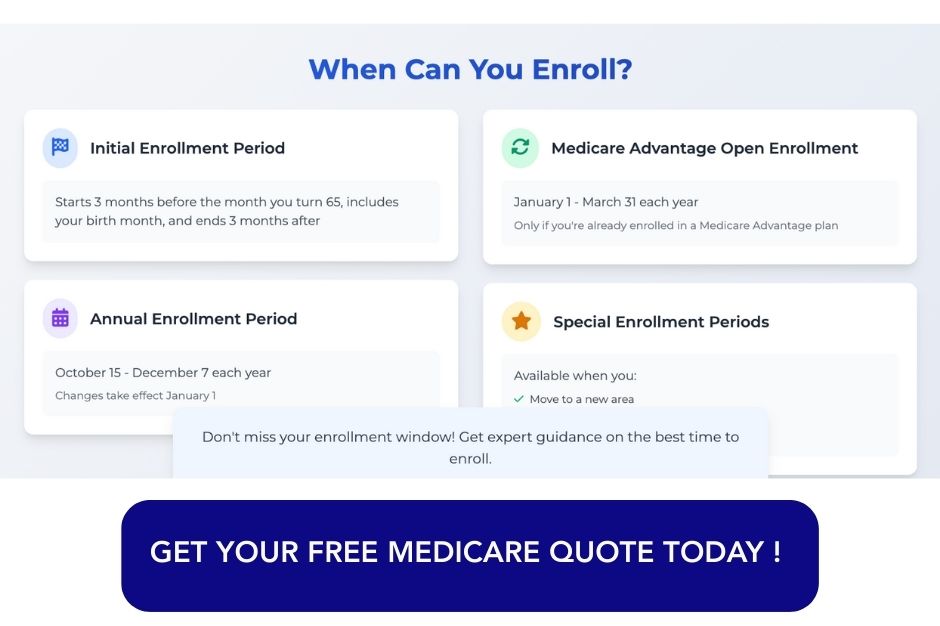

Yes, during the Annual Enrollment Period (October 15 – December 7), you can switch from Original Medicare to a Medicare Advantage plan with hearing benefits. Just be aware that switching plans affects all your healthcare coverage, not just hearing benefits.

This decision requires careful consideration of your overall healthcare needs. While gaining hearing aid coverage is valuable, you’ll also be adopting the Medicare Advantage plan’s network restrictions, copayments, and other rules for all your healthcare services.

Before making this switch, it’s essential to verify that your preferred doctors and specialists are in-network with the new plan. You should also compare out-of-pocket maximums, hospital coverage, and prescription drug benefits to ensure you’re not compromising on other important aspects of your healthcare. Our Medicare specialists can help you perform a comprehensive comparison that takes all these factors into account.

Are you finding Medicare’s hearing aid coverage options confusing? You’re not alone. Thousands of seniors struggle to navigate these complex choices each year.

Let our experienced advisors at Senior Benefit Services guide you through your options. We’ll analyze your specific hearing needs, budget constraints, and preferred providers to find the Medicare Advantage plan that offers the best hearing aid coverage for your situation.

Call us today at 1-800-924-4727 for a free, no-obligation consultation. Your journey to better hearing starts with a simple conversation.