This article will focus primarily on the Medicare donut hole, but we will also show how you will move thru each phase of a Medicare Part D prescription drug plan. Every year, from October 15 to December 7, during the Medicare open enrollment period, beneficiaries have the opportunity to enroll in a plan that offers Part D prescription drug coverage.

This can either be a stand-alone prescription drug plan (PDP) for those in traditional Medicare or a Medicare Advantage plan which includes all Medicare benefits, prescription drugs inclusive (MA-PD). In 2022, out of the 65 million people Medicare covers, 49 million are enrolled in Part D plans. More than half of these (53%) have enrolled in MA-PDs and 47% in PDPs.

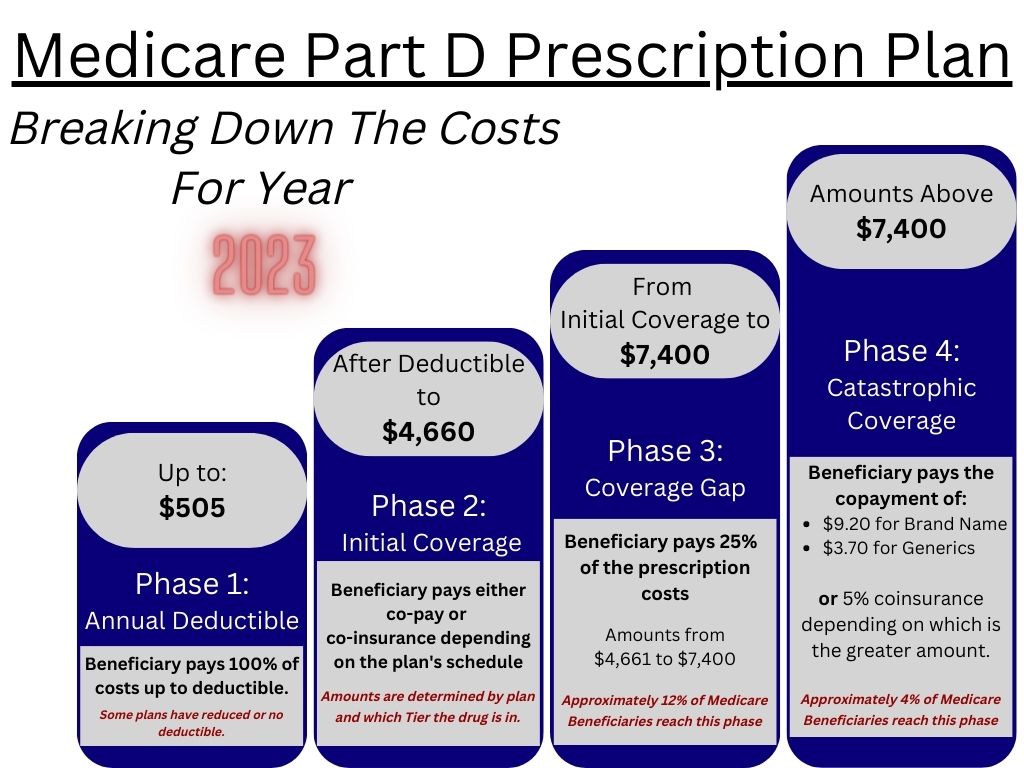

Prescription drug coverage operates through several stages. The initial phase begins with the effective date of your prescription drug plan, which is often January 1.

During this first phase, you must reach your deductible, which can be up to $505. You must pay this amount entirely.

Once you’ve satisfied the deductible, you progress to the initial coverage phase. Here, you’re only responsible for making copayments. When your drug costs escalate to $4,660, you transition into the donut hole stage.

While residing in the donut hole stage, you are obligated to pay 25% of the cost for both generic and brand-name drugs, until your out-of-pocket expenses total $7,400. As soon as you exit this gap, the final phase known as catastrophic coverage begins.

It is also important to keep in mind that your plan premiums do not count towards these phases. To understand a bit more about Medicare Part D plans and also penalties that can be incurred click here.

