that aligns with individual healthcare needs and preferences.

Selecting a Medicare Advantage plan in LaVale, MD, requires several factors to ensure it meets individual healthcare needs. First, evaluate the network of providers associated with each plan. If maintaining your current healthcare providers is important, verify that the plan’s network includes them. Additionally, consider the types of services you frequently use. Plans that offer extra benefits like dental, vision, or prescription drug coverage might provide added value.

It is important to keep in mind that Medicare Advantage plans are what we refer to as cost-sharing plans. This means that each time you receive services from a provider you will have some form of payment due. The payment could be a small co-pay or a co-insurance amount depending on the services rendered. One area of exposure that many of our clients are bothered by is the daily hospital co-payment. These are typically larger daily co-pays such as $295 – $320 per day during the first 4 – 6 days as an inpatient. While this can quickly add up, the good news is that our clients are able to protect themselves by simply adding a hospital indemnity to their insurance portfolio. These plans cost relatively little, and the insurer pays all benefits directly to the policyholder.

Currently there are 7 Medicare Advantage plans in LaVale and they all use a PPO network.

Cost is another critical factor. Compare premiums, deductibles, copayments, and out-of-pocket maximums across available plans. Although some plans might have lower premiums, they could result in higher costs for services.

To get started, contact Senior Benefit Services, Inc at our Cumberland office. Our office is located at 309 Willowbrook Road, Cumberland, MD 21502. Give us a call at (301)722-1414 and we will connect you to your own highly knowledgeable advisor who will make the process very easy for you.