Lately, some have wondered if Medicare Advantage Plans are bad. If you have been reading the news lately you have likely seen articles that are talking about how many seniors feel ‘trapped’ in a Medicare Advantage plan. We all know that bad news sells while people often overlook good news.

The reality is that the truth usually lies somewhere in between. This article decodes the pros and cons of Medicare Advantage plans, aiding your decision-making process. As you approach your golden years, the many decisions surrounding your healthcare can be both complex and crucial.

Among the myriad of choices, selecting the right Medicare plan is one of the most significant. Lately, Medicare Advantage (MA) plans have stirred up quite the debate, with opinions ranging from godsend to the scourge of elders’ healthcare.

But let’s dive deeper into the sea of healthcare options—do Medicare Advantage plans deserve their mixed reputation?

If we start from the beginning, the Balanced Budget Act of 1997 (BBA) introduced Medicare Part C (now known as Medicare Advantage) and to put it mildly became a bit of a disaster. Seniors flocked to these plans for primarily one reason, the prescription drug coverage benefit. Of course, the low cost of many of these plans didn’t hurt either. Over the months, it was a bit of the wild West and insurance companies were offering crab and even steak dinners to seniors just to come hear about the plans. Many folks signed up right at the dinners and jumped head first into these new plans.

Suddenly many of these Medicare beneficiaries were smacked in the face with why these plans were so low costing. Unlike original Medicare, these Part C plans required seniors to use a doctors who participated in the plan’s network. Since many of these carriers rushed their plans to market, the networks were very small. Many seniors were having to pick a new doctor and give up the ones they felt comfortable with. In addition to network issues, folks were also now dealing with pre-authorization requirements to continue to see a specialist for their more complicated health issues. The one thing that kept them in the plan was the prescription drug benefit, which at that time was one of the only ways that seniors could get help with the high costs of their prescriptions. Sadly these plans quickly started to exit the market and seniors went back onto original Medicare and paying for all of their prescriptions out of pocket.

In 2003 Medicare Advantage and stand-alone Part D prescription drug plans were introduced back into the market. If you are thinking that Medicare Advantage was basically a rebranding of Medicare Part C then you are on the right track. The problem once again was the lack of robust networks and many doctors pushing back against joining them. Many seniors remembered the fiasco of Medicare Part C back in the 1990s and were hesitant to enroll in the newer Medicare Advantage plans even though these plans had low daily hospital co-pays and reasonable maximum annual out of pocket limits for the plans. By the end of 2004 out of the 41 million Americans on Medicare only about 5 million were enrolled in a Medicare Advantage plan.

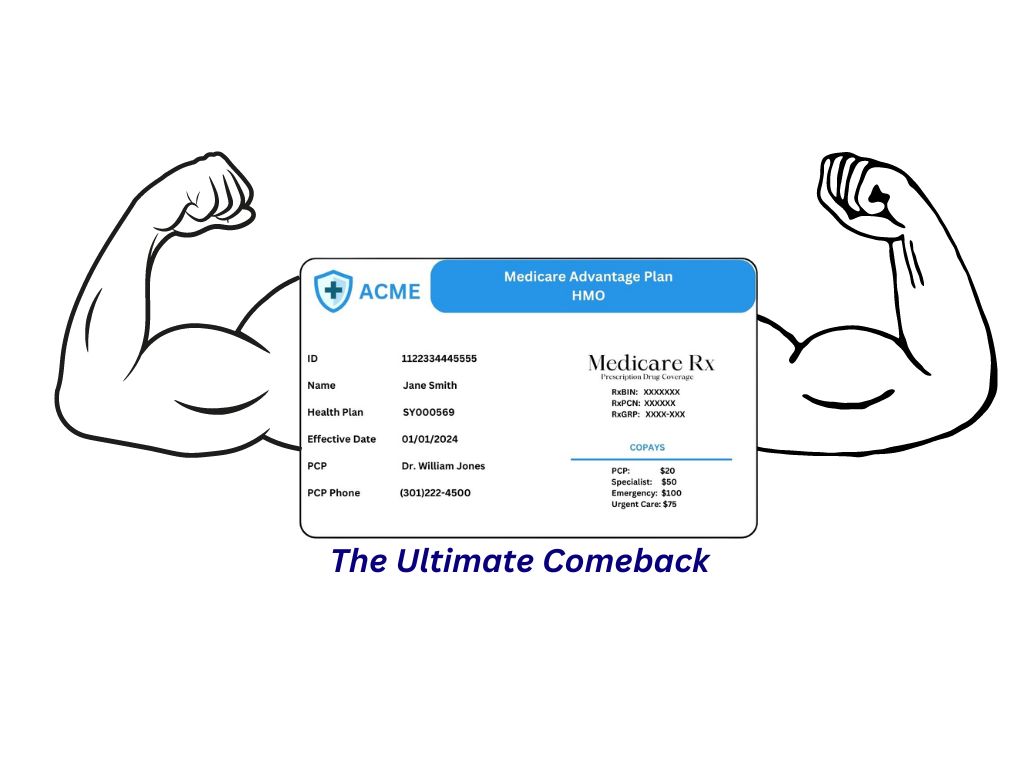

Fast forward to 2023 and out of the 65 million Americans enrolled in Medicare just under 32 million were enrolled in a Medicare Advantage plan. In less than 20 years there has been an increase in Medicare Advantage plan members of 540%. That is quite a remarkable number.