The designers of the Medicare Part D program intentionally included a coverage gap, commonly referred to as the “donut hole.” Prior to the Affordable Care Act, the program provided coverage for beneficiaries’ drug expenses up to a specific dollar amount after the deductible. On standard plan designs, beneficiaries paid 25% of the cost during this phase. Coverage then ceased completely until beneficiaries reached another expenditure level, after which more robust coverage kicked in. Beneficiaries then paid 5% of the cost or a nominal copay at this point.

The designers of the Medicare Part D program incorporated a coverage gap, commonly referred to as the “donut hole.” Before the Affordable Care Act, the program covered beneficiaries’ drug expenses up to a specific dollar amount after the deductible. On standard plan designs, beneficiaries paid 25% of the cost during this phase. Coverage then ceased completely until beneficiaries reached another expenditure level, after which more robust coverage kicked in. Beneficiaries then paid 5% of the cost or a nominal copay at this point.

Over the last few years, the donut hole has actually closed. Beginning in 2020, Medicare beneficiaries no longer had to pay the full cost of their medications while in the donut hole. Instead, they would now pay 25% of the cost during this period. That 25% cost share is what you still would pay during this phase. Depending on their plan design, however, there may still be differences in costs before and during the donut hole.

Once you reach the donut hole after spending $4,660 on your medications (in 2023), you will pay 25% of the cost of drugs. If your plan is designed with a copay instead of coinsurance before the donut hole, then your costs may change once you enter the donut hole. However, if you reach the catastrophic coverage stage, out-of-pocket costs decrease significantly.

Navigating the world of Medicare can be daunting. One of the most confusing aspects is the infamous “Medicare donut hole.” Before reaching this point in your Part D plan, your out-of-pocket costs are primarily covered by your copay or coinsurance. However, once you enter the donut hole, things change. Suddenly, the drug manufacturer provides a discount that mostly covers the cost of your brand-name drugs, while your coinsurance and Part D plan continue to cover generic drugs. It’s important to be aware of this shift and to educate yourself on the ins and outs of this notorious Medicare donut hole.

If you’re enrolled in Medicare and regularly take prescription drugs, you might have encountered the term “donut hole.” It’s the coverage gap where you’re responsible for a portion of your drug costs until you reach the catastrophic coverage level. Unfortunately, the spending required to get there has been increasing over the years. In 2023, you’ll need to spend $7,400 before your coverage reaches the catastrophic level. Any discounts you receive from drug manufacturers for brand-name drugs will count towards reaching the threshold. Once you reach the catastrophic level, your drug costs will be significantly reduced. In fact, starting in 2024, there will be no out-of-pocket costs during that coverage level.

There’s more good news. With each prescription refill, you accumulate a higher amount in your out-of-pocket expenses. This means you will transition into the catastrophic coverage phase earlier. Starting in 2024 the Inflation Reduction Act will eliminate the 5% coinsurance requirement in the catastrophic phase. You can read very informative article from the Kaiser Family Foundation that takes a very deep dive into Medicare Part D here.

While each year looks to enhance the Medicare Part D program, lets focus back in on this current year. Once again, if the total amount of expense paid out of your pocket combined with the expenses paid by your drug plan reaches $4,660 then you will move from the Initial Coverage phase into the Coverage Gap/Donut Hole. After you enter the donut hole, your out-of-pocket spending combined with manufacturer discounts will count towards your $7,400 maximum in this phase. Once you reach this maximum then you move into the catastrophic phase. For year 2023 your out-of-pocket costs while in the catastrophic phase would be as follows:

Though the out-of-pocket expenses may appear daunting and somewhat intimidating, estimates suggest that only about 12% of Medicare Beneficiaries will progress to the donut hole phase. Additionally, projections indicate that a mere 4% of Medicare Beneficiaries will advance to the catastrophic phase. Still need more help with your Medicare Part D prescription drug plan, then feel free to reach out to us at (800)924-4727.