The primary distinction lies in how they manage and pay for your healthcare benefits. While Original Medicare allows direct payment for healthcare goods and services, Medicare Advantage (MA) contracts with a network of providers, which dictates your access to care.

This basically means that instead of original Medicare paying benefits to your doctor, they are paying all your Medicare annual allowance to the Medicare Advantage plan you have enrolled in. It is then up to the MA plan to manage your healthcare costs.

If you have more expenses than what was paid by Medicare to the MA plan, then the plan loses money on you. If you have a healthy year then the MA plan makes money.

Additionally, MA plans receive federal subsidies from the Centers for Medicare and Medicaid Services (CMS) which helps with their profitability.

Despite their critics, Medicare Advantage plans have numerous advantages that make them a worthy competitor against Original Medicare. Let’s unpack these benefits to show a balanced side of the story.

The financial burden of healthcare can be significant for seniors. Medicare Advantage plans cap out-of-pocket spending for Part A and B services, providing predictability in healthcare costs. We know these caps as the plan’s Maximum Out of Pocket (MOoP).

This can be especially beneficial for those who face chronic health conditions that necessitate frequent doctor visits or hospital care. When an individual is covered only by Medicare Part A and Part B (without a Medicare Supplement) they do not have an annual cap.

Another plus of Medicare Advantage is the focus on care coordination. Some plans offer nurse hotlines, wellness programs, and other resources to help beneficiaries manage their health more effectively. The attention to coordination can reduce medical errors and can make the patient experience smoother.

While the benefits paint a rosy picture, it’s crucial to address the drawbacks. Medicare Advantage plans have their shortcomings and may not suit everyone perfectly.

Enrolling in a Medicare Advantage plan often means adhering to a specific network of doctors and hospitals. This can be restrictive, particularly for those who have established relationships with healthcare providers.

While the networks have become more robust over the last 20 years, they still pale in comparison to the number of providers who accept original Medicare. It’s essential to ensure that your preferred healthcare professionals are part of the plan’s provider network.

If the MA plan you are looking at uses an HMO network, then you need to understand that if you see a provider not in the plan’s network, then you are responsible for 100% of the medical bills.

Since CMS directly pays all your benefits to the MA plan, you can’t ask Medicare to cover the costs.

While MA plans offer a ceiling for out-of-pocket costs, they can also lead to higher expenses if care is sought outside the network.

Emergency care and urgent care services can potentially not be as covered as well as with the traditional Medicare program, which doesn’t have the same provider restrictions. As we mentioned earlier, an HMO network is the most restrictive and requires you to use a provider that participates in the plan’s network.

If your MA plan uses a PPO network, then you would have coverage when using a provider not in-network. There are serious pitfalls that you need to be aware of when using a non-participating provider.

Most plans have a separate maximum out of pocket cap for in-network vs out-of-network. The MA plan may have a MOop of $7,000 for in-network, but a separate MOop of $10,000 for out-of-network.

In addition, seeing an out-of-network provider can be billed differently. Instead of paying a $50 co-pay for the specialist, you might be required to pay 20% of the cost. These situations can lead to much higher amounts of expenses being paid out of pocket.

Medicare Advantage plans can alter their coverage on a yearly basis, including prescription drug formularies and benefits. This means they may not cover next year what they coveredd this year.

A Medicare Advantage plan does an annual contract with CMS, which means that they can choose not to continue to offer the plan in a certain county or even state. This means all those enrolled in that plan would have to find a new plan or return to original Medicare.

Beneficiaries need to review their plans and potentially switch annually, causing potential inconvenience and confusion.

You may wonder what all this means for you. How do you know if Medicare Advantage is the right choice? The answer to this question, as we often find in healthcare, is that it depends. Here are some factors to consider when navigating the maze of Medicare Advantage options.

Diving into the details is essential. Look beyond the surface benefits and consider the cost-sharing arrangements, such as premiums, deductibles, co-payments, and coinsurance.

These are just a few of the aspects that require thorough examination.

Everything we discussed above is comparing original Medicare Parts A and B to Medicare Advantage. The reality is that most folks on original Medicare also have a Medicare Supplement plan. When you do a comparison between a Medicare Supplement and a Medicare Advantage plan, things change dramatically.

Read our article Medicare Supplements vs Medicare Advantage Plans

Are Medicare Advantage plans really that bad? The truth, as always, is somewhere in the middle. They offer a host of advantages, including cost containment, supplemental benefits, and improved care coordination.

However, they also come with their share of inconveniences, such as provider network restrictions and the potential for increased costs under certain circumstances. It’s not about good or bad; it’s about what aligns best with your individual needs and preferences.

Contact Senior Benefit Services today at (800)924-4727 to see what type of plan is best for your personal needs.